The following e-file reject error is generating in EasyACCT when e-filing Form 940 or Form 941:

- Code 101. The 5-digit ETIN/PIN & 6-digit EFIN combination is not valid signature.

- You must be enrolled with the IRS as a Reporting Agent to successfully e-file for your clients.

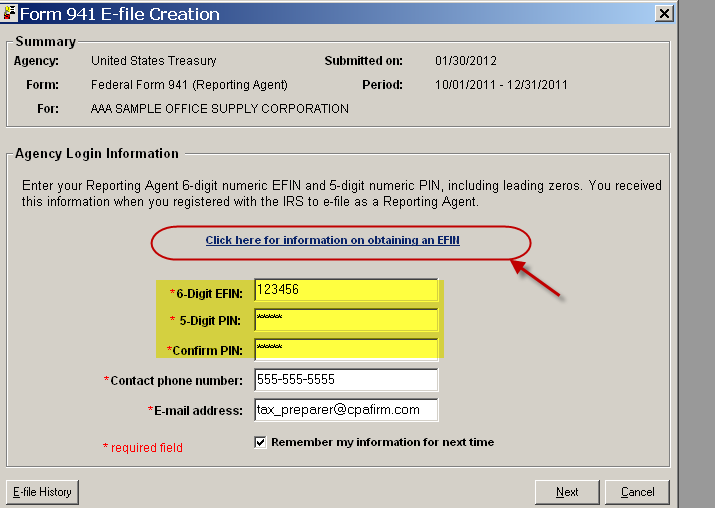

- If you are already enrolled and need to verify your 6-digit numeric EFIN and 5-digit e-filing ETIN (PIN) with the tax agency contact the IRS at 866.255.0654.

![]() The 5-digit PIN isn't the PIN entered on the form as the Third-Party Designee PIN.

The 5-digit PIN isn't the PIN entered on the form as the Third-Party Designee PIN.

Why is this error generating?

- The EFIN and ETIN/PIN are assigned by the IRS after the Reporting Agent files Form 8633.

- The 6-digit EFIN and 5-digit ETIN/PIN must be used exactly as assigned.

- You must file Form 8655 for each company to act as their Reporting Agent—and e-file Form 940/941.

- This form must be completed, signed by the taxpayer and submitted to the IRS by fax or mail before e-filing the forms.

Refer to this article for more information about requirements for e-filing Form 940/941.

Additional information

There's a link in EasyACCT to the information regarding Form 8633 and Form 8655:

Refer to IRS Pub 3823 for more information about electronically filing Form 940/941.