If Beginning Capital is entered on Screen 28, Schedule M-2, Lacerte will allocate the beginning capital to the partners' based on their partner percentages. If "0.000000" is entered for the ending ownership of capital on Screen 8, Partner Percentages, the partner's beginning capital will show "0" on Item L of the Schedule K-1.

Use the following steps to allocate beginning capital to the partners with "0.000000" ending ownership of capital if necessary:

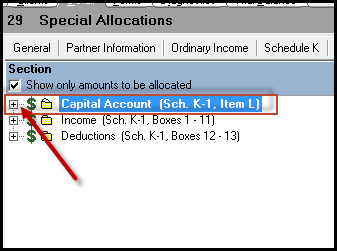

- Navigate to Screen 29, Special Allocations.

- Click on the + next to Capital Account (Sch. K-1, Item L) from the left navigation panel to expand it.

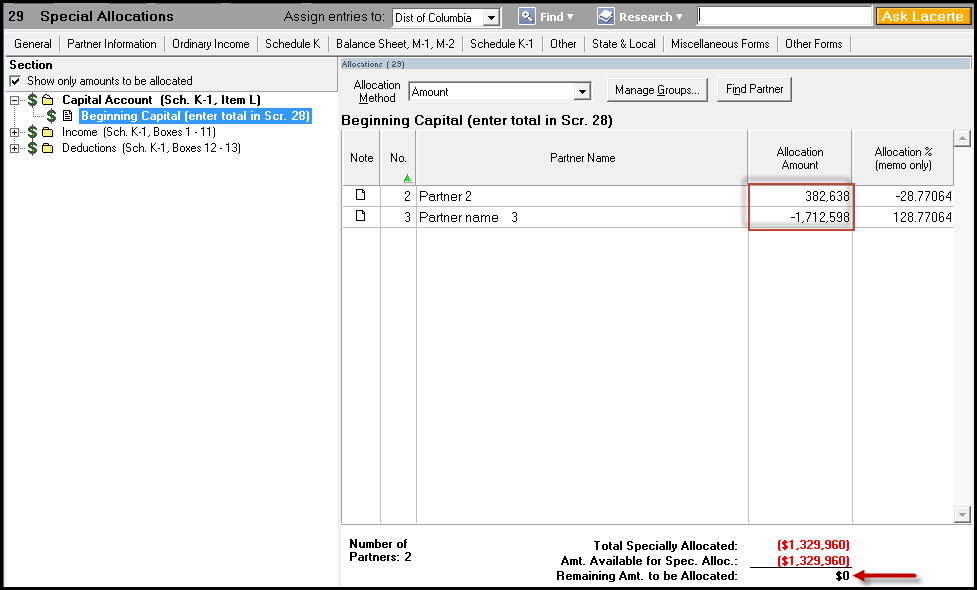

- Select Beginning Capital (enter total in Scr. 28).

- Enter the appropriate amount for each partner in the Allocation Amount column.

- The Remaining Amt. to be Allocated shown at the bottom of the screen will show "0" when completely allocated.

Note: If the check box in Screen 5, Other Information (Schedule B), Question 4 requirements are met is checked, Item L will not generate. There are two options to get Item L to print.

- Remove the checkmark for this box

OR

- Go to Screen 25, Balance Sheet Miscellaneous and check the box, Force Schedules L, M-1, and M-2 to print, in order for Item L to populate in the Schedule K-1.