- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax News and Updates

- :

- What's new in Lacerte® Tax 2021

What's new in Lacerte® Tax 2021

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What's New for Lacerte® Tax 2021

We’ve been hard at work making Lacerte better for you, so you can serve your clients even better. Check out these great features of your Lacerte software—plus new ways to get support from your partners at Intuit—so you can continue to tackle your clients’ most complex returns with confidence.

Helpful Resources:

- Tax Year 2021 Common Questions

- 2021 Getting Started Guide

- e-File Common Questions

- Form Availability Frequently Asked Questions

- More Lacerte News

For full details on each new feature, click here.

- Verify your EFIN in Lacerte

- Tax accuracy notifications (COMING SOON)

- New billing profile

- Easier onboarding to Hosting for Lacerte

- Lacerte Actionable Steps for Error Resolution (LASER)

- Lacerte 200 Federal 1040 enhancements

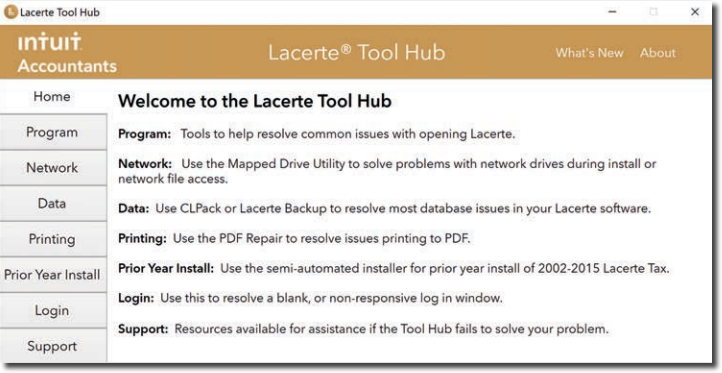

Lacerte Tool Hub

The tool hub enables you to quickly resolve common system issues and errors , so you can get back to serving your clients. Find this handy tool by searching for “Tool Hub” in Lacerte, and use it for issues including:

• Desktop alerts

• Repair updates

• Mapped Drive tool

• Component Repair tool

• Backup Utility

• Networking errors

Enhanced customer support, with one-on-one and self serve options...

Get product support on your schedule: We know your schedule can be hectic, so now you can request a support appointment or have the support team call you back.

Intelligent voice assistant: We’re helping you get what you need faster with a new listening tool that directs you to self-serve solutions so you don’t have to stay on hold to talk to an agent.

The Lacerte Tax Idea Exchange: Help us make the product enhancements that are important to you. Vote for the ideas you like most, then get updates on their status, whether they are under review, accepted, or implemented. Find it in The Community

Take advantage of the 120 forms and 46 e-filing types across 27 states.

Print and e-filing capabilities for the following forms (120):

Forms

FEDERAL

Individual

- Form 9000, Alternative Media Preference

- Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments

Individual, Corporate, S-Corporate, Partnership

- Form 14039-B, Business Identity Theft Affidavit

Individual, Fiduciary, Corporate, S-Corporate, Partnership, Fiduciary, and Exempt:

- Form 5471 Sch G-1, Cost Sharing Arrangement

Partnership:

- Schedule K-2, Partner's Distributive Share Items - International

- Schedule K-3, Partner's Share of Income, Deductions, Credits, etc. - International

ALABAMA

Individual:

- Schedule ATP, Additional Taxes & Penalties

- Schedule HBC, First Time Second Chance Home Buyer Deduction

S-Corporate and Partnership:

- Form PTE-E, Pass-Through Entity Election Form

- Form EPT, Electing Pass-Through Entity Payment Return

- Schedule EPT-K1, Electing Pass-Through Entity K-1

- Schedule EPT-C, Electing Pass-Through Credit

- Schedule PTE-AJA, Alabama Jobs Act-Investment Credit

ARKANSAS

Individual:

- Form AR2441, Child and Dependent Care Expenses

Individual, Corporate, S-Corporate, Partnership, and Fiduciary:

- Form AR8944, Preparer e-file Hardship Waiver Request

GEORGIA

Individual:

- Form IND-CR 213, Adoption of a Foster Child

INDIANA

Individual:

- Form IN-40PA, Indiana Post-liability Allocation Schedule

Partnership:

- Schedule IN-EL, Tax Computation Form Electing Partnerships

Fiduciary:

- Form IT-41 Schedule 1, Other Income

KANSAS

Individual:

- Schedule A, Itemized Deductions

MINNESOTA

Fiduciary:

- Schedule M1MB, Business Income Additions and Subtractions

- Schedule M1LOSS, Minnesota Limitation on Business Loss

Partnership and S-Corporation:

- Schedule PTE, Pass-Through Entity Tax

NEW YORK

Individual

- IT-203-F, Multi-Year Allocation Form

- IT-221, Disability Income Exclusion

- IT-237, Claim for Historic Homeownership Rehabilitation Credit

- IT-6-SNY, Metropolitan Commuter Transportation Mobility Tax for START-UP NY

Individual and Fiduciary:

- IT-112.1, NYS Resident Credit Against Separate Tax on Lump-Sum Distributions

Individual and Partnership:

- IT-239, Claim for Credit for Taxicabs and Livery Service

- IT-501, Temporary Deferral Nonrefundable Payout Credit

- DTF-630, Claim for Green Building Credit

Individual, Fiduciary, and Partnership:

- IT-211, Special Depreciation Schedule

- IT-212-ATT, Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit

- IT-236, Credit for Taxicabs and Livery Service Vehicles Accessible to persons with Disabilities

- IT-238, Claim for Rehabilitation of Historic Properties Credit

- IT-246, Claim for Empire State Commercial Production Credit

- IT-248, Claim for Empire State Film Production Credit

- IT-252, Investment Tax Credit for the Financial Services Industry

- IT-253, Claim for Alternative Fuels Credit

- IT-261, Claim for Empire State Film Post-Production Credit

- IT-602, Claim for EZ Capital Tax Credit

- IT-605, Claim for EZ Investment Tax Credit and EZ Employment Incentive for the Financial Services Industry

- IT-613, Claim for Environmental Remediation Insurance Credit

- IT-633, Economic Transformation and Facility Redevelopment Program Tax Credit

- IT-634, Empire State Jobs Retention Program Credit

- IT-636, Alcoholic Beverage Production Credit

- DTF-621, Claim for QETC Employment Credit

- DTF-624, Claim for Low Income Housing Credit

- DTF-626, Recapture of Low-Income Housing Credit

Fiduciary:

- IT-230, Separate Tax on Lump-Sum Distributions

Partnership:

- IT-250, Claim for Credit for Purchase of an Automated External Defibrillators

NORTH CAROLINA

Partnership and S-Corporation:

- Form NC-PE, Additions and Deductions for Pass-Through Entities, Estates and Trusts

OREGON

Individual:

- Form MC-40, Multnomah County Preschool for All

- Form MC-40-NP, Multnomah County Preschool for All

- Form MET-40, Metro Supportive Housing Services

- Form MET-40-NP, Metro Supportive Housing Services

Corporate:

- Form METBIT-20, Metro Supportive Housing Services Business Income Tax Return for Corporations

Fiduciary:

- Form METBIT-41, Metro Supportive Housing Services Business Income Tax Return for Trusts and Estates

Partnership:

- Form METBIT-65, Metro Supportive Housing Services Business Income Tax Return for Partnerships

S-Corporation:

- Form METBIT-20S, Metro Supportive Housing Services Business Income Tax Return for S-Corporations

SOUTH CAROLINA

Individual

- Schedule TC-38, Solar Energy or Small Hydropower System or Geothermal Machinery and Equipment Credit

E-Filing Capabilities

Main Return:

- Hawaii Partnership and Fiduciary

- Indiana Fiduciary

- Kentucky (Louisville) Individual, Corporate, S-Corporation, and Partnership

- Massachusetts Grantor Fiduciary

- North Carolina Fiduciary

Amended Returns:

- Arkansas Individual

- Colorado Individual

- Connecticut Individual

- District of Columbia Individual, Corporate, Fiduciary, S-Corporation, and Partnership

- Hawaii Individual, Corporate, Fiduciary, S-Corporation and Partnership

- Indiana Fiduciary

- Iowa Individual

- Kansas Individual

- Kentucky Individual

- Maine Individual

- Mississippi Individual

- Missouri Individual

- Montana Individual

- New Hampshire (BT Sum) Individual

- New Hampshire (DP-10) Individual

- New Mexico Individual

- North Carolina Individual

- Oklahoma Individual

- Rhode Island Individual

- South Carolina Individual

- Utah Individual

- Virginia Individual

- West Virginia Individual

Extension/Estimated Payments:

- Extensions - Kentucky (Louisville) Individual, Corporate, S-Corporation, and Partnership

- Estimated Payments - Virginia Individual

Get the most out of Lacerte with free training...

Anytime is a great time to sharpen your skills and learn more about your Lacerte 2020 software, which is why we provide a variety of free training opportunities throughout the year.

Lacerte Webinars

See the exciting new features and improvements coming to Lacerte for Tax Year 2020 from by watching one of our live or pre-recorded webinars. Deepen your knowledge, get great software tips, and stay ahead of the industry with free webinars catered to tax professionals like yourself.

View upcoming Lacerte webinars >>

Lacerte Training Portal

Prepare for tax season with our Training Portal, with relevant and personalized content recommendations on the features you use.

Check out the Training Portal >>

Time-Saving Features Learning Center

The average Lacerte user only knows about 48% of the basic time-saving features! What might you be missing? Discover new ways to work more efficiently in our Time-Saving Features Learning Center, created from ratings and surveys from your peers.

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For more Lacerte Tax News & Updates, click here.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For more Lacerte Tax News & Updates, click here.