- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: New to Lacerte - Fed Direct Deposit and State Payment

New to Lacerte - Fed Direct Deposit and State Payment

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Entered in a direct deposit refund for Federal, but the client has a payment for state that I want to have automatically debited. How do I enter this ... it keeps showing the payment in for paying by check in the filing instructions.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

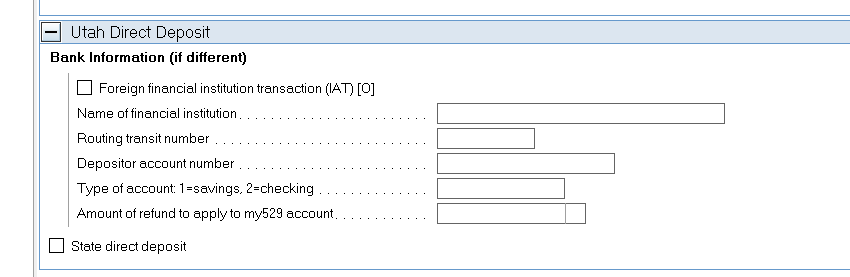

Screen 3 - It sounds like you have the bank entered and the direct deposit for Fed working well. You need to go down to the last of the Sections to find your State Direct Deposit of Refund/Electronic payment. There should a check box below Electronic Filing Only that is "Electronic payment of balance due". Right after that you can pick a date. Possibly your state does not permit this. Which state are you working with?

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is Utah - here is the bank information and I don't see anywhere to make a payment electronically, only for the direct deposit. Any ideas? Ultratax would allow

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree, it isn't there. Apparently UT and Lacerte don't communicate as well as UT and UT. Sorry.

Possibly @IntuitAustin could find a list of which state do direct debit for Individual (and maybe other modules).

Here's wishing you many Happy Returns