- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Ohio Source Income for N/R partner - input

Ohio Source Income for N/R partner - input

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How to enter Ohio sourced income from partnership for a nonresident partner?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

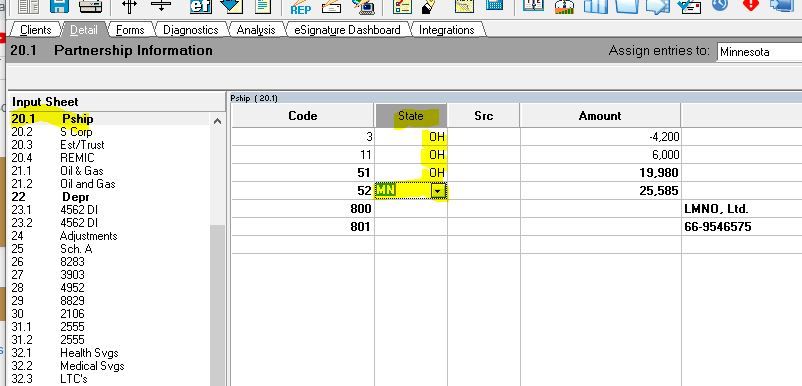

I assume you do have some resident state, so all K-1 income would be taxable in that state. For the line numbers on the K-1 (or possible for the whole K-1) select OH from the dropdown just to the right of each numeric entry. Using Ctrl + W you can enter the batch mode Go to the K-1 input screen # and find the appropriate K-1 and replace all the resident state code with OH. See image, I changed all but the last MN with OH. This will create the OH return and for most returns there will also be a credit for taxes paid to other states form created.

Here's wishing you many Happy Returns