From the IRS website:

On Nov. 26, 2013, the IRS issued final regulations (TD 9645) implementing the Additional Medicare Tax as added by the Affordable Care Act (ACA). The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

Refer to this IRS resource for more information about the Additional Medicare Tax.

Important information about the tax increase

- The employee portion of the Medicare tax will increase by 0.9% on the portion of wages paid over $200,000.

- The additional tax is only withheld from the employee.

- The employer portion of the Medicare tax won't be subject to the Additional Medicare Tax.

Refer to the IRS Questions and Answers for the Additional Medicare Tax for more information.

Follow these steps to set up the employee's Additional Medicare Tax:

- Open up Batch Payroll and select the Employee Information.

- Select the Wage/Withholding tab.

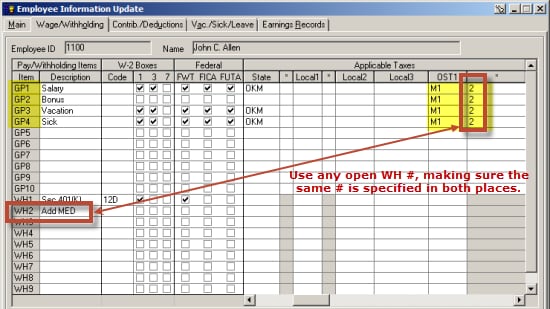

- In OST field of Applicable Taxes, enter the tax code M1 for each GP item to be included in total wages subject to medicare.

- The additional medicare applies to all wages contributing to an annual gross pay over $200,000.

- If the OST column is already used by another tax (such as C1) then use OST2 or OST3 for the Additional Medicare.

- The M1 code should be repeated on each GP item subject to Medicare.

- Designate an available withholding field as the accumulator for this amount by entering the WH number in the (*) field to the right of the OST field.

- The same WH # should be used for all the GP items subject to Medicare.

- In the example below, OST1 is using WH2 to calculate and hold the Additional Medicare. If WH2 is already in use, please select a different WH # as available in each Employee Wage/Withholding tab.

- Enter a description for the withholding item.

- Example 1: If you're using WH2, enter the description as 'Add MED' and enter the corresponding number 2 in (*) field of OST.

- Example 2: If you're using WH7, enter the description as "Add MED" and enter the corresponding number 7 in (*) field of OST.

After setting this up, you'll be able to see the Employee's Additional Medicare withholding calculations in different reports such as the Tax Deposit screen, Payroll Journal Reports, and Check Register.

NOTE: The Additional Medicare will show under the Other State Withholding section, select code M1. To show correctly on Form 941, back the amount out on the Other State Withholding and add it to the FICA and Federal Withholding section.

![]() For withholdings that are exempt from Medicare, you can enter the M1 code on the W/H line to exclude the additional Medicare tax. Refer to this article for more information.

For withholdings that are exempt from Medicare, you can enter the M1 code on the W/H line to exclude the additional Medicare tax. Refer to this article for more information.

Refer to IRS Pub. 15for more information about determining the correct treatment.

Processing the Additional Medicare Tax

Batch payroll

- EasyACCT will calculate the amount of additional Medicare automatically once it's set up correctly for each employee.

- The program will withhold the additional Medicare from the employee under the designated WH item.

- This is the WH number indicated in the OST* column with the M1 code.

- The program won't calculate any matching employer tax since this is an employee-based tax only.

Manual processing

- You'll need to enter the amount manually in the designated WH item chosen in the employee setup.

- The program won't calculate any matching employer tax since this is an employee-based tax only.

W-2

- The program will add the additional Medicare tax to the regular Medicare amount withheld in box 6.

- The additional Medicare must be set up correctly, and withheld from each check over $200,000, for the amounts to flow correctly to the W-2, box 6.