| Part VIII: Line 1a, Federated campaigns |

| Part VIII: Line 1b, Membership dues |

| Part VIII: Line 1c Fundraising events |

| Part VIII: Line 1d, Related organizations |

| Part VIII: Line 1e, Government grants (contributions) |

| Part VIII: Line 1f, All other contributions, gifts, grants, and similar amounts not included above |

| Part VIII: Line 2f, All other program services |

| Part VIII: Line 3, Investment income (including dividends, interest, and other similar amounts) |

| Part VIII: Line 4, Income from investment of tax-exempt bond proceeds |

| Part VIII: Line 5, Royalties |

| Part VIII: Line 6a, Gross rents |

| Part VIII: Line 6b, Less; rental expenses |

| Part VIII: Line 7a, Gross amounts from sales of assets other than inventory |

| Part VIII: Line 7b, Less; cost or other basis and sales expenses |

| Part VIII: Line 8a, Gross income |

| Part VIII: Line 8b, Less; direct expenses |

| Part VIII: Line 9a, Gross income from gaming activities |

| Part VIII: Line 9b, Less; direct expenses |

| Part VIII: Line 10a, Gross sales of inventory, less returns and allowances |

| Part VIII: Line 10b, Less; cost of goods sold (cost of labor) |

| Part VIII: Line 10b. Less; cost of goods sold (Other) |

| Part VIII: Line 10b, Less; cost of goods sold (Purchased) |

| Part VIII: Line 11a, Miscellaneous revenue |

| Part IX: Line 1, Grants and other assistance to domestic organizations and domestic |

| Part IX: Line 2, Grants and other assistance to domestic individuals |

| Part IX: Line 3, Grants and other assistance to foreign organizations, foreign governments and foreign individuals |

| Part IX: Line 4, Benefits paid to or for members |

| Part IX: Line 5, Compensation of current officers, directors, trustees, and key employees |

| Part IX: Line 6, Compensation not included above, to disqualified persons and persons described in section 4958(c)(3)(B) |

| Part IX: Line 7, Other salaries and wages |

| Part IX: Line 8, Pension pain accruals and contributions |

| Part IX: Line 9, Other employee benefits |

| Part IX: Line 10, Payroll taxes |

| Part IX: Line 11a, Fees for services - Management |

| Part IX: Line 11b, Legal |

| Part IX: Line 11c, Fees for services - Accounting |

| Part IX: Line 11d, Fees for services - Lobbying |

| Part IX: Line 11e, Fees for services - Professional fundraising |

| Part IX: Line 11f, Fees for services - Investment management fees |

| Part IX: Line 11g, Fees for services - Other |

| Part IX: Line 12, Advertising and promotion |

| Part IX: Line 13, Office expenses |

| Part IX: Line 14, Information technology |

| Part IX: Line 15, Royalties |

| Part IX: Line 16, Occupancy |

| Part IX: Line 17, Travel |

| Part IX: Line 18, Payments of travel or entertainment expenses for any federal, state, or local public officials |

| Part IX: Line 19, Conferences, conventions and meetings |

| Part IX: Line 20, Interest |

| Part IX: Line 21, Payments to affiliates |

| Part IX: Line 22, Depreciation, depletion, and amortization (Book amortization) |

| Part IX: Line 22, Depreciation, depletion, and amortization (Book depreciation) |

| Part X: Line 1, Cash - non-interest-bearing |

| Part X: Line 2, Savings and temporary cash investments |

| Part X: Line 3, Pledges and grants receivable, net |

| Part X: Line 4, Accounts receivable, net(Less allowance for doubtful accounts) |

| Part X: Line 5, Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees |

| Part X: Line 6, Loans and other receivables from other disqualified persons (as defined under section 4958(f)(1), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations of section 501(c)(9) voluntary employees' beneficiary organizations |

| Part X: Line 7, Notes and loans receivable, net |

| Part X: Line 8, Inventories for sale or use |

| Part X: Line 9, Prepaid expenses and deferred charges |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Automobiles or transportation equipment) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Buildings) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Furniture and fixture) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Improvements) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Land basis) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Machinery and equipment) |

| Part X: Line 10a, Land, buildings, and equipment; cost or other basis (Miscellaneous) |

| Part X: Line 10b, Land, buildings, and equipment; cost or other basis (Accumulated amortization) |

| Part X: Line 10b, Land, buildings, and equipment; cost or other basis (Accumulated depreciation) |

| Part X: Line 11, Investments - publicly traded securities |

| Part X: Line 12, Investments - other securities |

| Part X: Line 13, Investments - program related |

| Part X: Line 14, Intangible assets |

| Part X: Line 15, Other assets |

| Part X: Line 17, Accounts payable and accrued expenses |

| Part X: Line 18, Grants payable |

| Part X: Line 19, Deferred revenue |

| Part X: Line 20, Tax-exempt bond liabilities |

| Part X: Line 21, Escrow or custodial account liability |

| Part X: Line 22, Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons |

| Part X: Line 23, Secured mortgages and notes payable to unrelated third parties |

| Part X: Line 24, Unsecured notes and loans payable to unrelated third parties |

| Part X: Line 25, Other liabilities |

| Part X: Line 25 Other liabilities (Federal income taxes) |

| Part X: Line 27, Unrestricted net assets |

| Part X: Line Line 28, Temporarily restricted assets |

| Part X: Line 29, Permanently restricted net assets |

| Part X: Line 30, Capital stock or trust principal, or current funds |

| Part X: Line 31, Paid-in or capital surplus, or land, building, or equipment fund |

| Part X: Line 32, Retained earnings, endowment, accumulated income or other funds |

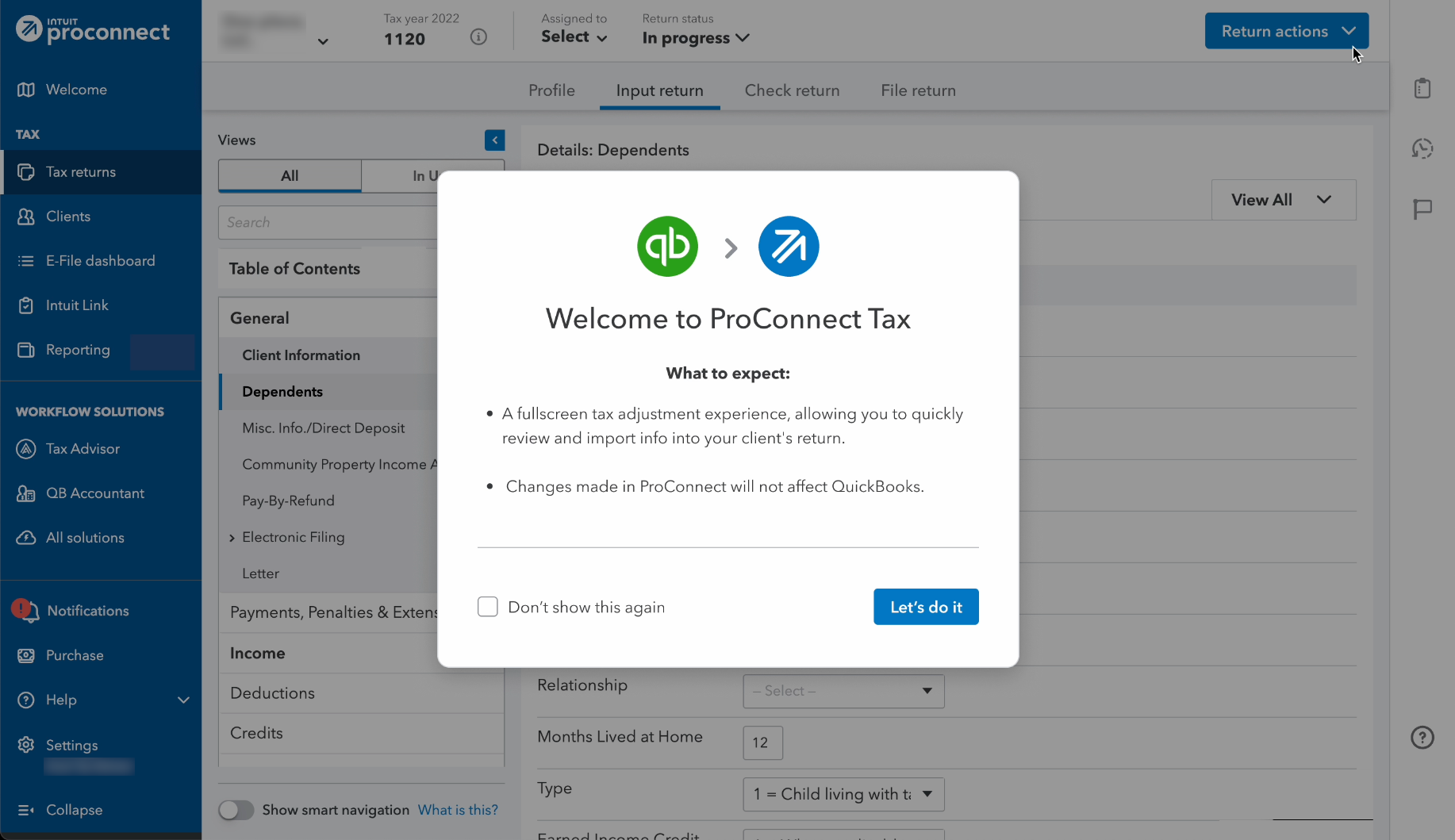

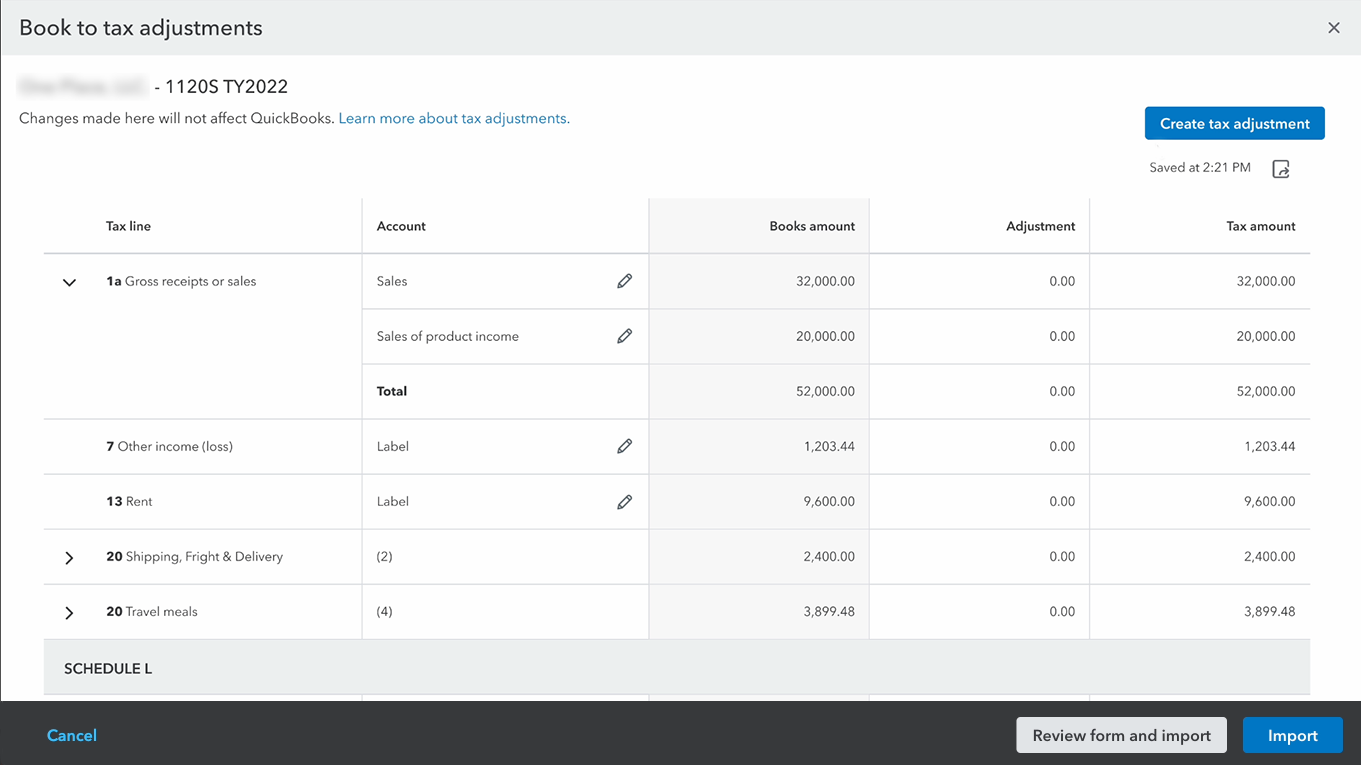

![]() Changes made by the tax preparer in ProConnect Tax will not impact the QuickBooks Accountant data at the bookkeeper level, and serve only to complete the tax return.

Changes made by the tax preparer in ProConnect Tax will not impact the QuickBooks Accountant data at the bookkeeper level, and serve only to complete the tax return.