This article will help you to generate Form 8958, Allocation of Tax Amount Between Certain Individuals in Community Property States.

Per the Form 8958 instructions:

- This form is used for married spouses in community property states who choose to file Married Filing Separately. This form is also for RDPs who are domiciled in Nevada, Washington, or California, and for individuals in California who, for state law purposes, are married to an individual of the same sex.

- Community property laws affect how you figure your income on your federal income tax return if you're married, live in a community property state or country, and file separate returns.

There are nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. Alaska is an opt-in community property state that gives both parties the option to make their property community property.

To generate Form 8958, follow these steps:

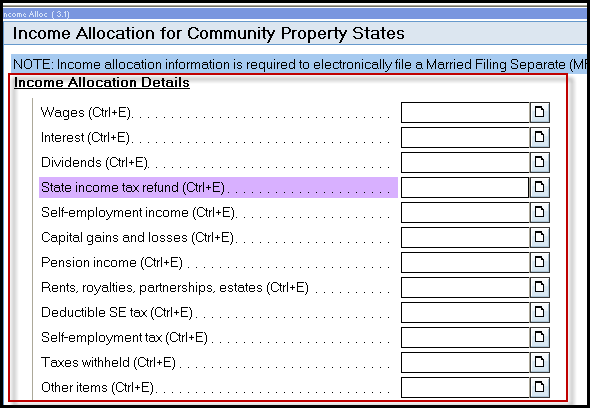

- Go to Screen 3.1, Community Property Income Allocation.

- Enter amounts in the Income Allocation Details subsection. Hold down Ctrl+E to display the detail window or select the expander icon in the field.

- Enter the Taxpayer and Spouse or Partner amounts.

- Form 8958 requires both taxpayer and spouse/partner amounts; therefore, both amounts will need to be provided. The total (taxpayer + spouse or partner amounts) will display on the input screen.

![]() When completing the 8958 details, the form will not generate on the joint return. Once the return has been split, the 8958 will generate an the Taxpayer and Spouse files.

When completing the 8958 details, the form will not generate on the joint return. Once the return has been split, the 8958 will generate an the Taxpayer and Spouse files.