This article will help to resolve the following critical diagnostic:

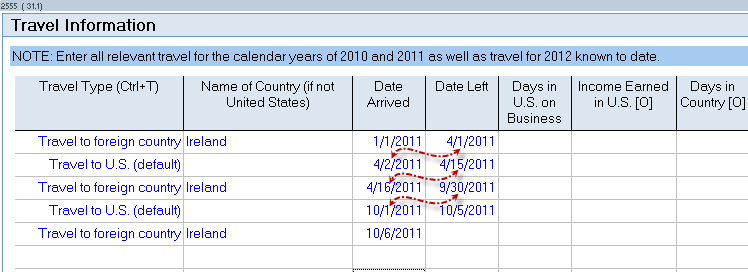

- One or more days between the first and last entered days of travel have been omitted. Based on the entries in "travel Information"' the first entered date and last entered date of travel for this taxpayer are mm/dd/yyyy and mm/dd/yyyy respectively. All days between the first entered day of travel and last entered day of travel must be accounted for or they will be considered foreign days. (ref. #6359)

Follow these steps to resolve this diagnostic:

- Go to Screen 31.1, Foreign Income Exclusion (2555).

- Scroll down to the Travel Information section.

- Revise any Date Arrived or Date Left that overlaps (if you leave the US on January 10, you arrive in the foreign country on January 11).

- Revise any Date Arrived or Date Left that has a gap between days (all days must be accounted for. For example, if you leave on March 3, you can't have arrived on March 6. Date Left should be March 3 and Date Arrived should be March 4).

- A full day is a period of 24 consecutive hours, beginning at midnight.

- See IRS Pub. 54 for examples and travel information.