This article will help you enter form 1099-DIV in an individual tax return in Intuit ProSeries Professional and Intuit ProSeries Basic.

Generally information from Form 1099-DIV is entered on Schedule B.

Follow these steps to enter Form 1099-DIV information on Schedule B:

- Open the tax return.

- Press F6 to bring up the Open Forms window.

- Type B and select OK to open the Schedule B.

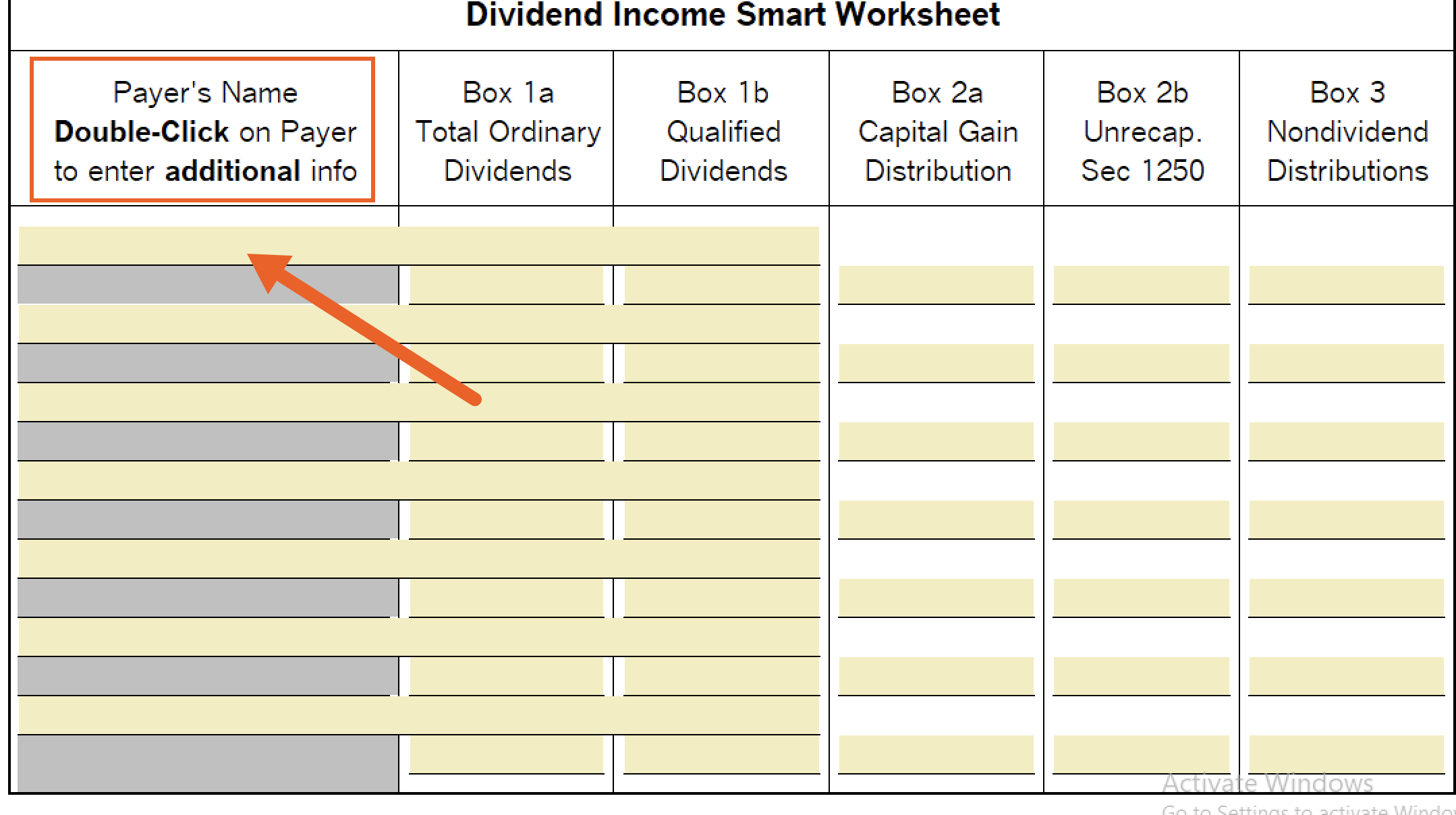

- Scroll to the Dividend Income Smart Worksheet.

- Enter the Payer's Name.

- Enter any amounts from box 1a, box 1b, box 3, box 2a, box 2b and box 3 directly on the Dividend Income Smart Worksheet.

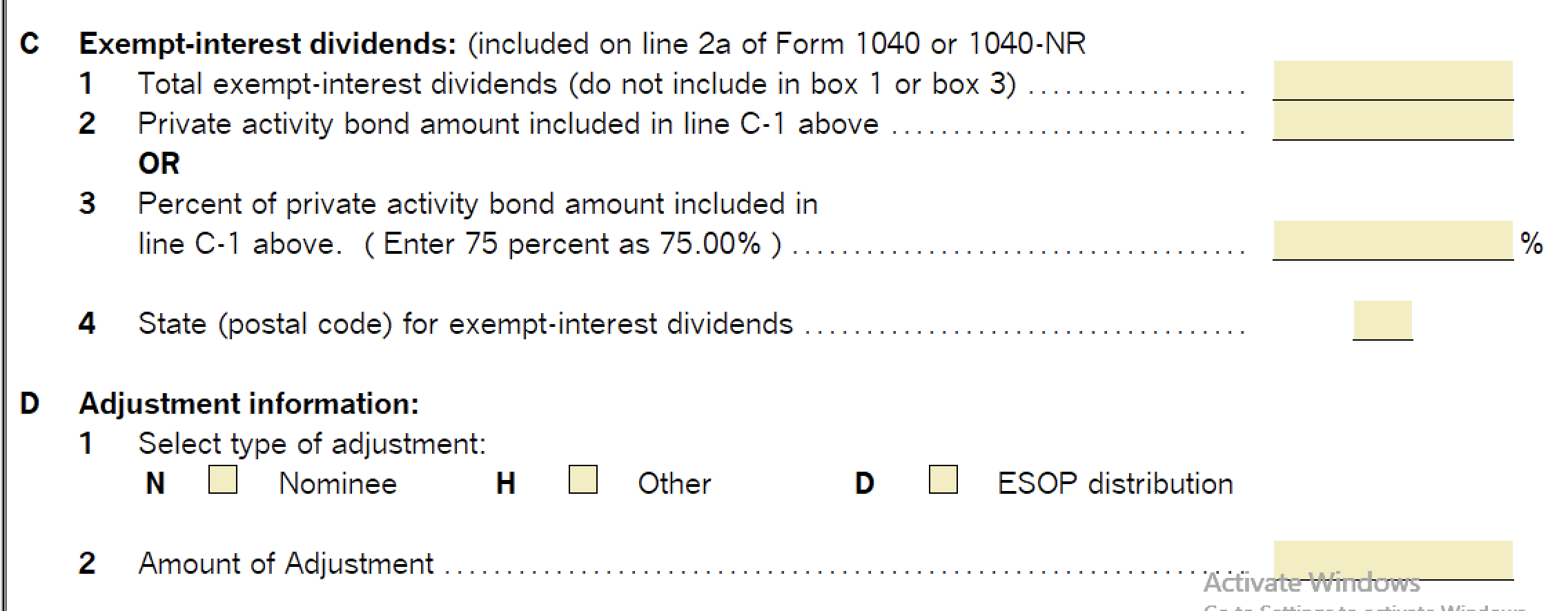

- If the 1099-DIV contains other information such as foreign transactions, or federal tax withheld, double-click the payers name to access the Dividend Income Worksheet.

Form 1099-DIV box 5, Section 199A dividends, should be entered on the Dividend Income Worksheet line 3 to the QBI Deduction Simplified Worksheet line 5.