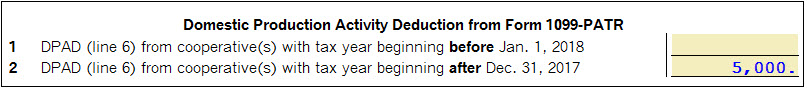

There are 2 types of Domestic Production Activities Deduction that can show up in the 1099-PATR box 6. They will not show up on the same one but the difference is whether the cooperatives accounting year is fiscal or calendar.

Cooperative filing on a calendar year or fiscal year where the tax year began after 12/31/17:

These cooperatives fall under the new regulations and have DPAD under IRC 199A(g). The amount from box 6 of the 1099-PATR does not go on the form 8903.

On the Schedule F there is a smart worksheet to enter the 1099-PATR line 6:

Once entered, this deduction amount will carry to Line 39 of the QBI Complex worksheet and the Schedule 1 line 22 and a required statement will be attached to reflect the 1040 Line 10 is adjusted by this 1099A DPAD.

Cooperative filing on a Fiscal year where the tax year began before 1/1/18:

These cooperatives still fall under the old regulations and have DPAD under IRC 199. The amount from box 6 of the 1099-PATR is reported on Line 23 of the 8903 which will flow to Schedule 1 as an adjustment to income.

QBI calculation needs to be adjusted on the appropriate entity the co-op income is reported on as the income that generates the DPAD cannot also be used for QBI.

A diagnostic warning will appear in Final Review if this adjustment needs to be made:

"Both Form 8903 and either Schedule F or Form 4835 are present in the return. Income associated to the Form 8903 deduction is not allowed for calculating the Qualified Business Income deduction. You will need to adjust the Qualified Business Income eligible for the deduction by the amount of income (possibly the amount in box 6 of the 1099-PATR). Go to the appropriate Schedule F or Form 4835 where the income was reported and override the amount on Line E1 of the Qualified Business Income Deduction Info worksheet at the bottom of the Schedule/Form."