Maximize efficiency by using the input drawer to review flagged items, import documents, view or edit the organizer, and track your clients' Intuit Link activity — all without leaving the tax return.

- See here to learn more about Intuit Link.

How to import data:

- Go to the Input Return workspace.

- Click the Lightning bolt icon on the right side of your screen to open the data import panel.

- If the documents you wish to import aren't already listed, click Browse to choose files from your computer.

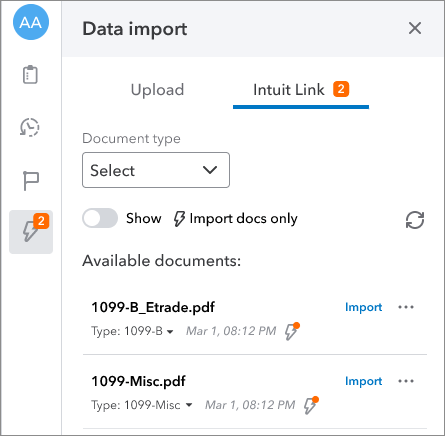

- If your client has already accepted an Intuit Link invitation this year, you’ll be able to switch between Upload and Intuit Link.

- The Uploads list will show documents added by your firm, and the Intuit Link list will display documents your client uploaded.

- Under the Uploads tab, you will be presented with two means of importing documents:

- Drag-and-drop browsing from your local device

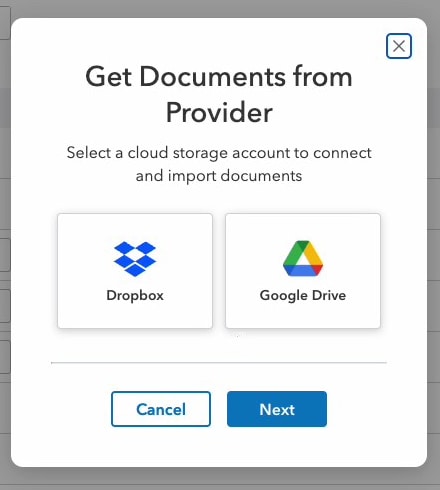

- Using a cloud-based service:

- In a secured pop-up, you will be asked to sign in to your Google or Dropbox account and grant the program access for the import task.

- The program will process the uploads and determine which documents can be imported.

- You can upload up to 20 documents at a time using Dropbox or Google Drive.

- Locate the document and click Import.

- A document viewer will appear where you can review the source document and the information to be imported.

- If you've already entered information for this document type in the return, you'll be asked whether you wish to replace the existing input or create a new record.

- Once you're satisfied, click Import.

After importing:

- Input fields completed by data import will be highlighted in green so you can identify them.

- A lightning bolt will appear next to the document in the data import panel, indicating that the import is complete.

How to flag items for review:

Flagged items are specific input fields marked as needing review. You can track missing data or estimated amounts by flagging the appropriate input fields.

- Go to the Input Return tab.

- Go to the input field you need to flag.

- Place your mouse over (or click inside of) the field. A flag button will appear to the right.

- Sometimes a more button will appear, which looks like three dots. Select more to see the Flag item option.

- Click the flag button or the Flag item option.

The flagged field will be highlighted in orange on your input screen, and the missing information added to a list of flagged items for the return.

To view and resolve previously flagged items:

- Select the flag button to the right, on the edge of your window.

- The button will have an orange badge showing the total number of items currently flagged in the return.

- A flagged items list will appear.

- Select the name of an item to jump to its input in the return, or select Resolve to show it's completed and remove the flag.

- Items can also be resolved on the input screen by simply clicking the flag button again.

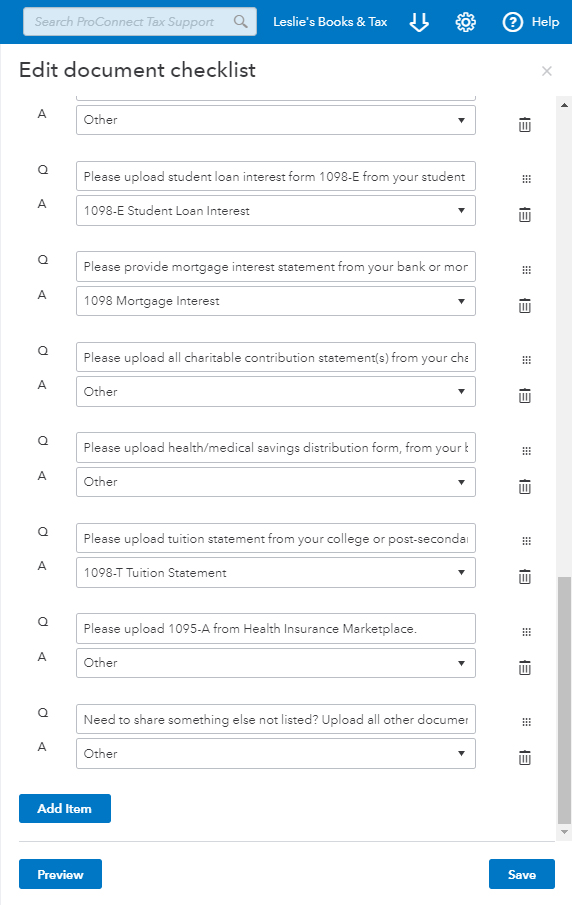

Adding and editing the Intuit Link organizer:

Import your client's source documents directly into the return using Intuit Link.