Before you start:

- ProSeries Basic doesn't have the same client letters as ProSeries Professional.

- The Firm Heading won't populate on the letter when the return is set up as a Non-Paid Preparer or Self-Prepared.

- For more information on using insert and trigger codes, review "Chapter 18, Client and Recipient Letters - Editing and formatting letters" in the ProSeries User's Guide

Click on a topic below to learn more.

New letters in ProSeries 2020 and newer:

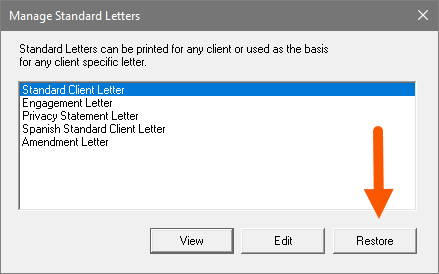

Starting in tax year 2020 ProSeries introduces new Standard Letters that are available for tax return clients:

- Standard Client Letter

- Engagement Letter

- Privacy Statement Letter

- Consent to Disclose Letter

- Consent to Use Letter

- Spanish Standard Client Letter

- Amended Letter

How do I pick which letter prints with the return?

With more then one letter to choose from you can now customize what letters print with the return:

- Open a client.

- From the File menu, select Print Options.

- From the left side of the screen, select Control Which Letters Print.

- Here, you can customize what letter prints with each specific copy of the return.

- Click OK to save your changes.