This article will help you:

- Learn more about the qualified business income (QBI) deduction

- Help you understand how to use ProSeries to calculate the QBI deduction

Table of contents:

About the qualified business income (QBI) deduction

The Tax Cuts and Jobs Act adds a new deduction for non-corporate taxpayers for qualified business income. The deduction is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate.

It reduces the less of taxable income or business income and is generally 20% of a taxpayer's qualified business income (QBI) from a Partnership, S-Corporation, or Sole Proprietorship, defined as the net amount of items of income, gain(s), deduction(s), and loss with respect to the trade or business. Certain types of investment-related items are excluded from QBI, including capital gains or losses, dividends, and interest income (unless the interest is properly allocable to the business).

Taxpayers whose taxable income exceeds the threshold amount of $157,500 ($315,000 in the case of a joint return) are subject to limitations based on the W-2 wages and the unadjusted basis in acquired qualified property.

When the taxable income is more than $157,500 but not more than $207,500 ($315,000 and $415,000 if married filing jointly), the computed 20% deduction amount will be partially limited to the higher of 50% of wages paid by the business, or 25% of the wages paid plus 2.5% of the unadjusted basis of qualified property. If the business has no wages paid, and no qualified property, a partial deduction will be allowed.

The deduction is taken for partnerships and S-Corporations at the partner or shareholder level. Trusts and estates are eligible for the deduction. W-2 wages and the unadjusted basis in acquired qualified property are apportioned between the trust or estate and the beneficiaries.

Specified agricultural or horticultural cooperatives are also eligible for the deduction under special rules. Qualified business income includes only income effectively connected with a U.S. trade or business (or Puerto Rico if all the income is subject to U.S. tax).

How to use ProSeries to calculate the QBI deduction in tax year 2019 and newer

First, follow the steps for each of the relevant schedules listed below for your client's return.

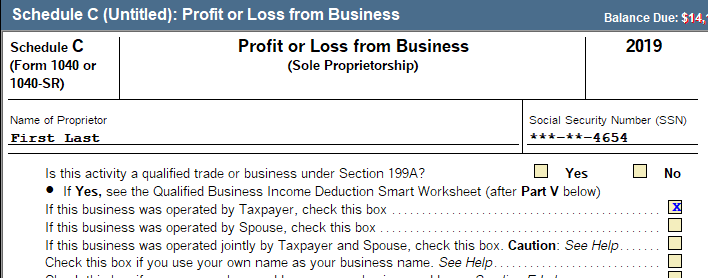

Individual returns, Schedules C and F

- At the top of the Schedule C or F check Yes for Is this activity a qualified trade or business under Section 199A?

- Enter income and expenses within the schedule following your normal workflow.

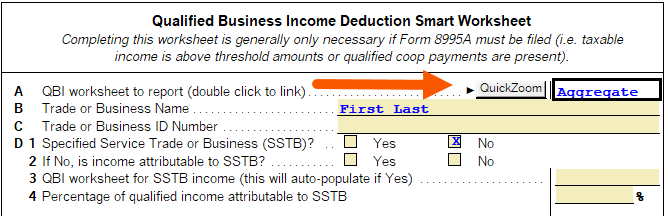

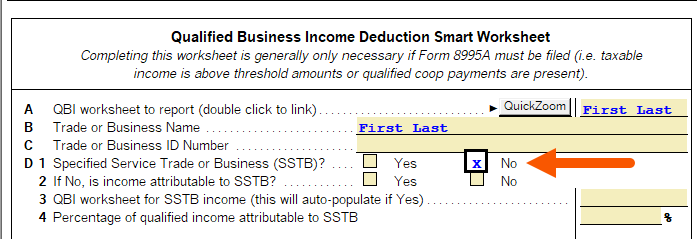

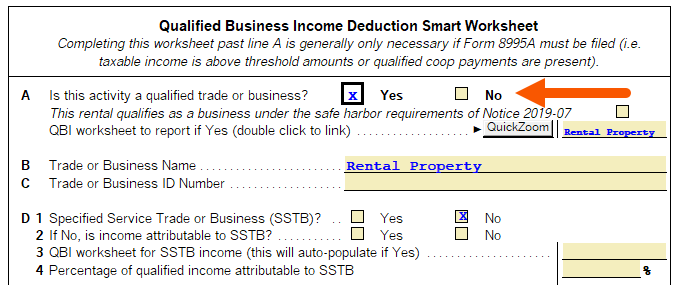

- Scroll down to the bottom of the schedule to review the Qualified Business Income Deduction Smart Worksheet.

- A QBI worksheet will automatically generate, but if you are aggregating this activity with others on your return in QBI Worksheet to report (double-click to link) choose the combined QBI Worksheet.

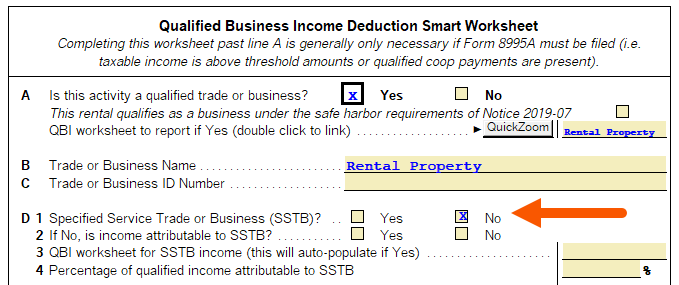

- Check Yes or No if the business is a Specified Service Trade or Business.

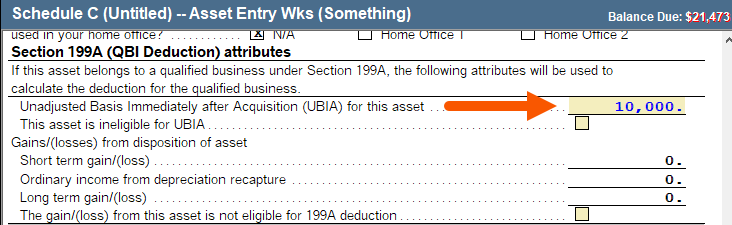

- If you have any adjustments to Unadjusted Basis Immediately after Acquisition for Depreciable Assets enter them in the new Section 199A (QBI Deduction) attributes section of the bottom of the Asset Entry Worksheet.

- Other Adjustments to income are still entered on line J2 of the Schedule C and F Qualified Business Income Deduction Smart Worksheet.

- Enter any applicable agricultural coop information on lines K1-4.

Individual returns, Schedule E

- Enter income and expenses within the schedule following your normal workflow.

- Scroll down to the bottom of the schedule to review the Qualified Business Income Deduction Smart Worksheet.

- Check Yes to Is this activity a qualified trade or business to activate the QBI Calculations.

- A QBI worksheet will automatically generate but if you are aggregating this activity with others on your return in QBI Worksheet to report (double click to link) choose the combined QBI Worksheet.

- Check Yes or No if the business is a Specified Service Trade or Business.

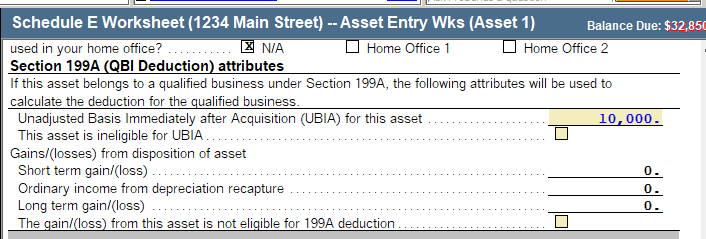

- If you have any adjustments to Unadjusted Basis Immediately after Acquisition for Depreciable Assets enter them in the new Section 199A (QBI Deduction) attributes section of the bottom of the Asset Entry Worksheet.

- Other adjustments to income are still entered on line J2 of the Schedule E worksheet Qualified Business Income Deduction Smart Worksheet.

Individual returns with Partnership or S Corp Schedule K-1 Income

Before you start there are some important changes for tax year 2019:

- Due to standardized guidelines published by the IRS, the K-1 Other Information will only contain one code for QBI. The K-1 Recipient should receive an attachment containing the information needed for the QBI calculation. If you are using the K-1 Import feature this additional statement will not import into the K-1 and need to be manually entered per the below steps.

- Enter K-1 information following your normal workflow.

- On the Other Information (K-1 Partnership line 20, K-1 S-Corp line 17) enter the code for Section 199A (Code Z for Partnerships and Code V for S-Corps) information. This code will generate an error stating: Box 17 Code V (or Box 20 code Z) has been selected but no Section 199A income has been entered on Statement A. This error will be cleared when you complete the next steps.

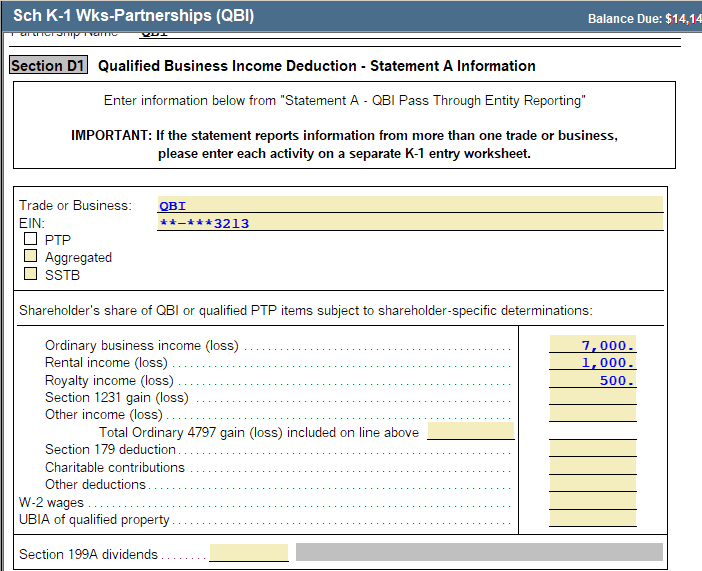

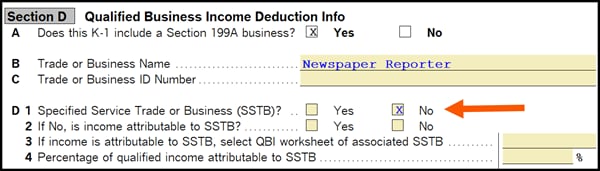

- Scroll to the bottom of the K-1 to review Section D: Qualified Business Income Deduction - Statement A Information

- In tax year 2019, the taxpayer should receive a statement with the K-1 that has been standardized by the IRS and will match the date entry available in this section. Enter the data exactly like it is listed on the statement received.

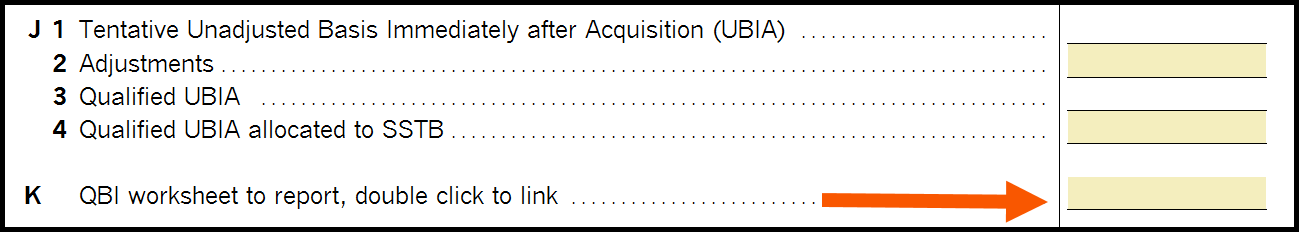

- Scroll down to Section D2 Qualified Business Income Deduction Info. A QBI worksheet will automatically generate but if you are aggregating this activity with others on your return in QBI Worksheet to report (double click to link) choose the combined QBI Worksheet.

- Enter any adjustments as needed.

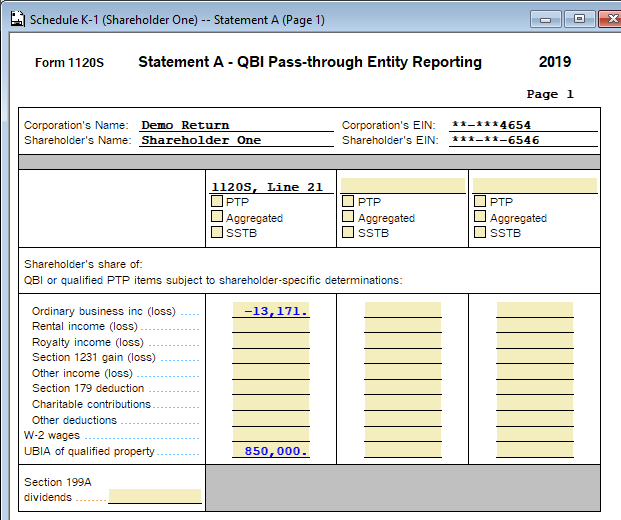

Business returns (Partnerships, S Corps, and Fiduciary)

- Enter information following your normal workflow.

- Press F6 on your keyboard to open the forms menu. Type in 199a, then press Enter.

- To activate the 199A worksheet select Yes to Is this activity a qualified trade/business?

- Check Yes or No if the business is a Specified Service Trade or Business.

- Enter any adjustments to wages or Unadjusted Basis Immediately After Acquisition.

Each activity will be summarized on the 199A Statement A Summary and Schedule K-1 Statement A - QBI Pass-through Entity Reporting for each partner, shareholder, or beneficiary. This replaces the additional codes on the K-1 Other Information that was used last year. If you use the K-1 Import feature to import into the taxpayer's 1040 return Statement A will not import with the K-1 data and will need to be manually entered.

Fiduciary returns with Schedule E income

If the trust has taxable income, ProSeries will calculate the Qualified Business Income Deduction for Schedule E activities.

- Enter information on Schedule E following your normal workflow.

- At the bottom of the Schedule E, review each property in the Qualified Business Income Deduction Info smart worksheet.

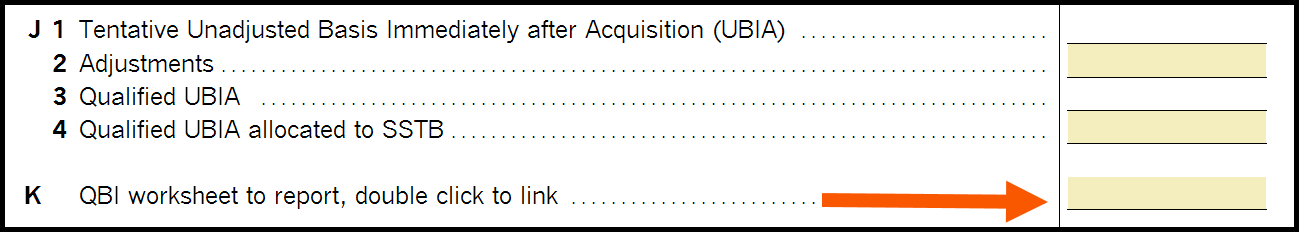

- Link each property to a QBI component worksheet by double-clicking in box B. You can link multiple activities to the same QBI component worksheet to aggregate them.

- Review the QBI Simple or QBI Complex worksheet that's generated.

- Review the QBI Deduction Summary worksheet. The Total QBI Deduction will appear at the bottom.

- Manually enter the total QBI deduction on Line 20 of the 1041.

Once you've completed the steps in each of the relevant schedules for your client's return, you're done. ProSeries will automatically generate the simplified or complex QBI Worksheet based on what's required for your client's return. ProSeries will also produce a QBI Component Worksheet where you can review your entries by activity, and a QBI Deduction Summary Worksheet showing the net amounts from all activities. You can find these worksheets and the deduction summary in the Forms In Use.

How to use ProSeries to calculate the QBI deduction in tax year 2018

First, follow the steps for each of the relevant schedules listed below for your client's return. You can also learn more about how it works in this video:

Individual returns, Schedules C, E, and F

- Enter income and expenses within the schedule following your normal workflow.

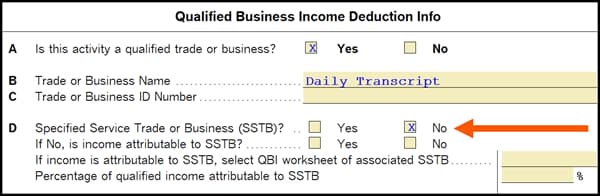

- Scroll down to the bottom of the schedule to review the Qualified Business Income Deduction Info section.

- Check Yes or No if the business is a Specified Service Trade or Business.

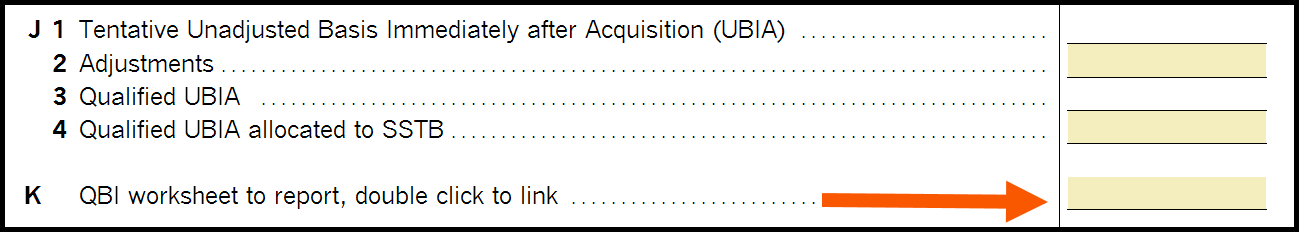

- Enter any adjustments to Unadjusted Basis Immediately after Acquisition into line J1.

- Enter any adjustments to income on line J2.

- Enter any applicable agricultural coop information on lines L1-4.

- Link the schedule to a new QBI component worksheet by double-clicking in QBI worksheet to report, or choose an existing QBI component worksheet to aggregate this activity with others on your return.

Individual returns with partnership or S Corp Schedule K-1 Income

- Enter K-1 information following your normal workflow.

- Scroll to the bottom of the K-1 to review Section D: Qualified Business Income Deduction info.

- Check Yes or No if the business is a Specified Service Trade or Business.

- Enter any adjustments to income or Unadjusted Basis Immediately after Acquisition, if needed.

- Link the K-1 to a new QBI component worksheet by double-clicking the QBI worksheet to report field, or choose an existing QBI component worksheet to aggregate this activity with others on your return.

Business returns (partnerships, S Corps, and fiduciary)

- Enter information following your normal workflow.

- Press F6 on your keyboard to open the forms menu. Type in 199a, then press Enter.

- Enter any adjustments to wages or Unadjusted Basis Immediately After Acquisition.

- Check Yes or No if the business is a Specified Service Trade or Business.

Each activity will be summarized on the Schedule K Other Info - Section 199A and Schedule K-1 Other Info - 199A statement for each partner, shareholder, or beneficiary.

Fiduciary returns with Schedule E income

If the trust has taxable income, ProSeries will calculate the Qualified Business Income Deduction for Schedule E activities.

- Enter information on Schedule E following your normal workflow.

- At the bottom of the Schedule E, review each property in the Qualified Business Income Deduction Info smart worksheet.

- Link each property to a QBI component worksheet by double-clicking in box K. You can link multiple activities to the same QBI component worksheet to aggregate them.

- Review the QBI Simple or QBI Complex worksheet that's generated.

- Review the QBI Deduction Summary worksheet. The Total QBI Deduction will appear at the bottom.

- Click QuickZoom to manually enter the total QBI deduction on Line J of the Other Deductions Statement.

Once you've completed the steps in each of the relevant schedules for your client's return, you're done. ProSeries will automatically generate the simplified or complex QBI Worksheet based on what's required for your client's return. ProSeries will also produce a QBI Component Worksheet where you can review your entries by activity, and a QBI Deduction Summary Worksheet showing the net amounts from all activities. You can find these worksheets and the deduction summary on the left side of the application screen, under Forms In Use.

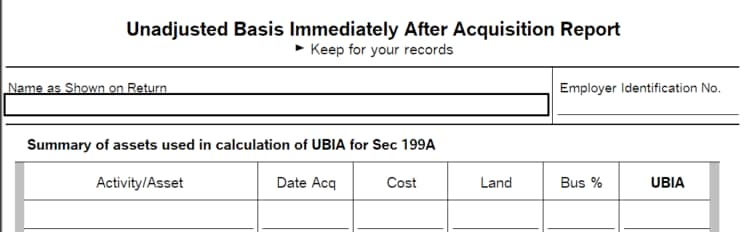

Understanding the ProSeries UBIA report for the QBI deduction

On February 27, 2019, a ProSeries update was released that added a new report related to qualified business income. The Unadjusted Basis Immediately After Acquisition Report is available in the following modules:

- Partnership

- S-Corporation

- Fiduciary

You can access the report from the Forms menu:

- Press F6 to open the Open Forms window.

- Type UBIA.

- UBIA Rpt should be the highlighted form.

The report provides a summary of assets that are being included in the UBIA for the section 199a calculation.