This usually occurs when the tax return was unmarked for e-file or if your EF Center view is filtered. In these cases the e-file record won't show in the EF Center (or EF Clients tab) view.

Make sure that the tax return is marked for e-file:

- Open the tax return you want to display in the EF Center view.

- On the Federal Information Worksheet scroll down to Part VI - Electronic Filing of Tax Return Information.

- Check the box to File the federal return electronically.

- If applicable, check the box to File state or city returns electronically.

- Open each state so the return is updated with the latest change.

- Save the return and go to the EF Center, Pending Tab view or E-File Clients tab in ProSeries Basic.

- To transmit the return, select the name of the client.

- From the E-FIle menu, select Electronic Filing, then Convert/Transmit Returns/Extensions/Payments...

Check the EF Center filtering:

ProSeries has filtering options to make it easier to find clients. If a filter is unknowingly set it may be temporarily hiding the return.

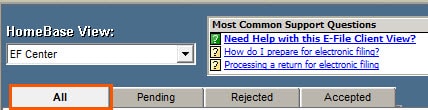

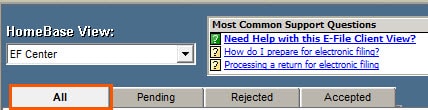

- In ProSeries Professional: On the EF Center make sure you are on the All tab and check for the return again.

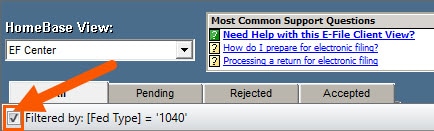

- In ProSeries Professional: Uncheck the Filtered by box and check for the return again.

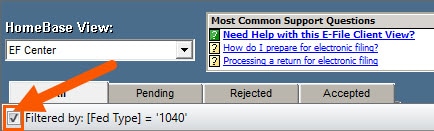

- In ProSeries Basic: Uncheck the Filtered by box and check for the return again.

Force the return to refresh the electronic filing information:

- Open the Information Worksheet.

- Scroll down to the Electronic Filing Information section.

- Uncheck the File state return electronically box.

- Uncheck the File federal return electronically box.

- Press F9 and then F10.

- Switch to the State Information Worksheet and press F9 and then F10.

- Switch to the Federal Information Worksheet.

- Scroll down to the Electronic Filing Information section.

- Check the File state return electronically box.

- Check the File federal return electronically box.

- Press F9 and then F10.

- Switch to the State Information Worksheet and press F9 and then F10.

- Select the EF Now button. Both the federal and state should be available for e-file. If it isn't, proceed to the next section.

Rebuild the HomeBase File for this return:

- These steps need to be completed from the HomeBase view for the tax type, not the EF Center.

- For example: if the return is a 1040 return, open the Form 1040: Individual view.

- Select the client.

- From the File menu, select Client File Maintenance, then Copy/Backup.

- Select the Set Target Directory button.

- Choose your Desktop.

- Select OK.

- Select the Backup Client(s) button.

- Make sure the client file appears on your desktop.

- On the HomeBase view, select the same client, right-click and choose Delete.

- Close ProSeries then open ProSeries to refresh the database.

- From the File menu, select Client File Maintenance then Restore.

- Select the Set Source Directory button.

- Choose your Desktop.

- Select the client.

- Select Restore Client(s).

- Open the return, make sure it's marked for e-file for both federal and state.

- Save the return.

There are occasions when a tax return wasn't e-filed. If the steps above don't correct the situation, sign in to your My Account to make sure the return was successfully e-filed.