When working on a Form 1065 with LLC members and you receive the following error message:

"Form 1065 p4-5: Recourse liabilities. The program will not allocate recourse debt to Limited Liability Company Members. Either reclassify the debt as nonrecourse or enter a special allocation code to indicate how the amount should be allocated."

There are two ways to resolve this error:

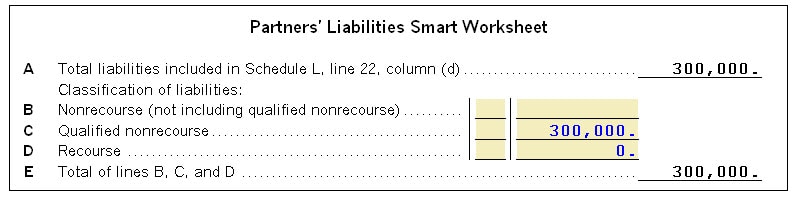

- Reclassify the debt as nonrecourse, or

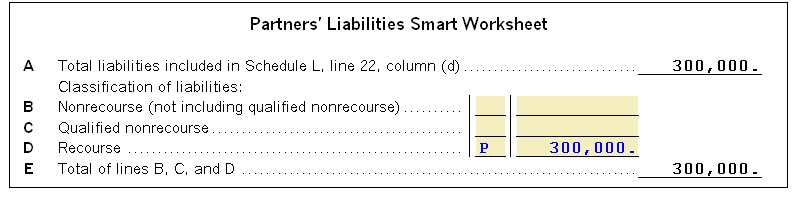

- Enter a special allocation code to allocate the recourse debt.

Please refer to the IRS instructions for Form 1065 and the Schedule K-1 for determining if you need to keep this amount as recourse or if you need to classify it as nonrecourse.