bobnbob

Level 1

03-13-2021

11:04 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

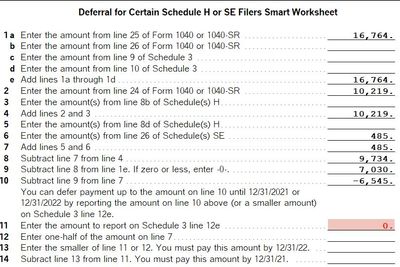

I am trying to avoid deferral of SE tax on Schedule Line 12e of form 1040. However, entering 0 on this line results in an error. The problem has something to do with the negative calculation on line 10 of this worksheet. Am I doing something wrong???

Solved! Go to Solution.

Labels

TaxGuyBill

Level 15

03-13-2021

11:19 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The IRS won't let you defer it if taxes have already being paid (there is a refund) on the tax return). It only can be done if the taxpayer OWES money.

Line 10 shows a negative number, which means that all taxes have been paid, so nothing can be deferred. You need to leave Line 11 blank.

bobnbob

Level 1

03-13-2021

11:23 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, TaxGuyBill. That answer was so simple, that I feel stupid! I thought that entering 0 would be like leaving the line blank. I guess not!