- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

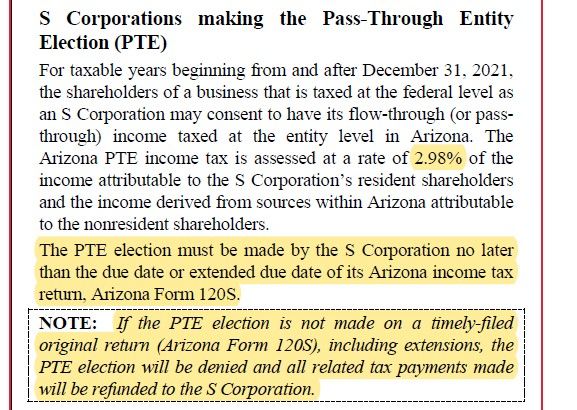

The election is made by paying the PTE tax timely. Read the instructions for Form 120S.

There are significant issues to know:

1. I advise learning how overpayments and underpayments of the PTE are treated by the AZ DOR.

2. What happens when some shareholders opt out?

3. Who are eligible shareholders?

Note that you have until the extended due date! That is really nice. California requires shareholders to pay by March 15. So Arizona law is more favorable.

I have only 1 Arizona client, so I have not yet learned all there is to know. The snip shows what I know. Please share what you learn, if you have time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@adspadcpa Let me know if anything I wrote is wrong. The thing that nags me is why AZ wants the PTE tax paid on an estimated voucher. That seems odd as contrasted with CA which has its own voucher. Thank you.