- Go to Screen 9, Extension (4868, 2350).

- Scroll down to the Extension for Taxpayers Abroad (2350) section.

- In the 1 = Form 2350, 2 = blank (MANDATORY) field enter a 1.

Intuit Help

Intuit

12-05-2019

04:46 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

This article will help you:

- Complete the required entries to generate an extension

- E-file an extension

- Batch print extensions for multiple clients at once

To generate a Form 4868 for Individual:

- Go to Screen 9, Extensions (4868, 2350)

- In the 1=automatic extension 2=blank (MANDATORY) field, enter a 1.

How do I e-file an extension?

We recommend you review your e-file critical diagnostics for any that reference the extension before filing.

- Click on the Clients tab.

- Highlight the client(s) to e-file.

- From the E-File menu choose Start e-file Extension Wizard.

Use caution when selecting the e-file Extension Wizard. If you choose the incorrect wizard the return itself will be transmitted and cannot be canceled. An amended return would need to be filed.

Use caution when selecting the e-file Extension Wizard. If you choose the incorrect wizard the return itself will be transmitted and cannot be canceled. An amended return would need to be filed.

- Verify the Client Name is correct and the correct extensions are selected under Federal and State Extensions when applicable and click Next.

- Once the extension is validated click on the Send e-file Returns Now.

To e-file after 4/15 for filers abroad:

Certain taxpayers who are out of the country on the tax deadline have until 6/15 to request an extension using Form 4868. To e-file these extensions after the original tax deadline, you must verify that box 8 of the form is checked, and that your client's tax home isn't listed as a U.S. address.

- Go to Screen 9, Extensions (4868, 2350)

- Enter a 1 in 1=automatic extension, 2=blank (MANDATORY).

- Scroll down to the Extension Pursuant to Regulation 1.6081-5(a) section.

- Enter a 1 to indicate your client's tax home was outside the U.S. on 4/15.

- Go to Screen 1, Client Information.

- Verify that your client's complete foreign address is entered here. The program won't allow you to transmit an extension after 4/15 for a client with a domestic address.

To generate a Form 2350 for US Citizens and Resident Aliens Abroad

To generate a Form 7004 for Partnerships:

- Go to Screen 6, Automatic Extension (7004)

- In the Print extension: 1=1065 2=8804 3=both field enter a 1.

- The extension for Form 8804 can not be electronically filed.

- If planning on electronic filing, check the e-file extension box.

- Complete any other applicable information in this section that applies to your client.

To generate a Form 7004 for Corporations:

- Go to Screen 12, Automatic Extension (7004)

- In the 1=automatic extension, 2=blank (MANDATORY) field enter a 1.

- If planning on electronic filing, check the e-file extension box.

- Complete any other applicable information in this section that applies to your client.

To generate a Form 7004 for S-Corporations:

- Go to Screen 12, Extension of Time to File (7004)

- In the 1=automatic extension, 2=blank (MANDATORY) field enter a 1.

- If planning on electronic filing, check the e-file extension box.

- Complete any other applicable information in this section that applies to your client.

To generate a Form 7004 for Fiduciary or 8868 for 5227 and 1041-A:

- Go to Screen 14, Extension (7004/8868)

- Check the box for Print applicable extension request (7004 or 8868).

- If planning on electronic filing, check the e-file extension box.

- Complete any other applicable information in this section that applies to your client.

To generate a Form 8868 for Exempt Organizations:

- Go to Screen 15, Extensions

- There are three sections present. Use the one that matches the type of 990 being filed by the client.

- In the 1=automatic extension, 2=blank (MANDATORY) field enter a 1.

- If filing a Form 990/990-PF and you are planning on electronic filing, check the e-file extension box.

- Complete any other applicable information in this section that applies to your client.

If the extension form does not generate:

- From the Settings menu, choose Options.

- Select the Tax Return tab.

- Scroll down to the Federal Tax Options section.

- Locate the Form XXXX with return option, where XXXX is the form number for the applicable extension.

- Select 'Yes' from the drop down menu.

The state extension forms will not generate if the Global Option Form XXXX With Return is set to No. It must be set to Yes to generate both federal and state extensions with the return.

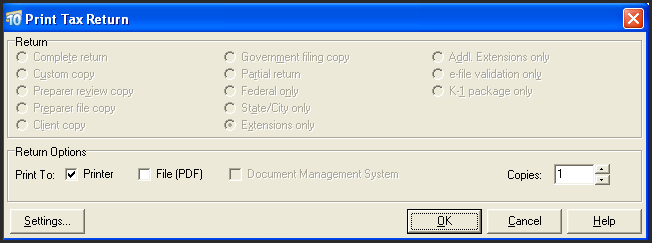

How do I batch print extension forms?

- From the Clients tab highlight the clients you need extensions for.

- From the Print menu choose 1st Extension.

- Under Return Options choose to print to the Printer or File (PDF).

- Click OK to begin printing.

Related Topics:

- Electronic filing deadlines and perfection periods for individual returns and extensions (1040, 1040...

- Electronic filing deadlines and perfection periods for business returns and extensions (1120, 1120S,...

- 1040 state extension frequently asked questions

- Common questions about electronic filing of extensions in Lacerte

Labels