Below, you'll find information on entering amounts reported on Form 1099-PATR, pertaining to Domestic Production Activities Tax Deduction for cooperatives, in Intuit ProConnect. Refer to the IRS Instructions for Form 1099-PATR for more information.

Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

When filing Form 1099-PATR, you may include distributions received from a cooperative to your income.

How to include backup withholding as income tax withheld

For an individual return:

- Go to the Input Return tab.

- From the left of the screen, select Income and choose SS Benefits, Alimony, Misc. Income.

- Under the Tax Withheld section, enter the backup withholding amount in the field labeled Federal Income Tax Withheld [Adjust].

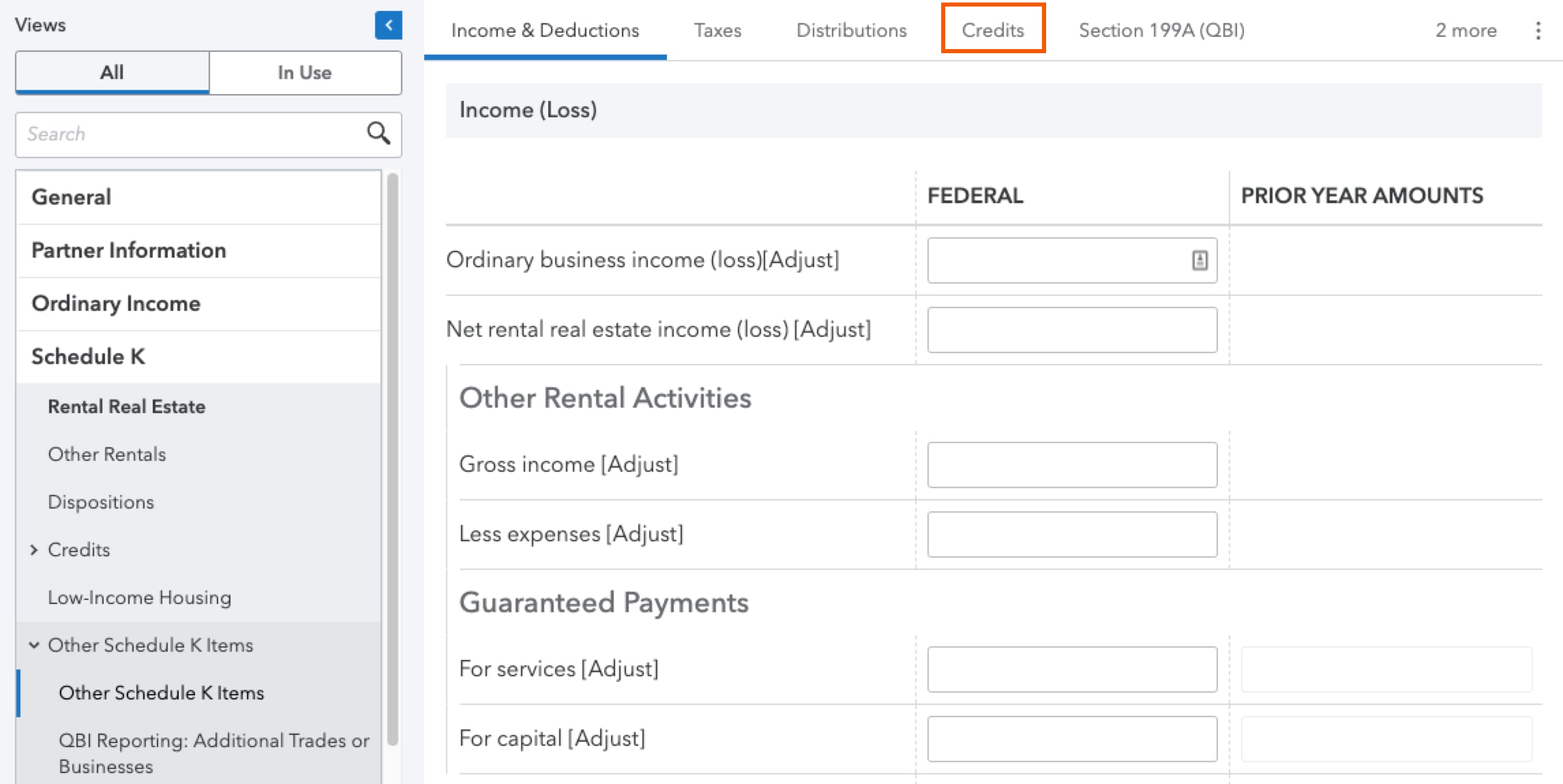

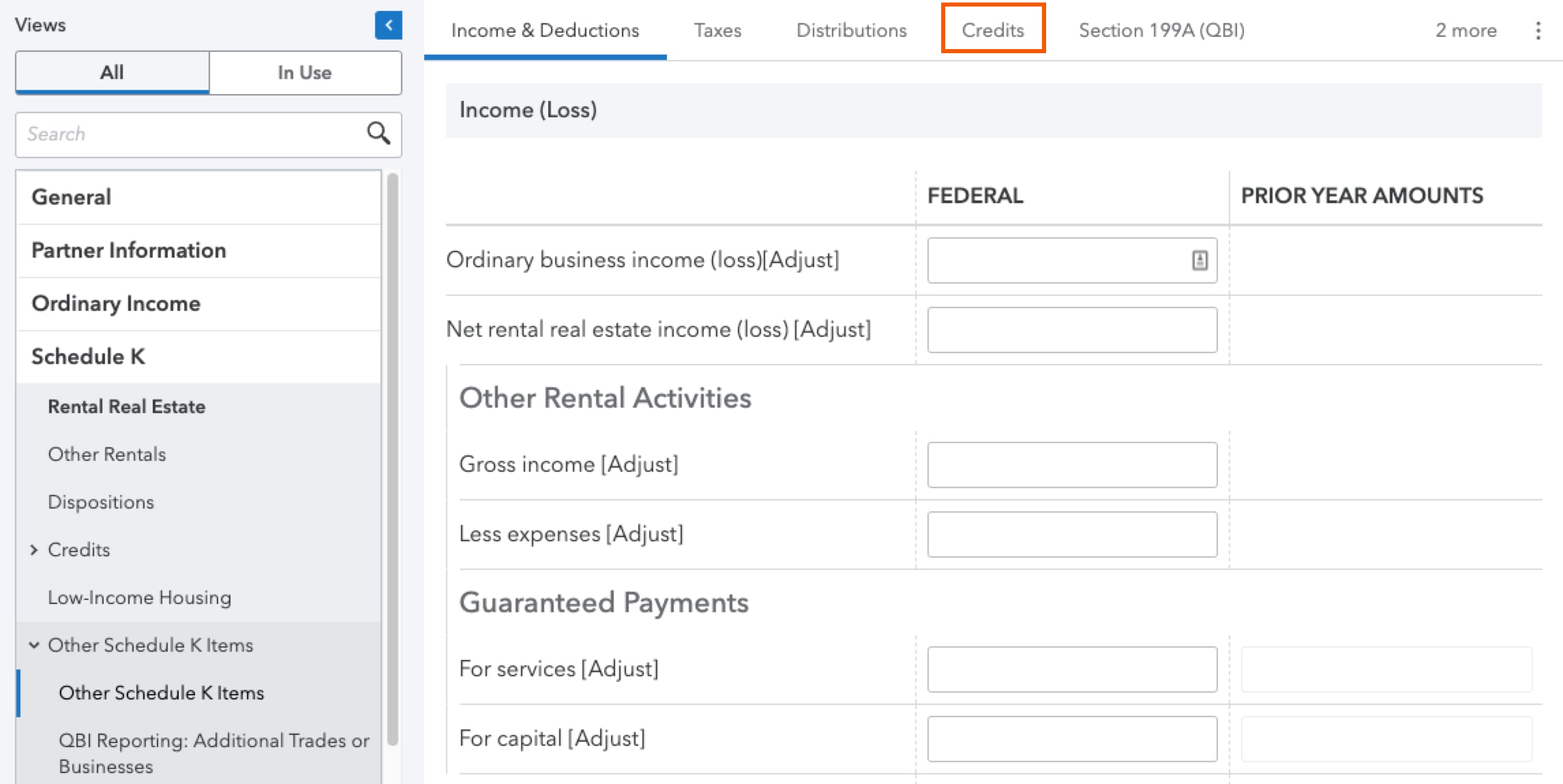

For a partnership return:

- Go to the Input Return tab.

- From the left of the screen, select Schedule K and choose Other Schedule K Items.

- Select Other Schedule K Items.

- From the top of the screen, select Credits.

- In the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- This will appear on Line 15 of the Schedule K/K-1 (1065).

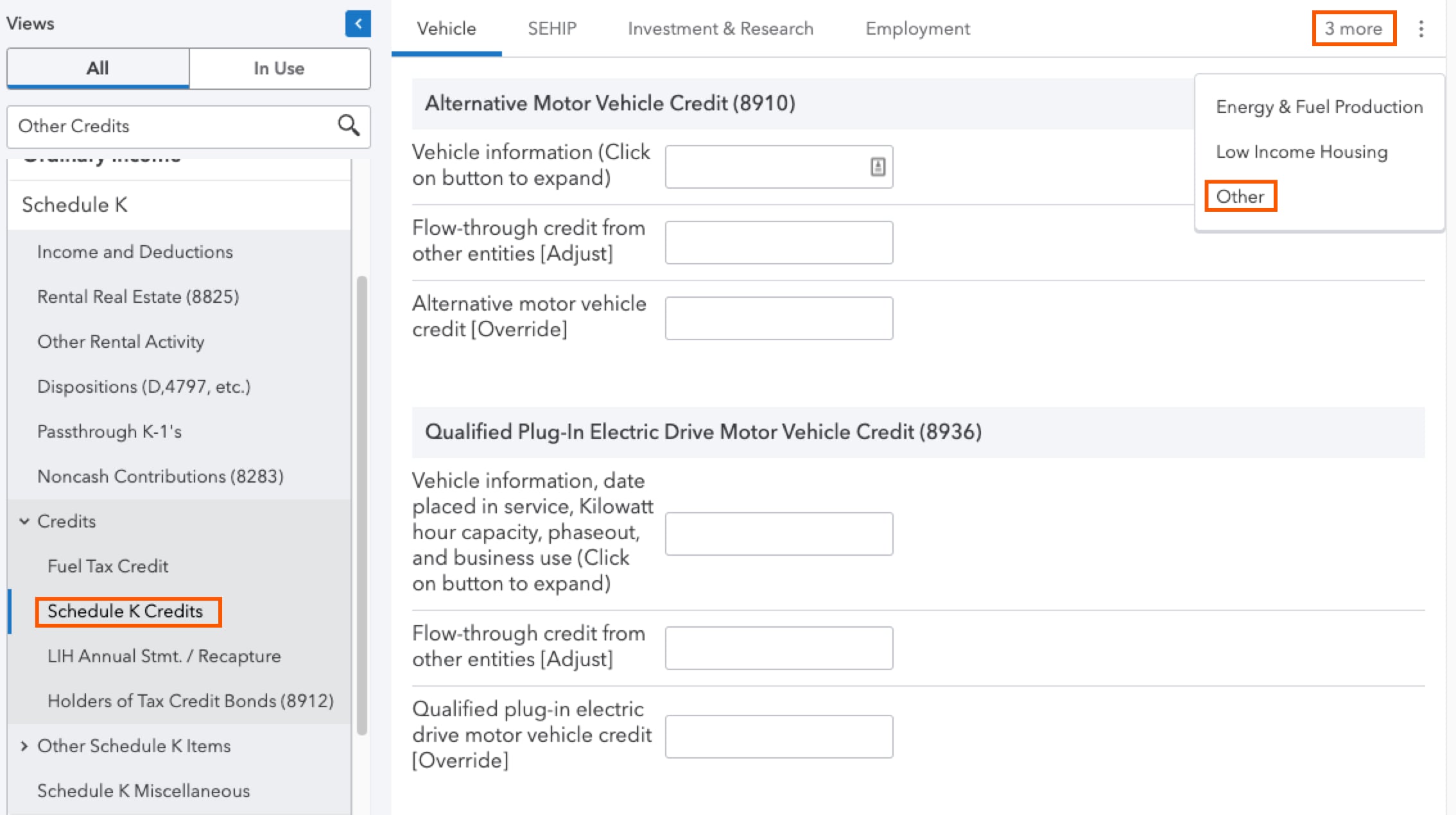

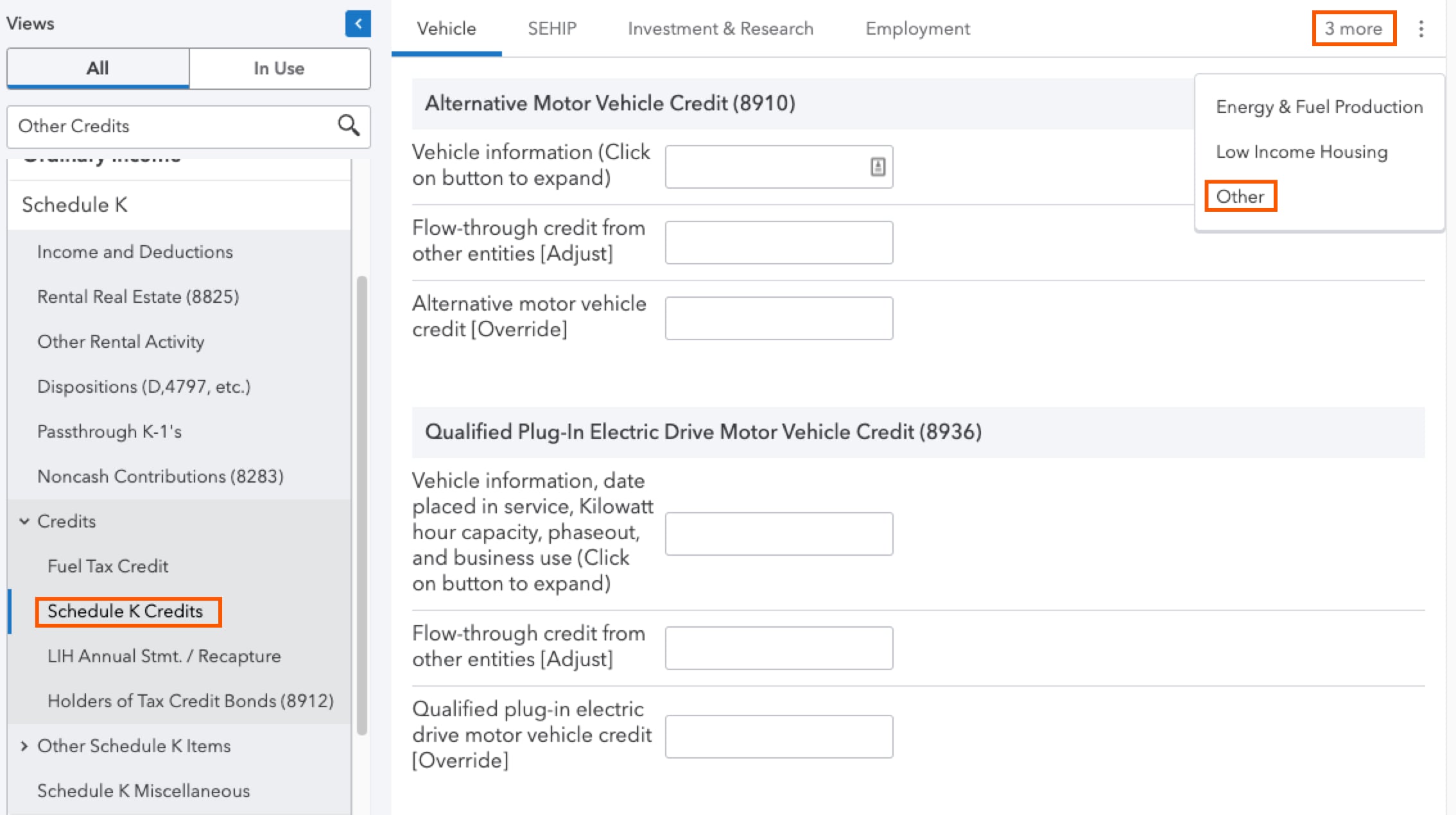

For an S-Corporate return:

- Go to the Input Return tab.

- From the left of the screen, select Schedule K and choose Credits.

- Select Schedule K Credits.

- From the top of the screen, click the three dots in the upper right corner and select Other

- Scroll down to the Other Credits - Schedule K Lines 13C - 13G section.

- In the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- This will appear on Line 13 of the Schedule K/K-1 (1120-S).

Where to report specific items reported on Form 1099-PATR

Box 1

For individuals, unless nontaxable, report on the activity associated with the 1099-PATR:

- The Business Income (Sch C) screen

- The Farm Income (Sch F, 4835) screen

Box 2

For individuals, unless nontaxable, report on the activity associated with the 1099-PATR:

- The Business Income (Sch C) screen

- The Farm Income (Sch F, 4835) screen

Box 3

For individuals, unless nontaxable, report on the activity associated with the 1099-PATR:

- The Business Income (Sch C) screen

- The Farm Income (Sch F, 4835) screen

Box 4

How to enter for an individual:

- From the left of the screen, select Income and choose SS Benefits, Alimony, Miscellaneous Inc.

- Scroll down to the Tax Withheld section.

- Enter the amount in Federal income tax withheld [Adjust].

How to enter for a partnership:

- From the left of the screen, select Schedule K and choose Other Schedule K Items.

- From the top of the screen, select Credits.

- Scroll down to the Credits section.

- For the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- Enter the applicable amount(s).

- This will appear on line 15f of the Schedule K/K-1 (1065).

- Click OK.

How to enter for a S corporation:

- From the left of the screen, select Schedule K and choose Credits.

- Select Schedule K Credits.

- From the top of the screen, select Other.

- Scroll down to the Other Credits - Schedule K Lines 13C - 13G section.

- For the Other credits (Click on button to expand) field, select O = Backup withholding as the K-1 Code.

- Enter the applicable amount(s).

- This will appear on line 13g of the Schedule K/K-1 (1120-S).

- Click OK.

Box 5

For individuals, unless nontaxable, report on the activity associated with the 1099-PATR:

- The Business Income (Sch C) screen

- The Farm Income (Sch F, 4835) screen

Boxes 6, 7, 8, and 9

Individual module - Scroll down to the Qualified Business Income Deduction section of the Business Income (Sch. C) screen or the Farm Income (Sch. F, Form 3845) screen and enter any adjustments to this activity’s QBI for the income received from a cooperative.

Boxes 10, 11, and 12

Corporate module - Your entry will depend on the credit or deduction shown. Go to the General Business Credits (3800) screen and enter the amount in the appropriate field.

For those credits allowed to be reported directly on Form 3800, you need to use the Credit from cooperatives (Part II) field.

For those credits allowed to be reported directly on Form 3800, you need to use the Credit from cooperatives (Part II) field.

![]() Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

Starting in tax year 2018, the Domestic Production Activities Deduction has been repealed. Form 1099-PATR now applies to cooperatives only.

![]() For those credits allowed to be reported directly on Form 3800, you need to use the Credit from cooperatives (Part II) field.

For those credits allowed to be reported directly on Form 3800, you need to use the Credit from cooperatives (Part II) field.