Form 1095-B

Before 2019, individuals who did not have minimum essential coverage and did not qualify for an exemption from this requirement could be liable for the individual shared responsibility payment, and this form was required reporting.

ProSeries provides a Form 1095-B Health Coverage worksheet that closely resembles the Form 1095-B that your client may receive. Similar to a W-2, you will transfer the values from the client's Form 1095-B to the 1095-B Health Coverage worksheet in ProSeries.

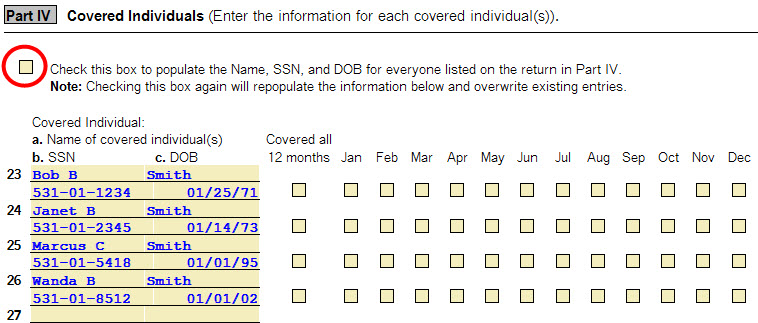

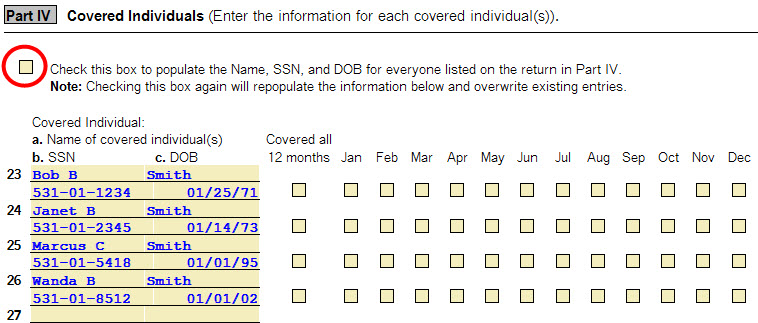

Lines 22-28 will list each individual covered. Column (d) Covered all 12 months, will be checked if the individual was covered for at least one day in every month of the year. For individuals who were covered for some but not all months, information will be entered in column (e) Months of coverage, indicating the months for which theses individuals were covered. If there are more than six covered individuals, you will receive one or more additional Forms 1095-B that continue Part IV.

Note - To quickly populate Part IV with the Name, Social Security Number, and Date of Birth for the taxpayer, spouse, and each dependent already entered on the Federal Information Worksheet, mark the check box located beneath the Part IV 'Covered Individuals' heading. To complete Part IV you will then only need to mark the appropriate check boxes to identify 'Covered all 12 months', or to mark the specific months that individual was covered.

If using this check box results in the presence of individuals not documented on the taxpayer's Form 1095-B, simply remove the unwanted individuals. To easily remove a row (individual), right-click on the Covered Individuals Name and in the menu that appears select Delete Line in Table. The row will be deleted.

- Press F6 to bring up Open Forms.

- Type 1095-B and click Create new copy.

- Enter the Issuer or Other Coverage Provider Name and click Create.

- Check if Form 1095-B is for the Taxpayer or Spouse.

- Entering Part I, Responsible Individual (Policy Holder).

- Information for Line 1, 2, 3, 4, 5, 6, and 7 will be completed by the program.

- Line 8 Enter the letter identifying Origin of the Policy:

- A. Small Business Health Options Program (SHOP).

- B. Employer-sponsored coverage.

- C. Government-sponsored program.

- D. Individual market insurance.

- E. Multiemployer plan.

- F. Miscellaneous minimum essential coverage.

- Line 9 will be blank for 2015.

- Part II Employer-Sponsored Coverage (Complete if Line 8 is A or B):

- Line 10 enter the Employer Name.

- Line 11 Enter the Employer Identification number (EIN).

- Line 12 Street Address.

- Line 13 City or town.

- Line 14 State or province.

- Line 15 Country and Zip or foreign ZIP code.

- Part III, Issuer or Other Coverage Provider.

- Line 16 will be completed based on the name entered when the copy was created.

- Line 17 Employer ID.

- Line 18 Telephone No.

- Line 19 Street Address.

- Line 20 City or town.

- Line 21 State or province.

- Line 22 Zip code.

- Part IV Covered Individual (Enter the information for each covered individual(s).)

Form 1095-C

- Press F6 to bring up Open Forms.

- Type 1095-C and click Create new copy.

- Enter the Employer Name and click Create.

- Check the box to indicate if owned by Taxpayer or Spouse.

- Part I Employee:

- Lines 1, 2, 3, 4, 5, and 6 will be completed based on the ownership box checked.

- Line 7 is completed when entering the name of the Employer for the copy.

- Line 8 EIN of the Employer.

- Line 9 Street address of the employer.

- Line 10 is Phone number of the employer.

- Line 11 is the City or town of the employer.

- Line 12 is the State of the employer.

- Line 13 is the Zip code of the employer.

- Part II Employer Offer and Coverage for all time periods:Line 14 Offer of Coverage code:

- 1A. Minimum essential coverage providing minimum value offered to you with an employee contribution for self-only coverage equal to or less than $1,108.65 (9.5% of the 48 contiguous states single federal poverty line) and minimum essential coverage offered to your spouse and dependents(s) (referred to here as a Qualifying Offer). This code may be used to report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12 months of the calendar year.

- 1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to your spouse or dependent(s).

- 1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) but NOT your spouse.

- 1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your spouse but NOT your dependent(s).

- 1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse

- 1F. Minimum essential coverage NOT providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse

- 1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in self-insured employer-sponsored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months Box on line 14.

- 1H. No offer of coverage (you were NOT offered any health coverage or they were offered coverage that is NOT minimum essential coverage).

- 1I. Your employer claimed "Qualifying Offer Transition Relief" for 2015 and for at least one month of the year you (and your spouse or dependent(s)) did not receive a Qualifying Offer. Note your employer has also provided a contact number at which they may request further information about the health coverage, if any, they were offered (see line 10.)

- Part III, Covered Individuals, Line 17 - 22:

- Part III reports the name, Social Security number, and coverage information about each individual (including any full-time employee and non-full-time employee, and any employee's family members) covered under the employer's health plan, if the plans is "self-insured".

- Tip! To quickly populate Part III with the Name, Social Security number, and Date of Birth for the taxpayer, spouse, and each dependent already entered on the Federal Information Worksheet, mark the check box located beneath the Part III 'Covered Individuals' heading. To complete Part III you will then only need to mark the appropriate check boxes to identify the coverage months.

- If using this check box results in the presence of individuals not documented on the taxpayer's Form 1095-B, simply remove the unwanted individuals. To easily remove a row (individual), Right-Click on the Covered Individuals Name and in the menu that appears select Delete Line in Table. The row will be deleted.

- For the 'Covered all 12 months' to be checked, the individual must be covered for at least one day in every month of the year. For individuals who were covered some but not all months, mark the check boxes to indicate the months that the individual was covered.

- If there are more than 6 covered individuals, the taxpayer should receive one or more additional Forms 1095-C that continue Part III.