- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

Coming soon: To learn more about Intuit Tax Advisor and reserve your free credits, click here.

This article will help you create plans and reports in Intuit Tax Advisor based on your clients' returns in Lacerte or ProConnect Tax.

To start your first plan

![]() If you use Lacerte, you'll need to enable cloud syncing of tax return data first. We'll walk you through it.

If you use Lacerte, you'll need to enable cloud syncing of tax return data first. We'll walk you through it.

- Sign in to Intuit Tax Advisor with the username and password you use for your tax program.

- If you've used other Intuit Accountants products before, you may see a list of firms. Select the account that you use for Lacerte or ProConnect.

- Press Create tax plan.

- Select the client you're planning for.

- If you use Lacerte, the individual clients you've synced to the cloud will show here.

- If you use ProConnect, all of the active clients you normally see in ProConnect will be listed.

- Choose the tax return you want to base the plan on, then press Start planning.

Changing the baseline

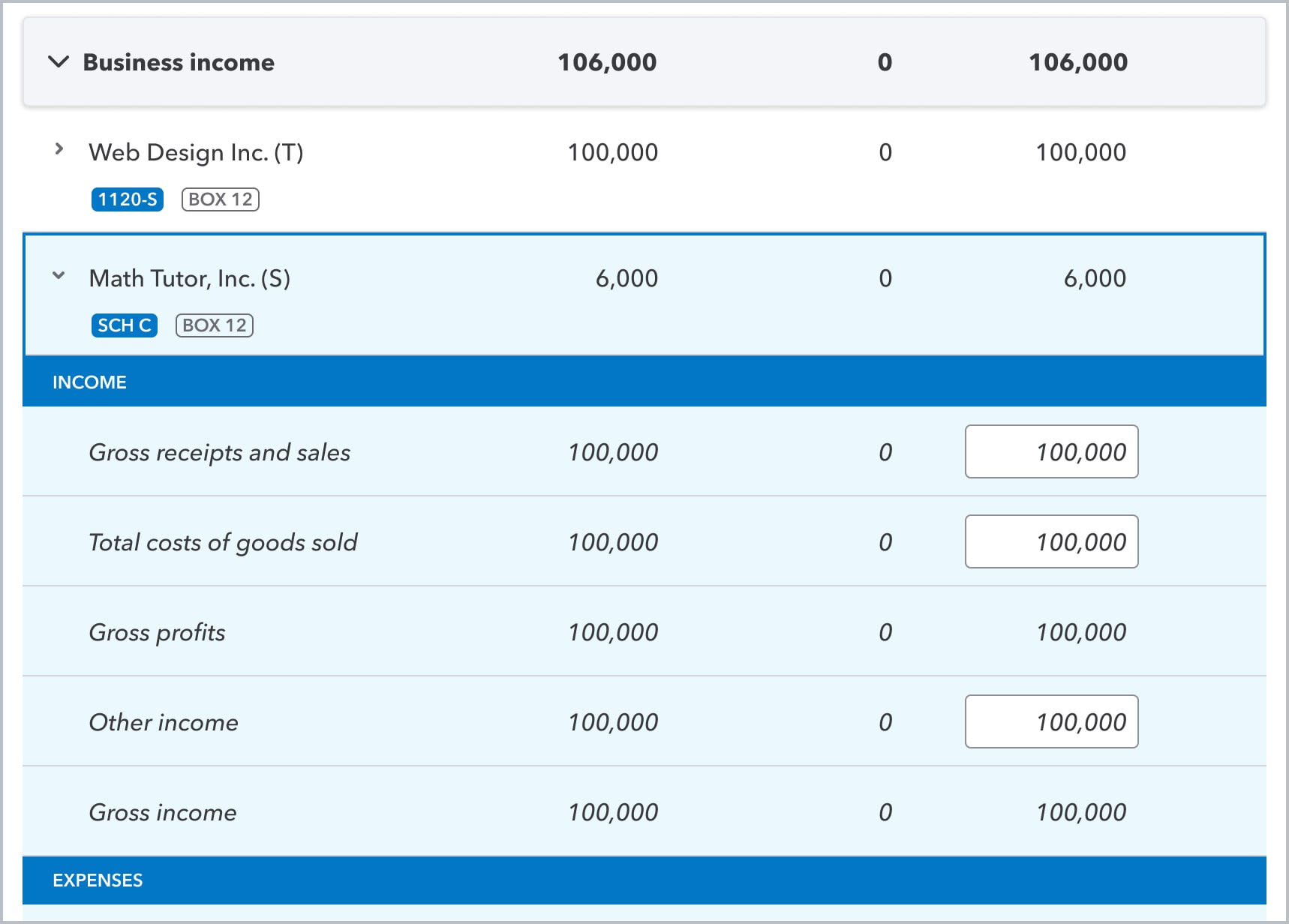

Your plan will open to the Pre-strategy baseline view, where you can review the 2021 Actual amounts imported from the return, and make changes to the 2022 Baseline column.

This is where you can make changes based on what you know is already going to be different for the year - like a raise your client received, or a capital loss. Click into any line item to see and edit details.

- Intuit Tax Advisor will automatically calculate certain year-over-year differences, like the deduction for self-employment tax, based on next year's rates.

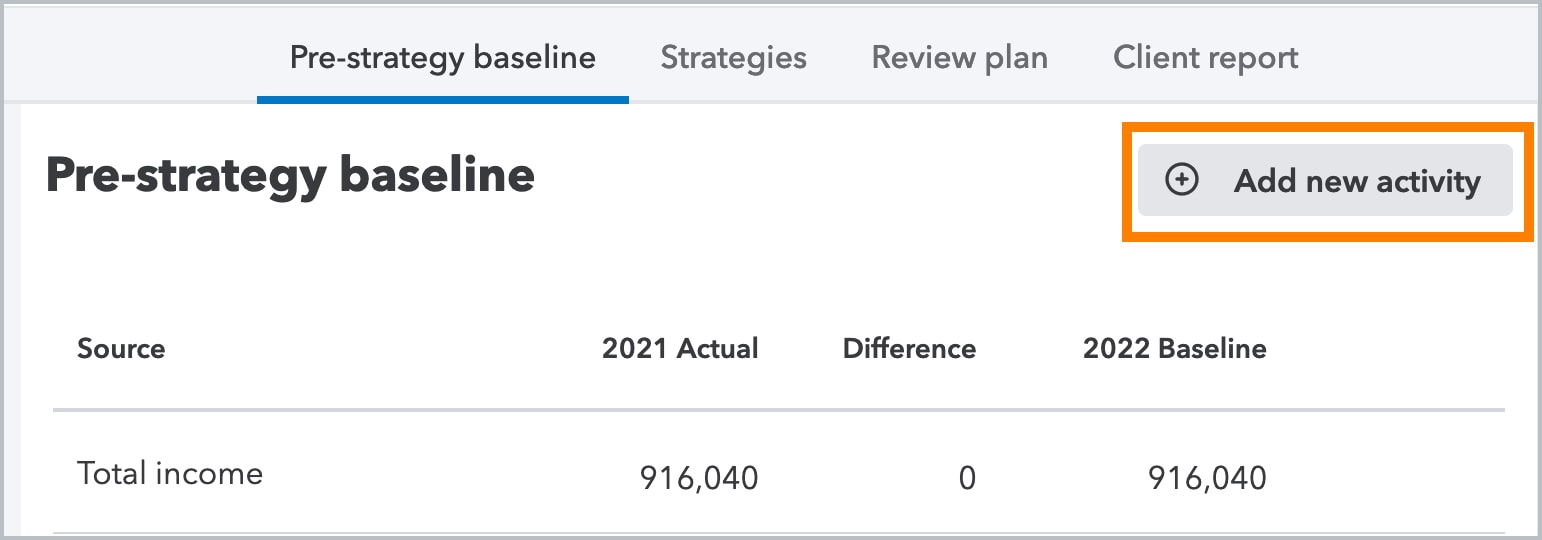

Add new activities

You can also add new lines here to account for jobs, businesses, or K-1s that weren't present in last year's return:

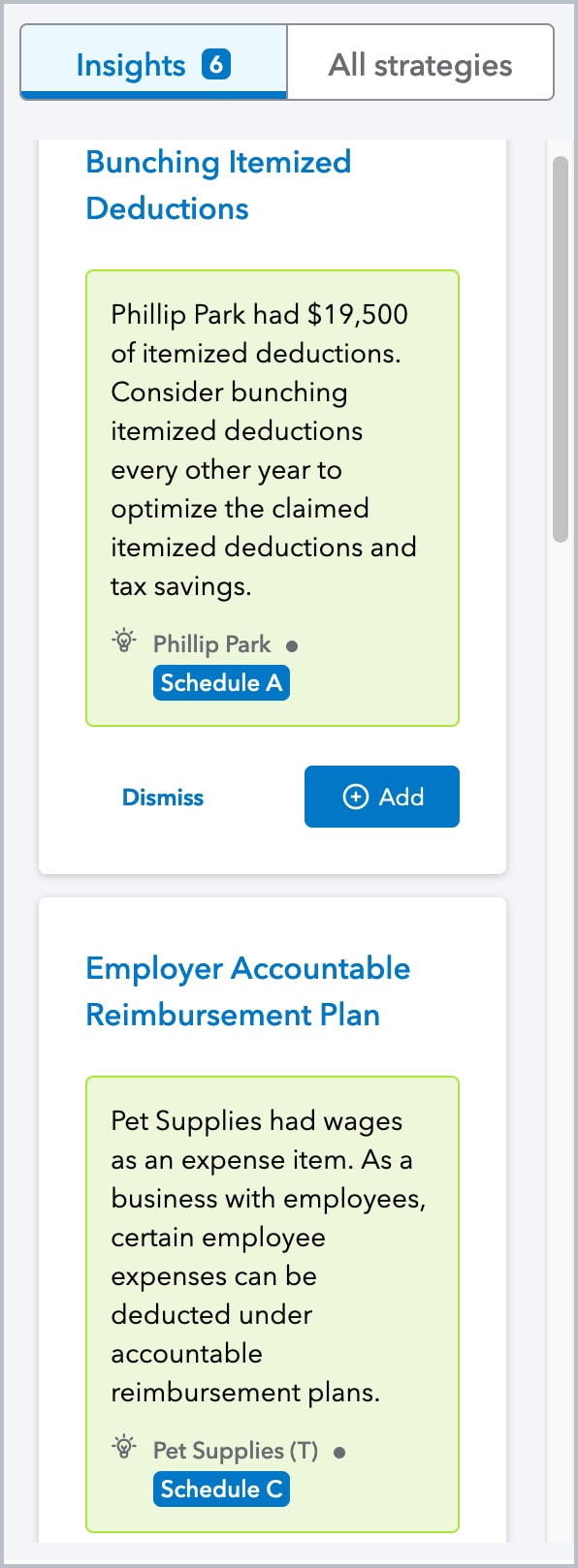

Apply insights and strategies

Once you've set the 2022 baseline amounts, head to the Strategies screen to review any Insights that we think your client may benefit from.

- Click on the insight's name to view details,

- Press Add to apply the strategy to this return,

- Or press Dismiss to hide the strategy from the Insights list. If you change your mind, you can always find it later under All strategies.

Or click All strategies to view a full list.

View and print client reports

After you review the plan, head to the Client Report tab to preview the documents generated for your client.

Services proposal

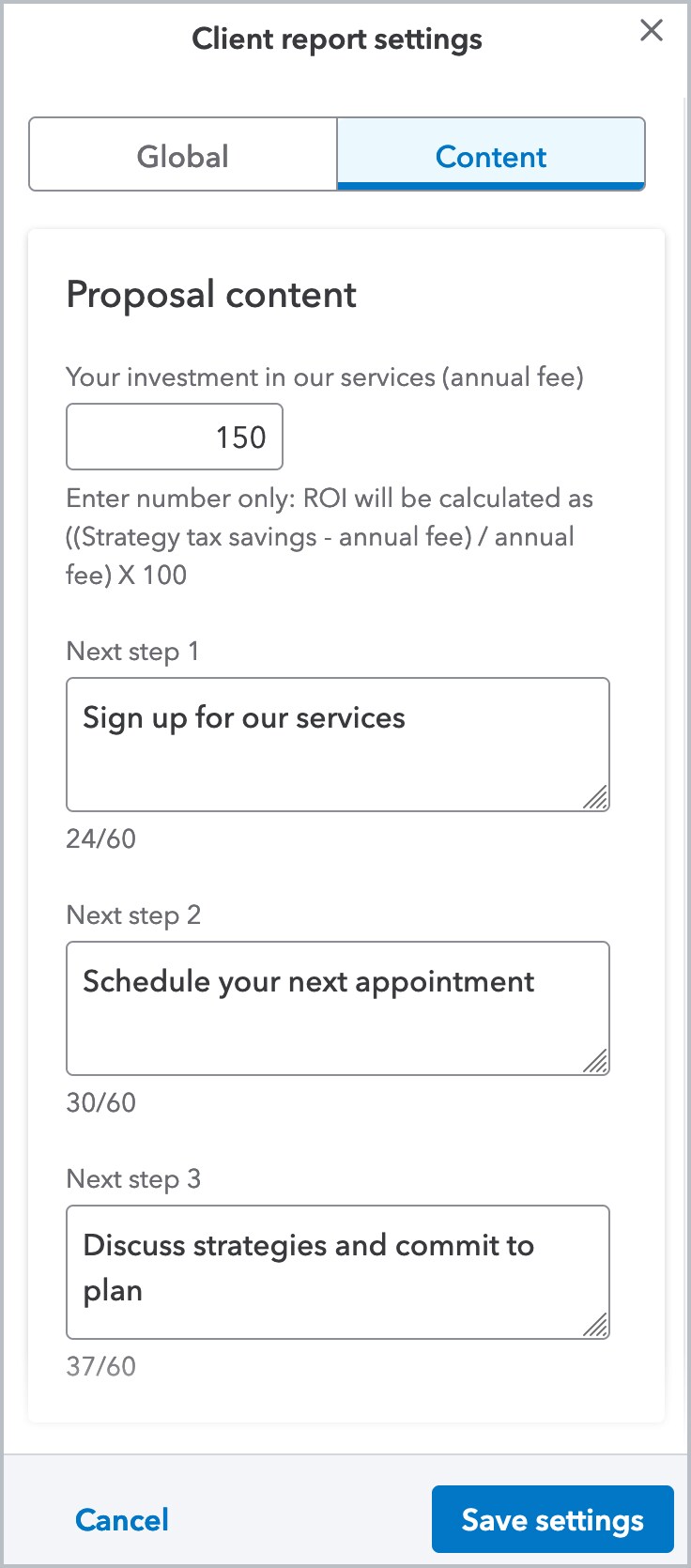

The proposal is a short summary of the value you can provide to your client through advisory planning:

Press Report settings at the top right to customize your reports.

- Global settings will apply to all the reports from your firm.

- Content settings are customized for each client proposal.

Tax plan

The tax savings plan is a detailed report you can provide to your client with information about specific tax savings strategies and next steps to take.

Save or print reports

- Press the Download icon

at the top right of your screen to generate a PDF.

at the top right of your screen to generate a PDF. - The PDF will open in your web browser where you can save it to your computer or print a copy.