Intuit Help

Intuit

03-19-2021

10:54 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

E-file activity reports can show you details on a particular client's e-filing status, or a summary of all of your e-filed returns for any tax type. The following options are available:

- The Complete Activity Report lists an in-depth history of the client(s) you select, including the reason for rejection, if applicable.

- The Condensed Activity Report is a one line summary of activity which includes the client number, social security number, submission ID, type of electronic return, dates the e-file return was sent and received, and when the return was accepted or rejected.

Follow these steps to view or print the report:

- Highlight the client(s) on the Clients tab you want to print or view.

- Hold down Shift on your keyboard to select multiple clients. Or, press F3 to select all clients using Group Select.

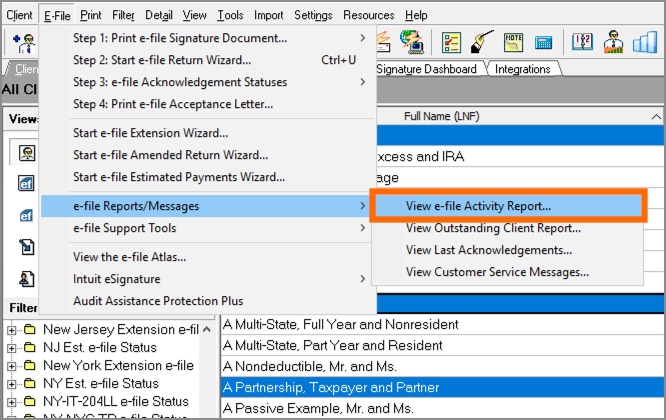

- Click the E-File menu, then e-file Reports/Messages.

- Select View e-file Activity Report.

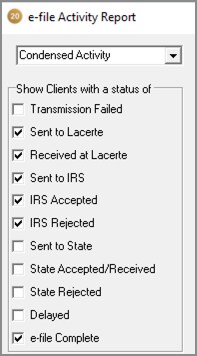

- Click Complete Activity or Condensed Activity.

- Select any of the checkboxes on the left in the Show Clients with a status of section to include in the report.

- For example, to include when the return was transmitted to the IRS, but not when it was sent to the state, select the checkbox next to Sent to IRS and leave the Sent to State checkbox blank.

- Click Preview to view the report, or click Print to print the report.

Note that e-file activity is stored on a per-client basis. If an e-file client is restored from a backup, all e-file activity is replaced with the restored client's e-filing activity.

Labels