ProSeries offers e-filing for New York and New York City corporate estimated tax payments. For instructions on how to e-file New York estimated tax payments in ProSeries, continue reading below.

Solution Description:

Before e-filing the New York estimated tax payments, you must make sure the return is properly marked for e-filing the estimates.

![]() Each quarterly estimated tax payment must be e-filed separately and in the order of the quarterly payments. Only a single payment will be displayed in the EF Center at a time. Additional payments will only be displayed after the prior payment has been transmitted and accepted. You may e=file all NY and NYC quarterly estimated tax payments at any time, but each payment must be submitted separately. It isn't necessary to postpone transmission of the quarterly payment until the quarter in which the payment is due.

Each quarterly estimated tax payment must be e-filed separately and in the order of the quarterly payments. Only a single payment will be displayed in the EF Center at a time. Additional payments will only be displayed after the prior payment has been transmitted and accepted. You may e=file all NY and NYC quarterly estimated tax payments at any time, but each payment must be submitted separately. It isn't necessary to postpone transmission of the quarterly payment until the quarter in which the payment is due.

Refer to the New York Electronic filing mandate for business taxpayers for more information.

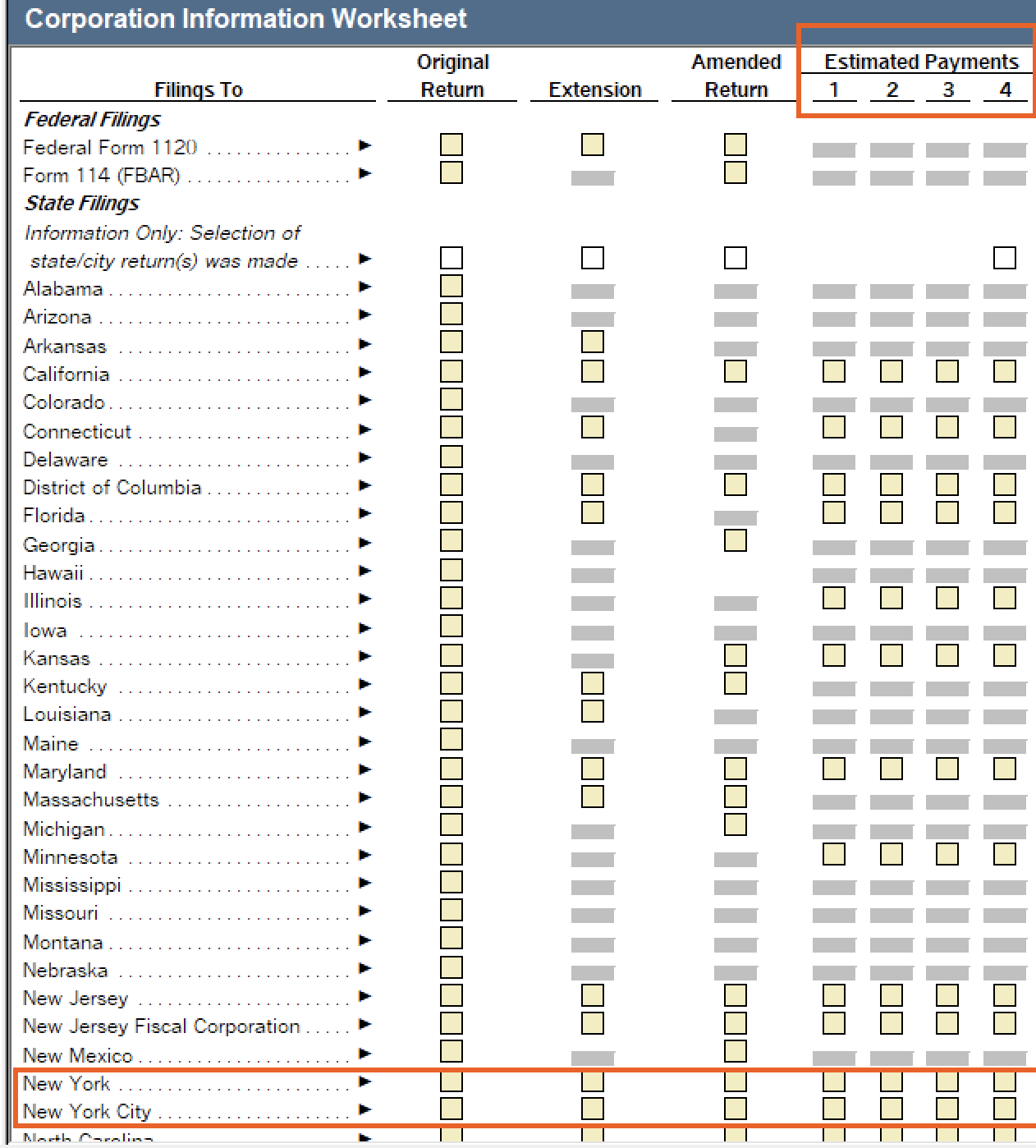

On the federal Corporation Information Worksheet:

- Scroll down to Part VI - Electronic Filing Information.

- Mark the checkbox to file the state(s) return electronically.

- In the Choose returns to be filed electronically table select the New York State Corporation or New York City Corporate.

- Mark the checkboxes to e-file each of the four state estimated tax payments.

- Complete the federal and state/city corporate return, including the Worksheet for Estimated Payments within the New York return.

On the New York Corporate Information Worksheet:

- Scroll to Part V - Electronic Filing Information.

- Make sure the Estimated payments will be filed electronically box is checked based on your selection on the federal Corporate Information Worksheet.

- Review the table indicating the Quarter, the Payment Amount and the Payment Due Date.

- This information will be calculated based on the information entered on the Estimated Payments Worksheet.

- Complete the Date to Withdraw and the Date Signed fields.

- The 1st Quarterly Payment will display an X indicating completed. The reason for this is that the 1st New York payment must be transmitted with the return. The 1st Quarterly Payment won't result in an electronic quarterly payment record in the EF Center.

- Complete any remaining information in this section.

- Scroll down to Part VI - Electronic Funds Withdrawal Information.

- Check the Yes box for Do you want electronic funds withdrawal of state tax payment (EF only)?

- Complete the Bank Information, Payment Information, and International ACH Transactions sections.

- Save the return.

- Go to the EF Center HomeBase.

On the New York City Corporate Information Worksheet:

- Scroll to Part V - Electronic Filing Information.

- Make sure the Estimated payments will be filed electronically box is checked based on your selection on the federal Corporate Information Worksheet.

- Review the table indicating the Quarter, the Payment Amount and the Payment Due Date.

- This information will be calculated based on the information entered on the Estimated Payments Worksheet.

- Complete the Date to Withdraw and the Date Signed fields.

- The 1st Quarterly Payment will display an X indicating completed. The reason for this is that the 1st New York payment must be transmitted with the return. The 1st Quarterly Payment won't result in an electronic quarterly payment record in the EF Center.

- Complete any remaining information in this section.

- Scroll down to Part VI - Electronic Funds Withdrawal Information.

- Check the Yes box for Do you want electronic funds withdrawal of state tax payment (EF only)?

- Complete the Bank Information, Payment Information, and International ACH Transactions sections.

- Save the return.

- Go to the EF Center HomeBase.

On the ProSeries EF Center HomeBase:

- Locate the client return.

- The Estimated Payment will be identified as NY Corp Payment or NYC Corp Payment in the Return Type column.

- When you're ready to e-file the payment, select the row associated with the client's NY Corp Payment or NYC Corp Payment and transmit the payment as you would any electronic return.