Form 1095-A is used to report certain information to the IRS about family members who enroll in a qualified health plan through the Marketplace. Form 1095-A also is furnished to individuals to allow them to claim the premium tax credit, to reconcile the credit on their returns with advance payments of the premium tax credit (advance credit payments), and to file an accurate tax return.

Starting in tax year 2019, if you didn't sign up for health insurance through the exchange, you don't need to enter your health coverage for federal returns.

If the taxpayer, spouse, or dependents enrolled in the marketplace, even if they never activated their policy, the marketplace may have issued them a 1095-A. If the return is e-filed without the 1095-A the IRS will reject the return with Error F8962-070: The e-File database indicates that Form 8962 or a binary attachment with description containing "ACA Explanation" must be present in the return. If the taxpayer is unsure have them contact HealthCare.gov to search for all the SSN's on the tax return.

If the taxpayer, spouse, or dependents enrolled in the marketplace, even if they never activated their policy, the marketplace may have issued them a 1095-A. If the return is e-filed without the 1095-A the IRS will reject the return with Error F8962-070: The e-File database indicates that Form 8962 or a binary attachment with description containing "ACA Explanation" must be present in the return. If the taxpayer is unsure have them contact HealthCare.gov to search for all the SSN's on the tax return.

Follow these steps to enter Form 1095-A:

- Go to Screen 39, Premium Tax Credit (1095-A, 8962).

- Click on Health Insurance Marketplace Statement (Form 1095-A) from the left navigation panel.

- Complete the Recipient Information (Part I) section:

- Check the box, Spouse is recipient, if applicable.

- Enter the (2) Market-place assigned policy number.

- Note: Enter the last 15 characters of the policy number. The policy number may contain letters, numbers, and certain special characters.

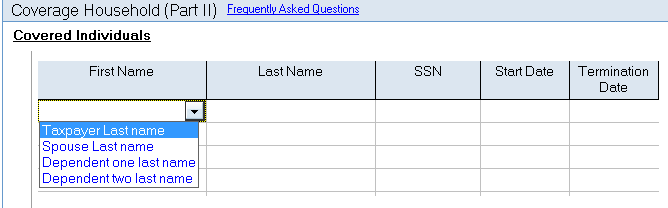

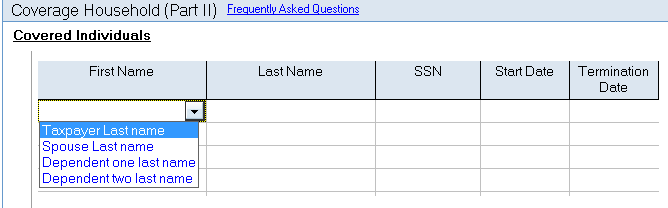

- Scroll down to Covered Individuals (Part II) section.

- Select the First Name of the individual from the drop down menu. Lacerte will populate the last name and SSN.

- Enter the coverage Start Date.

- Enter the Termination Date (if applicable).

- Scroll down to the Coverage Information (Part III) section.

- Complete the Monthly Premium, Monthly Premium of Second Lowest Cost Silver Plan (SLCSP), and/or Monthly Advance Payment of Premium Tax Credit columns based on the information from Form 1095-A:

- Monthly Premium

- Monthly Premium of Second Lowest Cost Silver Plan (SLCSP) - This column is the monthly premium amount for the second lowest cost silver plan (SLCSP) that the Marketplace determined applied to members of the family enrolled in coverage. The premium for the applicable SLCSP is used to compute the monthly advance credit payments and the premium tax credit.

- Monthly Advance Payment of Premium Tax Credit, if applicable

- Click on Add from the left navigation panel to add an additional Form 1095-A (if the Taxpayer received multiple 1095-As).