Intuit Help

Intuit

12-05-2019

05:49 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

This article will show you how to enter multi-state maounts in Intuit ProConnect.

Before you start:

- Go to the Profile tab.

- Enter the applicable states in the field labeled Add a state return.

- Go to the Input Return tab.

- Under the Resident Status section, select the Multi-State Return? checkbox to activate multi-state input.

Follow these steps to enter multi-state amounts:

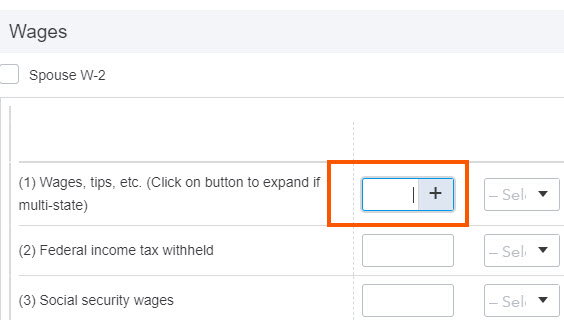

- Select any input field.

- If that field allows multi-state amounts, a plus sign (+) will appear.

- Select the plus icon to open the multi-state input box.

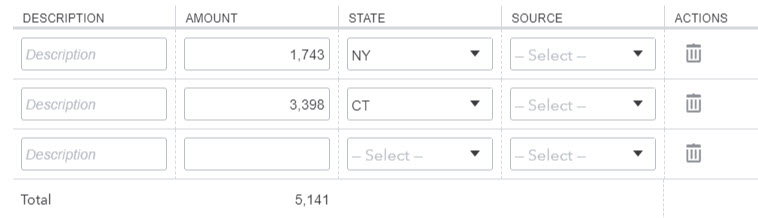

- Enter the Amount for each state.

- In the State column, select the state abbreviation.

- For states with no income tax, like Texas, choose US.

- Leave the Source column blank, or see Using the Source column and understanding the meaning of S and N for more information.

Related topics:

Labels