- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

For tax year 2018 the IRS did not have a specific form to calculate Complex Section 199A calculations. This article will help you determine the QBI calculations for a tax year 2018 return. For current year calculations see How to enter and calculate the qualified business income deduction, section 199A, in Lacerte.

The Tax Cuts and Jobs Act adds a new deduction for non-corporate taxpayers for qualified business income. The deduction reduces taxable income, and is generally 20% of a Taxpayer's qualified business income (QBI) from a Partnership, S-Corporation, or Sole Proprietorship, defined as the net amount of items of income, gain(s), deduction(s), and loss with respect to the trade or business. Certain types of investment-related items are excluded from QBI, e.g., capital gains or losses, dividends, and interest income (unless the interest is properly allocable to the business).

Taxpayers whose taxable income exceeds the threshold amount of $157,500 ($315,000 in the case of a joint return) are subject to limitations based on the W-2 wages and the unadjusted basis in acquired qualified property. For specified service related businesses, there is a separate phase-out if taxable income exceeds the threshold amount.

The deduction is taken for Partnerships and S-Corporations at the Partner or Shareholder level. Trusts and Estates are eligible for the deduction. W-2 wages and the unadjusted basis in acquired qualified property are apportioned between the trust or estate and the beneficiaries. Specified agricultural or horticultural cooperatives are also eligible for the deduction under special rules. Qualified Business Income includes only income effectively connected with a U.S. trade or business (or Puerto Rico if all the income is subject to US tax).

The deduction is intended to reduce the tax rate on qualified business income to a rate that is closer to the new Corporate tax rate.

Complex Calculation:

An additional consideration with the Complex approach is the concept of a specified service business. This designation becomes important if the taxpayer's taxable income exceeds the threshold. A specified service trade or business is generally excluded from the definition of 'qualified trade or business income'. Therefore, no QBI, W-2 wages, or unadjusted basis immediately after acquisition (UBIA) of the qualified property from the specified service trade or business are taken into account in figuring the QBI deduction.

If the specified service trade or business is conducted by a pass-through entity, the same limitation applies to the pass-through items regardless of whether the Taxpayer is a passive owner or materially participates in the business. See: Lacerte Qualified Business Income 199a - Specified Services

Complex Worksheet:

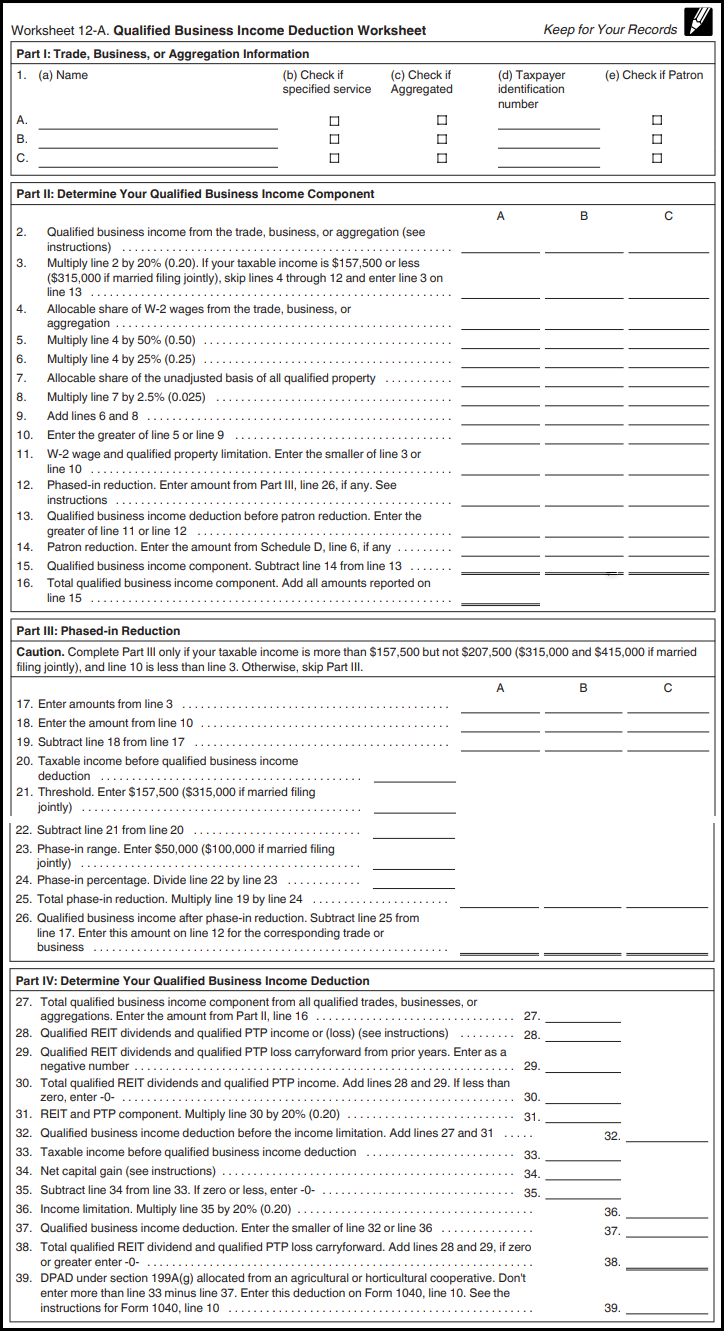

The images included below and in the expandable sections are draft copies of the Qualified Business Income Deduction Worksheet. This is the main worksheet for computing QBI in the tax return that flows to the main return form. There are additional schedules referenced in Publication 535 that may need to be completed before completing Part I of the Worksheet. Each of the specific purposes is captured in general below.

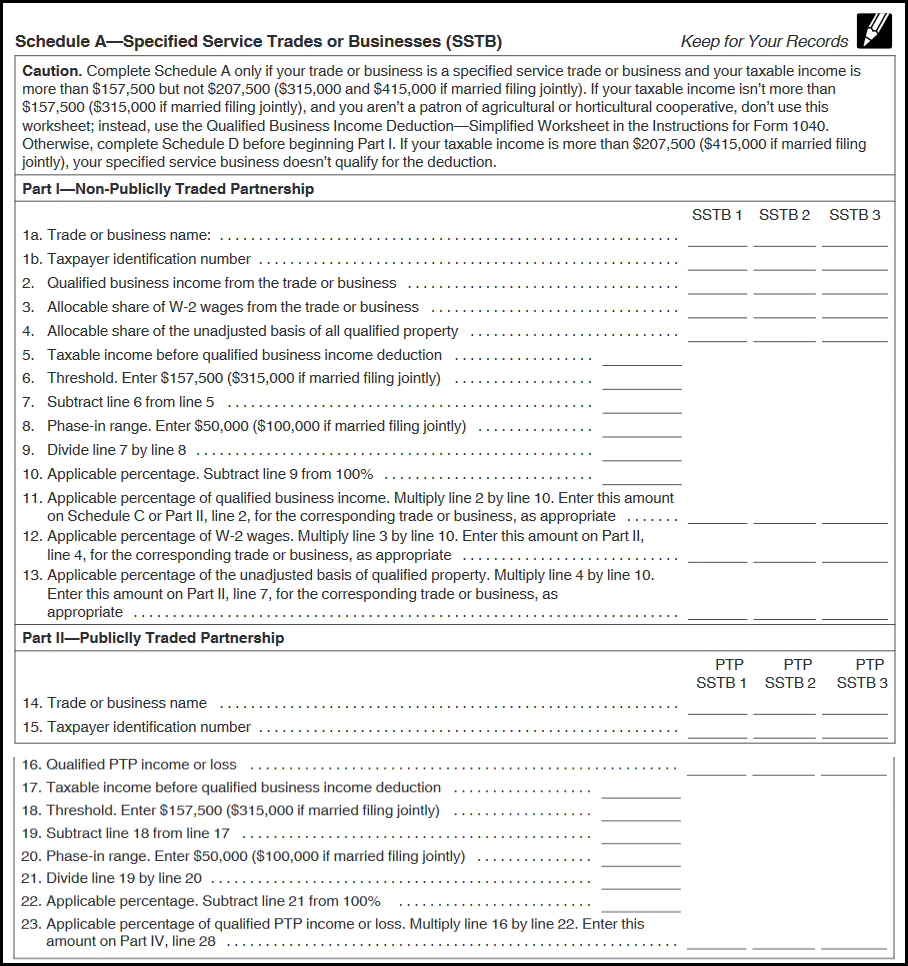

- Schedule A – When trade or business is a specified service trade or business and your taxable income is more than $157,500 but not more than $207,500 ($315,000 and $415,000 if married filing jointly).

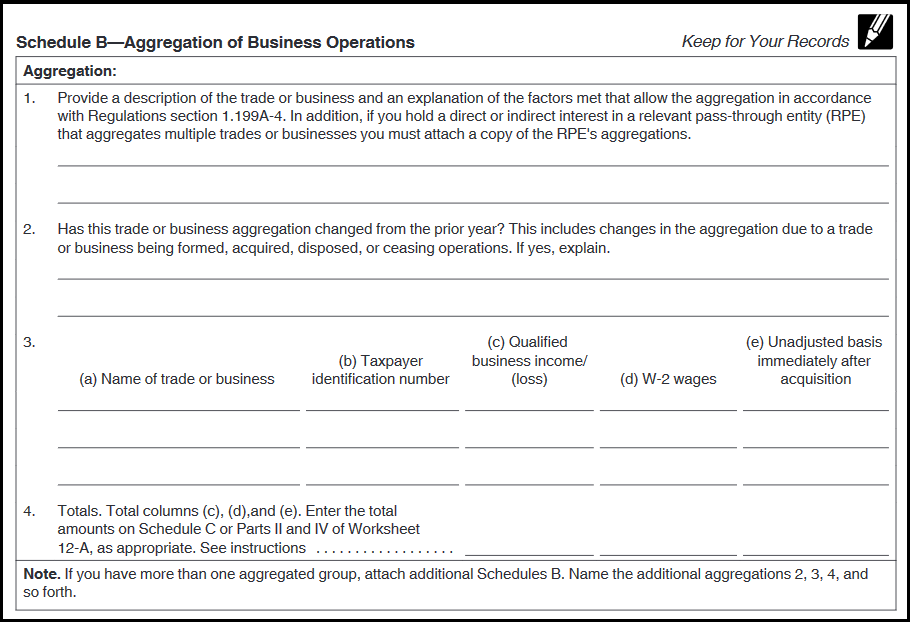

- Schedule B – If there are multiple trades or businesses, then there is an option to aggregate these into a single trade or business for the purposes of applying the limitations.

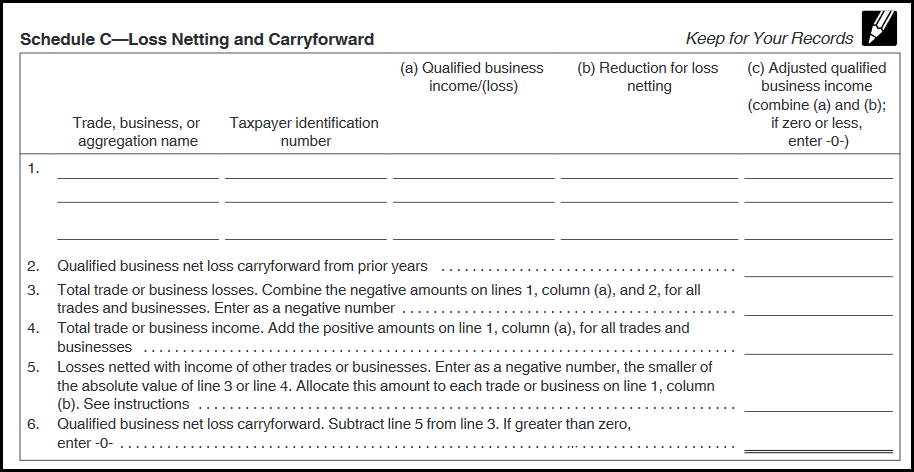

- Schedule C – If any of the trades or businesses have a net loss for the current year or have a qualified business net loss carryforward from prior years; this schedule will offset the trade or business net losses against net income from the other trades or businesses.

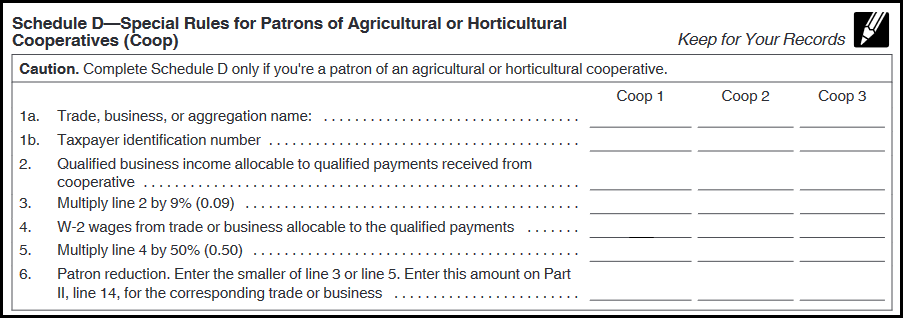

- Schedule D – Patrons of agricultural or horticultural cooperatives have special rules and use this schedule.

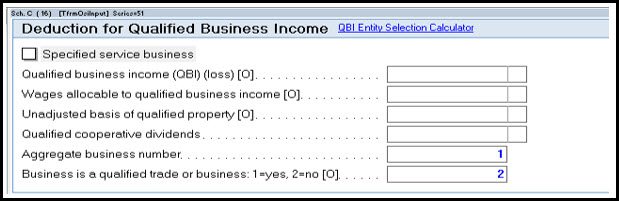

These schedules are generated based on answers to the questions in the Deduction for Qualified Business Income section for Business Income, Farm Income, Rent/Royalty Income (as shown in Figure 2) or Pass-Through Income (referenced in Figure 3). How these are generated are discussed in the sections that cover the schedules individually later in the document.

After these schedules are completed as applicable, then the Qualified Business Income Deduction Worksheet is used to calculate the qualified business income deduction. When the taxable income is more than $157,500 but not more than $207,500 ($315,000 and $415,000 if married filing jointly), the computed 20% deduction amount will be partially limited to the higher of 50% of wages paid by the business, or 25% of the wages paid plus 2.5% of the unadjusted basis of qualified property. If the business has no wages paid, and no qualified property, a partial deduction will be allowed.

When the taxable income is above taxable income threshold, and also above maximum phase-out range (above $207,500, or $415,000 if MFJ). In determining the limitations, wage and property limits are fully considered. The computed 20% deduction amount will be limited to the higher of 50% of wages paid by the business, or 25% of the wages paid plus 2.5% of the unadjusted basis of qualified property. If the business has no wages paid, and no qualified property, then no deduction is allowed at all.

Example Input Screen 16, Schedule C, Business Income (Schedule C): Available input within the Deduction for Qualified Business Income section. Operationally the data will need to be entered into the Schedule C. In order to implement the QBI considerations a new section has been added to make that determination. How the QBI rules are applied will depend on the data entered in this section.

Schedule A - Specified Service Trades or Business (SSTB)

Schedule B - Aggregation of Business Operations

If there are multiple trades or businesses, then there is an option to aggregate these into a single trade or business for the purposes of applying the limitations. According to the instructions each trade or business is a separate trade or business for purposes of applying the W-2 wage limitation or the UBIA limitation. However, a preparer may choose to aggregate multiple trades or businesses into a single trade or business for purposes of applying the limitations.

Within the Lacerte program, there is a mechanism to associate the businesses. Trade or Business activities that have the same ‘Aggregate Tax Identification Number’ will be consolidated for the purposes of QBI. These aggregated businesses will be represented on this worksheet based on the information entered for the income to be considered.

Requirements to aggregate:

- A person or a group of persons directly or indirectly own 50% or more of each trade or business for a majority of the tax year and all trades or businesses use the same tax year end,

- None of the trades or businesses are specified service trade or business, and

- The trades or business meet at least two of the following factors.

- They provide products or services that are the same or that are customarily offered together.

- They share facilities or share significant centralized business elements such as personnel, accounting, legal, manufacturing, purchasing, human resources, or information technology resources.

- They are operated in coordination with, or reliance upon, one or more of the businesses in the aggregated group.

Schedule C - Loss Netting and Carryforward

Schedule D - Special Rules for Patrons of Agricultural or Horticultural Cooperatives (Coop)

Detailed Scenarios and Calculation Flowchart:

To view detailed scenarios including a calculation flowchart, see: Tax Reform - Qualified Business Income (QBI) Deduction

Related Topics:

Tax Reform - Qualified Business Income (QBI) Deduction

2018 Individual and Business Tax Reform - Summary of Changes

2018 Qualified Business Income (QBI) Entity Selection Calculator

Qualified Business Income 199A - Specified Service Trade or Business (SSTB)