As part of our continuing commitment to work with the IRS, states, and industry to combat tax fraud, Intuit requires all tax professional customers to have IRS documentation of EFIN registration on file before e-filing through Intuit's professional tax products. We'll also ask for EFIN documentation when you make changes to your firm name or business address.

This article will help you:

- Understand if you need to register your EFIN before e-filing returns

- Learn how to register your EFIN with Intuit

- Change your Firm Name or Address

Intuit EFIN Registration video

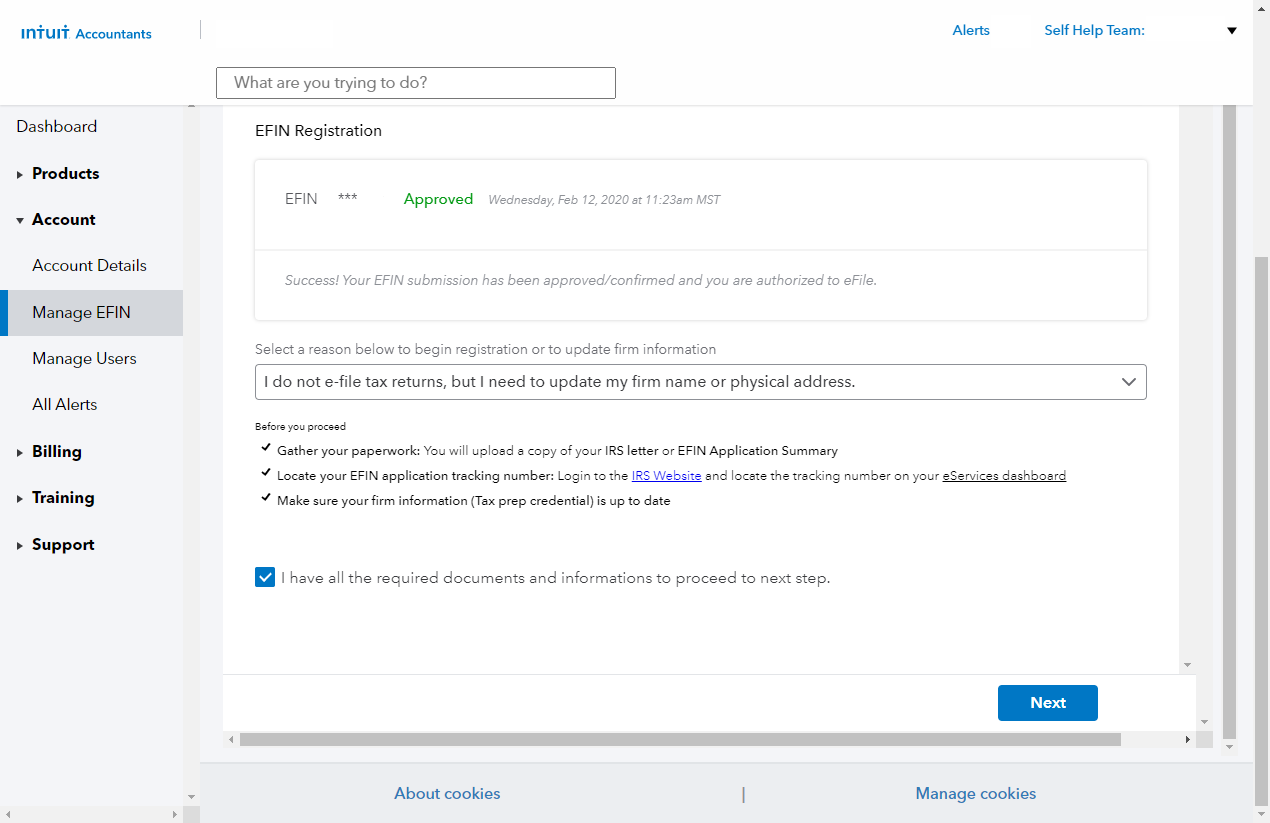

You can check the status of your EFIN at any time:

- Sign in to My Account.

- From the left-side menu, select e-File center ⮕ Manage EFIN.

- Your status will show beneath EFIN Registration.

If your status is Not Enrolled or Not Approved, you need to provide EFIN registration.

Do I need to provide EFIN registration?

Protecting your EFIN account and your taxpayer data is as important to us as it is to you. As such, we require that all Electronic Return Originators (EROs) provide registration of their EFIN before you're approved to start e-filing. It's an important first step in preventing tax-related identity theft and fraud.

If any of the following conditions apply to you, you need to register your EFIN before e-filing returns:

- You're new to e-filing with Intuit and haven't previously submitted registration.

- Your firm name or business address changed. The IRS requires that your firm name and business address match your IRS EFIN Application Summary.

- You're notified by email.

- You're notified by an e-file reject message, such as "853 Oops! The EFIN has not been registered to your Account!" or "854 Attention! Your EFIN privileges have been temporarily disabled by Intuit."

You don't need to register your EFIN if:

- You don't intend to e-file returns.

- You've previously submitted the Application Summary, you are currently able to e-file successfully, and your EFIN Application DBA name and physical address are current.

Follow these steps to register your EFIN with Intuit:

Follow the steps below if you 're using Lacerte or ProSeries. If you are using ProConnect refer to this article for instructions.

- Sign in to My Account.

- From the left menu, select e-File center ⮕ Manage EFIN.

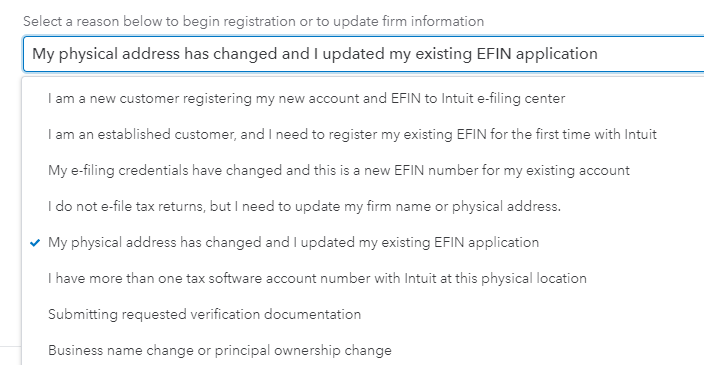

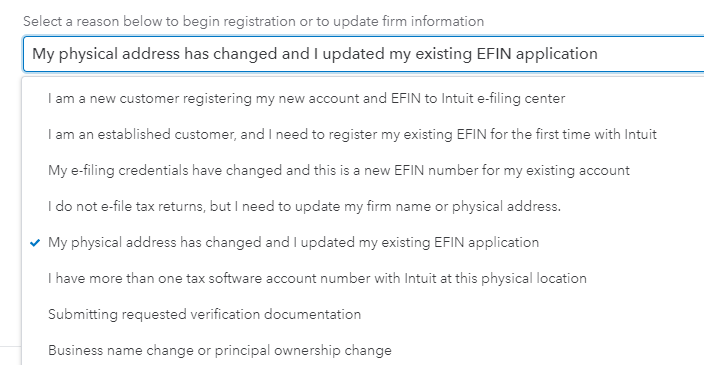

- Under EFIN Registration, click on the down arrow to choose the reason that best matches your situation.

- Check the box for I have all the required documents and information to proceed to next step.

- Click Next.

- Enter your updated information in the form. This should match exactly with the IRS documentation.

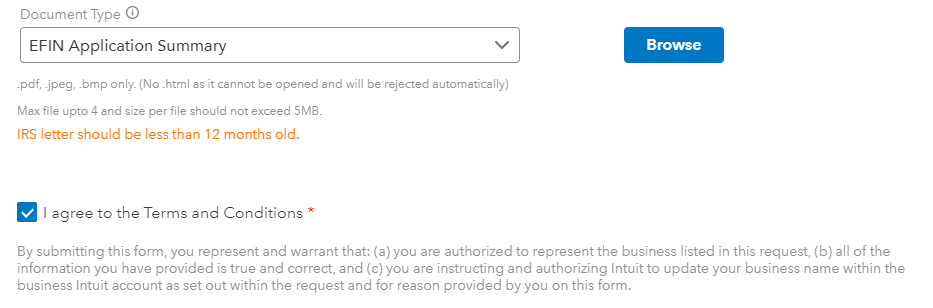

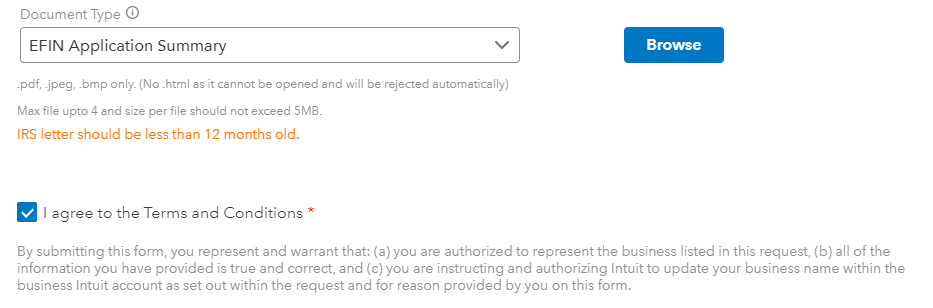

- Choose the Document Type and click Browse.

- Select the EFIN Application Summary to be uploaded, then press OK.

- Check the I agree to the Terms and Conditions box.

- Click Submit.

If you don't know how to find your EFIN Application Summary, refer to this article for instructions on accessing it on the IRS e-Services website.

Common questions for EFIN verification including common rejection causes:

When will my EFIN documentation be processed?

EFIN updates are usually made within 2 business days after you complete the registration form. E-filing may be delayed until the process is complete.

What if my EFIN registration is Rejected?

If your EFIN registration is rejected you will receive an email from EFIN_Verification@intuit.com with further information. Some of the most common rejection reasons are:

- Incorrect Documentation: This rejection is caused if the uploaded file is not the Application Summary or EFIN Acceptance Letter. Click here for information on how to download the correct form from the IRS e-Services website. Once you have the correct form, re-submit your EFIN registration.

- Not a current customer: If you have not yet renewed for the current tax year or purchased a product your EFIN registration will be rejected until you make a purchase.

- Critical Registration Information Missing: This rejection is caused when the attachment is a scanned copy and some of the key pieces of data are blurry, missing or hard to read. For best results download a new copy of the EFIN Application Summary from the IRS e-Services website. Click here for information on how to download a new copy and then submit your registration again.

- Documentation is older then 12 months: EFIN documents are only good for 12 months from the date they were issued or printed. Click here for information on how to download the correct form from the IRS e-Services website. Once you have the correct form, re-submit your EFIN registration.

- Incomplete Documentation: This rejection is caused when the Application Summary is submitted before the IRS has finished processing it. On the IRS e-Services website be sure the EFIN Application Summary shows Complete for the status before saving and submitting the form. Once the status is Complete on IRS e-Service submit EFIN registration again.

How can you safeguard your EFIN?

The IRS recommends that you help safeguard your EFIN. During the filing season, check on your EFIN status to ensure that your EFIN is not being used by others improperly. Your e-file application on the IRS e-Services website will help register the volume received by the IRS which you can match to your records. The statistics are updated weekly. Should you see a higher volume than you transmitted, please contact the IRS e-help Desk at 866-255-0654.

Usage, name, and address requirements

- It's important that your firm name (DBA name), firm physical address, EFIN, and ERO contact on your EFIN Application Summary match the account information Intuit has on file.

- By submitting your application summary, you authorize Intuit to make changes to your Intuit account name and address to conform to the EFIN registration with the IRS. If you make changes to your EFIN registration with the IRS, please notify Intuit immediately by submitting a new EFIN registration form.

- P.O. boxes will not be approved for your firm address. The IRS requires a physical address on your EFIN Application and for ERO lookup purposes. Intuit requires your physical address for licensing of the software in the End User License Agreement.

- For approval, your EFIN status must be Active and your ERO status must be Accepted.

- Only one EFIN may be used to transmit returns from one software license. The EFIN should be registered to the firm where returns are prepared. For more information, see IRS FAQs About Electronic Filing ID Numbers.

IRS regulatory requirement

IRS Publication 3112, page 12, requires e-file transmitters (such as Intuit) to register your EFIN:

"Authorized IRS e-file Providers may use only other Authorized IRS e-file Providers to perform IRS e-file activities, including but not limited to origination and transmission of electronic submission. For example, Transmitters must ensure that they are transmitting only for Authorized IRS e-file Providers. Providers should request other Providers provide information to ascertain that they are Authorized IRS e-file Providers."

ProSeries: Registering an additional firm:

Because only one copy of ProSeries may be installed on a Local Area Network without data corruption issues, ProSeries provides a process of adding additional firm identities to this installed software copy for multi-firm use in a local computer network. Certain licensing restriction applies to this process, noted below.

- Primary Firm – The firm identity installing the licensed software on the Network Additional Firm – The Secondary Firm(s) installing a license file only onto the same local network installed software.

- Site License – ProSeries requires a site location license for all firms using separate identities, no exceptions. Additional firms must license the software annually to continue to have Additional Firm name privileges

Primary Firm Responsibilities:

The Primary Firm controls any additional Firm Names allowed to be associated with their installed software. They should notify Intuit to remove any dated or defunct additional firms from their software licensing. The Primary firm should ensure the additional firm has purchased a ProSeries Software license for that firm’s identity, even if the software from that license is not installed on any computers. The additional Firm is licensing Intuit’s intellectual and copyrighted property as a paid preparer; incurring royalties in the form of licensing fees back to Intuit in return.

Additional Firm Responsibilities

The Additional Firm secures agreement with the Primary Firm to share their computer network in one of the following ways:

- As co-located independent entities sharing the same office computer network.

- As a customer of the Primary Firm, who acts as a Service Bureau for the Additional firm, processing their tax returns electronically using the Primary Firm’s software and personnel for a negotiated fee on behalf of the Additional Firm using the Additional Firms Business Name and address on the returns.

- The Additional Firm has some other business related to the Primary Firm, such as final review and proofing for certain returns processed by the Additional Firm prior to filing with Federal and state agencies. This may be a business entity that is a customer of the Primary Firm, who has their own in-house accounting department and for legal reasons needs a CPA to file the return on their behalf.

The additional Firm secures a license to use the ProSeries tax program that is commensurate with the volume of returns they process in the normal course of business as if they were a standalone firm.

The Additional Firm secures agreement with the Primary Firm to share their computer network by completing the EFIN registration procedure:

- Obtain a software License to use Intuit’s copyrighted software products.

- Submit EFIN documentation on the Customer Account Number of the Additional Firm for EFIN Registration using the Submission Reason Code “Other Reason Not Listed Above."

- At the same time, the Additional Firm submits the same EFIN on the CAN ID of the Primary Firm with the Submission Reason Code “Other Reason Not Listed Above.”

This licensing feature is not available for 2002 and prior.