This article will help you resolve the following e-file diagnostics in Lacerte:

- "e-file: When filing an extension, the State of California requires an amount due and for the amount to be paid electronically via direct debit."

- Individual (ref. #47233)

- Partnership (ref. #47294)

- Corporate (ref. #47293)

- S-Corporate (ref. #47312)

- Fiduciary (ref. #47241)

- "e-file: When filing an extension, the State of California requires an amount due and for the amount to be paid electronically via direct debit. For LLC's the amount due is the nonconsenting members' tax liability amount. If there is no amount for this line and there is an overall tax due then an override amount may need to be entered on the Extension screen." Partnership return - (ref. #47605)

California grants an automatic extension and doesn't require the extension form to be filed electronically unless there is a payment due with the extension. If you don't have an amount due on the extension, this form should be removed.

When running the e-file wizard, the California Extension checkbox should only be checked when there's a balance due for CA.

See this short video on how to solve Lacerte CA Extension Diagnostic from Customer Success & Training on Vimeo.

Creating filters to find clients that may need to e-file a CA Extension with Payment:

Follow these steps to create Filter Groups

- From the Filter menu, choose Modify Filters.

- In the Custom Filters window, select Add.

- Enter 'CA Extension'.

- Click OK.

- In the Custom Filters window, Select Groups...

- Enter 'CA Return'.

- Click OK.

- In the Filter Conditions window click Add.

- In the Category field, click Client Information.

- Field Name: State / Compare: is / Value: type 'CA'.

- Click OK.

- In the Filter Conditions window click Add.

- In the Category field, click Taxes.

- Field Name: State Tax Due Plus Penalties & Interest / Compare: is at least / Value: type '1'.

- Click OK.

- In the Filter Groups window click Add.

- Enter 'Multi State'.

- While highlighting Multi State, in the Filters Condition window click Add.

- In the Category field, click Client Information.

- Field Name: Multi-State Return? / Compare: is / Value: yes.

- Click OK.

Follow these steps to add a column for State Tax Due (to use with multi-state filter):

- From the Settings menu, choose Options.

- Click the Display tab.

- Click the '+' symbol next to Taxes, in the Available window.

- Select State Tax Due Plus Penalties & Interest.

- Click the '>' button between the Available and Display windows to add to the Display window.

- You can highlight this item and move it up and down to adjust the order, as needed.

- Click OK.

Using filters to find clients that may need to e-file a CA Extension with Payment:

Follow these steps for California returns:

- In the left column of the Clients tab locate the 'CA Extension' filter.

- Click the '+' to view the groups created.

- Select CA Return.

- This will display all CA resident client files with an amount due. The amount due will show in the St Tax w/Pen. column.

Follow these steps for multi-state returns:

- In the left column of the Clients tab locate the 'CA Extension' filter.

- Click the '+' to view the groups created.

- Select Multi State.

- This will display all multi-state client files which may contain California. Using the column St Tax w/Pen. allows you to view the returns that may also contain an amount due. These client files will need to be reviewed individually to determine if a CA extension with payment can be sent.

To remove the CA Extension from the E-File Wizard:

If you need to remove the CA Extension for just one client:

- From the E-File menu, select Start E-File Extension Wizard…

- Uncheck the box for CA Ext. in the State Extension column.

- Click Next to continue e-filing your Federal Extension.

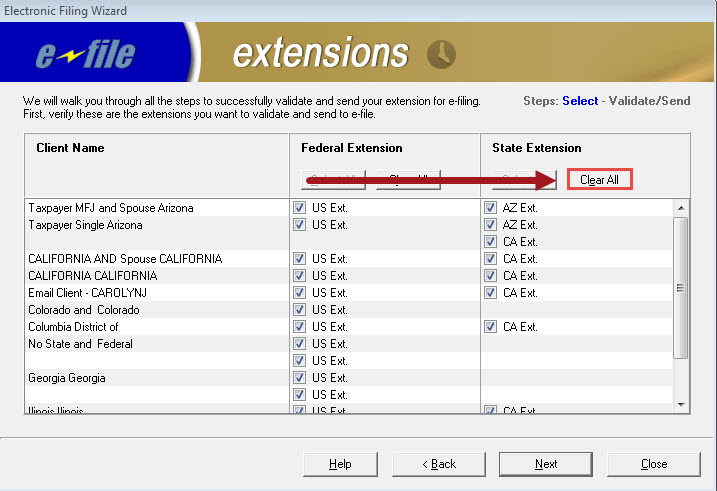

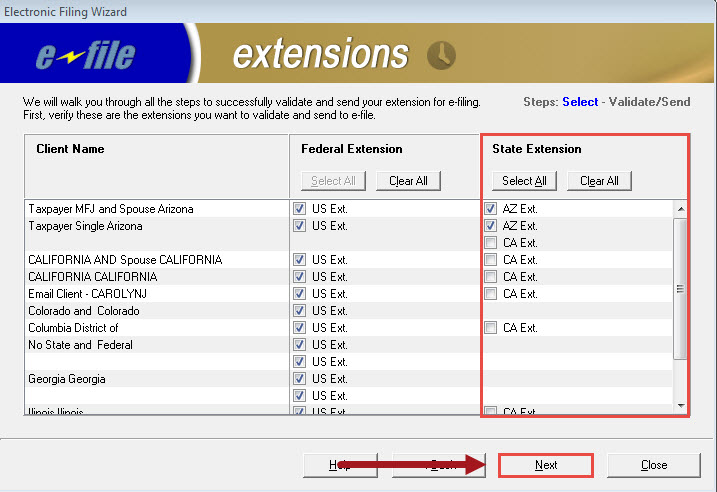

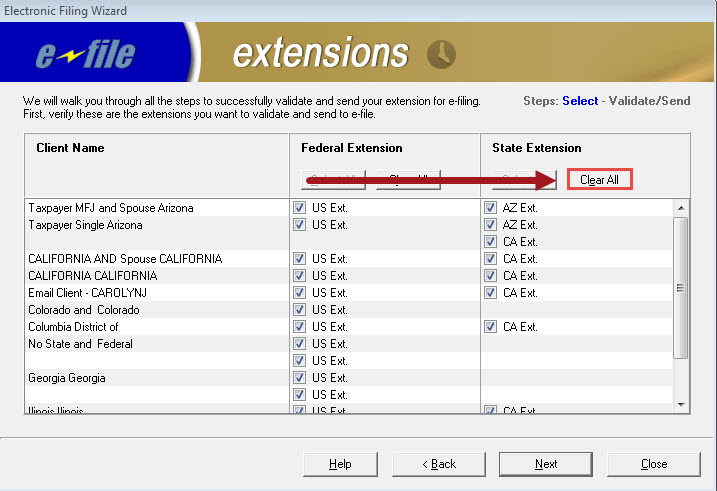

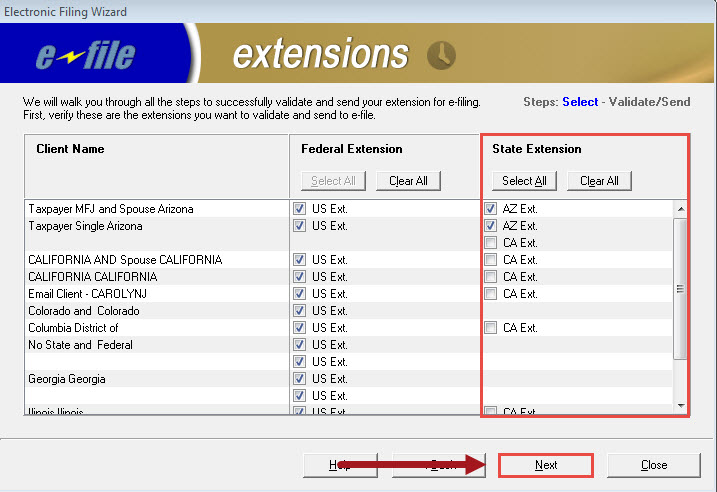

If you need to remove the CA Extension for more than one client:

- From the E-File menu, select Start E-File Extension Wizard…

- In the State Extension column, select Clear All.

- Go back and check any state extensions you do wish to transmit.

- Click Next to continue e-filing your extensions.