- Open the state return.

- Press F6 on your keyboard, and select the amended form. Enter the calendar year, or mark the appropriate box to activate the calculation of the amended return.

- If your state doesn’t have a separate form for amending, check the Amended box on the main form or Information Worksheet..

- Go back to the federal return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

This article will help you create and file Form 1040-X, Amended U. S. Individual Tax Return in Intuit ProSeries.

Before you start:

- Save the file with the original info before generating and activating the 1040X or any states.

- If you're recreating a 1040 filed by someone else, use the main forms and worksheets. Don't override amounts on the 1040.

- Starting in 2020 you can e-file amendments even if you didn't file the client's original 1040. See "Which amended returns can I e-file?" below for more details.

- For help amending a 1040NR see Common questions on Form 1040NR in ProSeries

To complete Form 1040X:

- Open the client’s original return.

- From the File menu, select Save as.

- Save the return using a different name. For example, SmithCopy20.20I

- Go to Homebase.

- Open the originally filed return (not the copy you just created). Use the File name column to tell them apart.

- Press F6 to bring up Open Forms.

- Type X to highlight Form 1040-X in the list.

- Click OK.

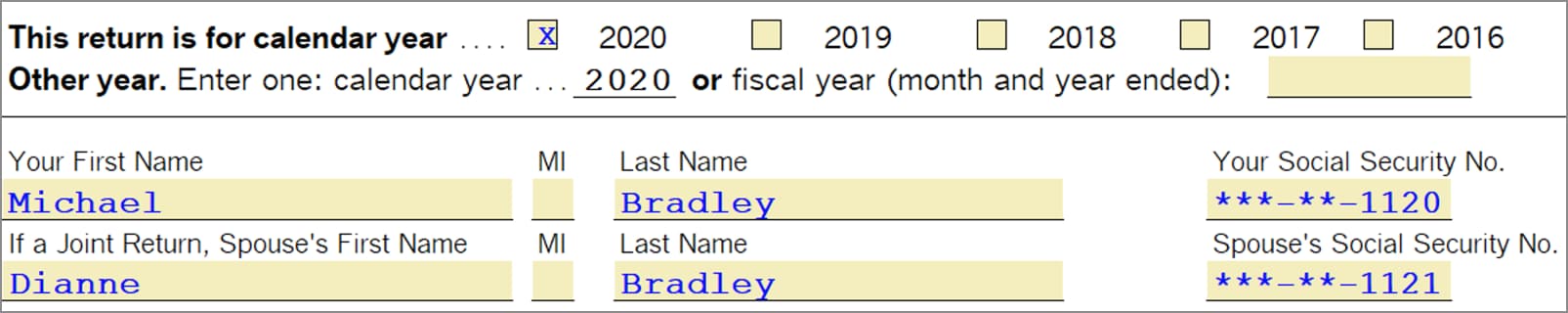

- Scroll down to the This return is for calendar year line.

- Check the box for the year you’re amending.

- Checking the current year box tells ProSeries to freeze the “Original amount” figures for column A at that moment. However, columns A-C won’t show any numbers until you enter changes on the return.

- Scroll down to Part III and enter an Explanation of Changes.

If amending a state return as well:

- Make the amended changes on the original form or worksheet.

- For example, if you’re amending to add another child to the return, go to the Federal Information Worksheet. Or, to report additional sole proprietor income, go to the Schedule C.

- After you enter your change(s) on the original forms, review the 1040X.

ProSeries will automatically complete the lines of the 1040X that are required based on the change you’re reporting.

To e-file the amended return:

- Open the Federal Information Worksheet.

- Click the QuickZoom button to jump to Part VII - E-file extend/amend.

- Check the box to File federal amended return electronically.

- If not already checked, mark the box for Check if original federal return was successfully e-filed.

- Manually check if the original return was accepted in a different data file, or if the original return was submitted by a different program or tax preparer.

- This option is not available in ProSeries 2019 or prior. See "Which amended returns can I e-file?" below.

- Run Final Review to check for errors or diagnostics.

- Save the return, and go to the EF Center or EF Clients Homebase view.

- Highlight the client. Look in the Amended Return column to see which line is Marked for EF if you’re not sure which file to transmit.

- Their EF Status will show as Duplicate SSN, since the copy you created is also listed here.

- Go to the E-file menu and select Electronic Filing.

- Click on Convert/Transmit Returns and Extensions…

- You’ll see a warning that another taxpayer with the same SSN is present. Click Yes to continue with transmitting the return.

- Convert and transmit the client's amended individual return.

Make sure to check for e-file acknowledgements after e-filing.

Which amended returns can I e-file?

Several amended conditions aren’t eligible for e-filing. You’ll receive errors with details if your amendment can’t be e-filed, so make sure to run Final Review. Most amended state tax returns can’t be e-filed.

- For tax years 2020 and 2021, the original 1040 must have been filed electronically and accepted by the IRS.

- For tax year 2021, California, Colorado, Georgia, Michigan, New York, North Carolina, Pennsylvania, Vermont, and Wisconsin are supported for e-file.

- For tax year 2020, Georgia, Michigan, New York, Vermont, and Wisconsin are supported for e-file.

- For tax year 2019 amended returns can only be e-filed through ProSeries 2019, and e-filing is only supported if the original return shows as "Accepted" in ProSeries. Tax year 2018 and prior must be paper filed.

To paper file the amended return:

If your client doesn’t meet the conditions for e-filing, you can still file a paper return. You may also need to paper file if you’re unable to resolve an e-file rejection for the 1040X.

- Scroll down to Part VI of the Federal Information Worksheet and remove any checkboxes for electronic filing.

- Run Final Review.

- Print the return(s). Have your client sign and mail them to the address shown on the Filing Address Smart Worksheet at the bottom of the 1040X in ProSeries.

How to amend a previously amended return

- Open the client’s previously amended return.

- From the File menu, select Save as.

- Save the return using a different name. For example, SmithCopy20.20I

- Go to Homebase.

- Open the previously amended return (not the copy you just created). Use the File name column to tell them apart.

- Open the 1040X.

- From the Forms menu, select Remove Form 1040-X. Click Yes.

- Press F6 to open forms, then type X to highlight Form 1040-X in the list.

- Click OK.

- Scroll down to the This return is for calendar year line.

- Check the box for the year you’re amending.

- Checking the current year box tells ProSeries to freeze the “Original amount” figures for column A at that moment. However, columns A-C won’t show any numbers until you enter changes on the return.

- Scroll down to Part III and enter an Explanation of Changes.

- Make the amended changes on the original form or worksheet.

- For example, if you’re amending to add another child to the return, go to the Federal Information Worksheet. Or, to report additional sole proprietor income, go to the Schedule C.

- After you enter your change(s) on the original forms, review the 1040X.

ProSeries will automatically complete the lines of the 1040X that are required based on the change you’re reporting.

How to amend a prior year return using the current year program

- Open the current year return.

- Scroll down to Part VI of the Federal Information Worksheet and remove any electronic filing checkboxes.

- Go to the File menu, and select Save As, and change the file name to indicate this is an amended copy.

- Press F6 to open forms, then type X to highlight Form 1040-X in the list.

- Click OK.

- Scroll down to the This return is for calendar year line.

- Check the box for the year you’re amending.

- Manually enter the original amounts in column A.

- Manually enter the corrected amounts in column C.

ProSeries will automatically calculate the net change for column B.

How to resolve ProSeries error - "Transfer was unsuccessful. Internal Error."

After amending Form 1040X and transferring data to the state, the following error appears in ProSeries:

"Transfer was unsuccessful. Internal Error."

A secondary error message may also appear after the state product is opened:

"We were unable to go to the selected state. You may need to remove the existing state return, or re-install your state product."

Why is this error generating?

This error may occur when amendment related changes are made prior to activating Form 1040X, or when Form 1040X is activated and amendment changes are entered directly on Form 1040X. For example, in the following columns: Original Amounts (Column A), Net Change (Column B), and Correct Amount (Column C).

Form 1040X won't calculate Columns A-C in this manner. Manual changes that are different than what ProSeries would calculate could result in a transfer error.

Form 1040X requires minimal input, the only requirement is to check the box for the calendar year to activate it and complete the Explanation of changes section in Part III. All amendment-related changes thereafter will be made on related forms, schedules, and worksheets. Calculation changes resulting from the addition of these forms, schedules, and worksheets will flow to Form 1040X, accordingly.

For instructions on amending Form 1040, refer to the information in previous sections of this article.

Additional information

One other possible cause of the "Internal Error" could be due a space in between paragraphs in the Explanation of changes section on Form 1040X, Part III. If there is a space (or spaces) try cutting and pasting the line (or lines) into the next available open space in the table to consolidate the text.