Intuit Help

Intuit

12-05-2019

05:05 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

This article will help resolve following e-file critical diagnostic:

- Form W-2 #: Contains no wages. If the W-2 is reporting nontaxable third-party sick pay verify that Box 12(a, b c or d) contains J - Nontaxable sick pay and Box 13 is marked Third-party sick pay. Enter combat wages reported in box 12 (Q - Combat Pay) of the W-2 when reporting Military Combat Pay for members of the U.S. Armed Forces who served in a combat zone. (ref. #363)

To resolve the diagnostic follow these steps:

Option 1:

- Review the information in the e-file critical diagnostic. If any of the Box 12 subsection dropdown menus has a code of DD - Cost of employer-sponsored health coverage and an amount, but no wages are reported, the diagnostic will be generated.

- Per F1 help on Screen 10, Box 12a (code 46):

- DD - Cost of employer-sponsored health coverage. The amount reported with code DD isn't taxable.

- Because this amount has no effect on the tax return, all information related to code DD can be removed.

Option 2:

Paper file the return.

This e-file diagnostic can also generate under the following circumstances:

- If previously entered W-2's have been deleted for the current tax year.

- If the client file has been damaged.

- If the diagnostic is generating for W-2's that are no longer present on Screen 10, Wages, Salaries, Tips. Delete the current W-2, and reenter the information.

- In Screen 10, Wages, Salaries, Tips review the States(s) column.

- Make sure the correct states are selected.

- Check assigned entries at the beginning of the screen.

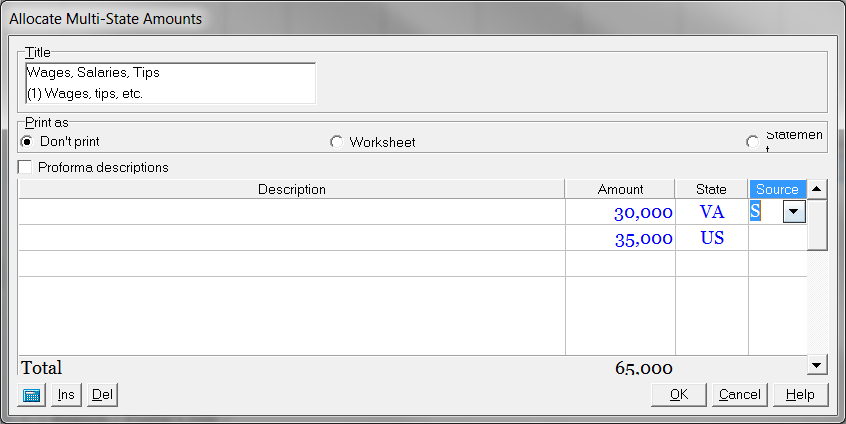

- Scroll down to (1) Wages, tips, etc, press Ctrl+E to open the window and make sure there are wages being sourced to a state with an S in the Source column, and there's also a line for the total US wages to be reported on Form 1040.

Labels