Follow these steps to enter a bulk sale in the depreciation screen:

- Go to the Depreciation screen. If the assets haven't already been entered, enter all pertinent information for each of the assets.

- Individual module - Screen 22

- Partnership module - Screen 14

- Corporate module - Screen 21

- S-Corporate module - Screen 16

- Fiduciary module - Screen 27

- Select the main asset for the bulk sale from the left panel.

- When selling a building, land, and improvements, use the building as the main asset. In all other situations, use the lowest numbered asset as the main asset. For example, if Assets 10, 11 and 12 are being sold in a bulk sale, use Asset 10 as the main asset.

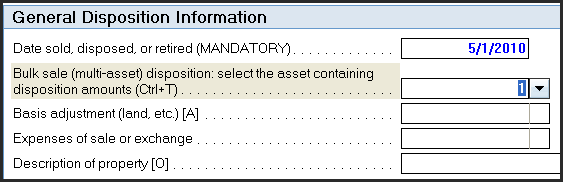

- Scroll down to the General Disposition Information section.

- Enter a date in Date sold, disposed, or retired (MANDATORY) (code 16).

- Scroll down to the Sale of Asset (4797/6252) section.

- Enter the total sales price in Sales price (-1=none) (code 61).

- The sales price should only be entered for the main asset.

- Select the next asset in the bulk sale from the left panel.

- Scroll down to the General Disposition Information section.

- Enter the date sold in Date sold, disposed, or retired (MANDATORY) (code 16). The date sold should be the same as in the previous step.

- Select the asset number for the main asset in Bulk sale (multi-asset disposition: select the asset containing disposition amounts. (Ctrl+T) (code 80).

- Repeat steps for each additional asset.

- If the box Form 4797, Part I [O] is selected in the Miscellanous subsection for the main asset of the bulk sale, Form 4797, page 2 won't generate. A green WKS: Bulk Sale link will appear next to Form 4797, Page 1, Line 3.

Additional information regarding land

When disposing of a building which includes land, a few different situations may occur:

- Recapture differences: refer to Troubleshooting diagnostic ref. 2000274 when entering a bulk sale in Lacerte.

I have an asset I would like to sell which includes land. I do not currently have an asset set up for land.

- In the Depreciation screen, navigate to your building asset. This asset should be your main asset in the bulk sale.

- Scroll down to the General Disposition Information section of the asset input.

- Here you will already have entered the date of disposition in Date sold, disposed, or retired (MANDATORY).

- Notice the field which says Basis adjustment (land, etc.) [A]. You can enter the amount of basis for land here. This amount of basis will not be calculated in the depreciation of the property itself.

Note: When using the Basis adjustment (land, etc.) [A] field to include the land basis, when a land asset is present;

- Enter a Date sold, disposed, or retired (MANDATORY) within the existing land asset.

- Do not enter a Sales price (-1 = none) amount, this field should remain blank.

Entering this date lets the program know to discontinue tracking this asset in future years.