Before you start:

- Taxpayers who are claimed as a dependent on someone else's return, or who are Married Filing Separately, don't qualify for this deduction.

- The maximum student loan interest deduction allowed is $2,500.

- To claim a tuition and fees deduction (Form 8917), use Screen 38, Education Credits/Tuition Deduction instead.

To enter the amount for the interest paid From 1098-E for Form 1040, Schedule 1, line 20:

- Go to Screen 24, Adjustments to Income.

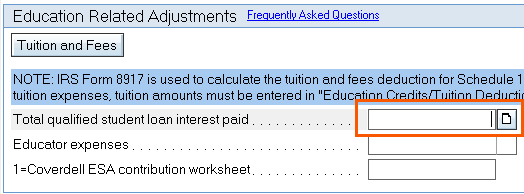

- Using the Section List in the lower-left, select the Education Related Adjustments section.

- Enter the amount in Total qualified student loan interest paid.

Enter the total amount of qualified student loan interest paid here. Lacerte will calculate the deductible amount to be reported on Form 1040 based on the worksheet in the Form 1040 Instructions. This calculation can't be overridden.

To view how the deduction was calculated:

- Go to the Forms tab.

- Open US form Sch 1.

- Scroll down to Line 20 and select the green WKS link.