Your client may receive Form 1095-B if they had health insurance coverage at any point in the year. This form isn't required to be filed with their tax return, but for tax year 2018 and prior, you can use it to help calculate any Shared Responsibility Payment your client owed under the Affordable Care Act. Starting in tax year 2019, the Shared Responsibility Payment is reduced to $0, so Form 1095-B won't have any effect on your client's tax liability.

For tax year 2019 and later returns

No 1095-B entry is needed, since the Shared Responsibility Payment, or health coverage penalty, has been reduced to $0.

For tax year 2018 and earlier returns

Forms 1095-B and 1095-C are issued to taxpayers for information purposes only. You aren't required to enter them in order to prepare the return. Some additional helpful information:

- The Part IV input field is provided to conveniently calculate the Individual Shared Responsibility Payment penalty if some or all of the household members don't have full year coverage for all months.

- You can also make this entry on Screen 39.1 under the Minimum Essential Coverage not Indicated Elsewhere section, and both are not required.

- For clients with all members having coverage the full year it is another checkbox year under Screen 39.1, enter a 1 for Entire household covered for all months. No additional input is required.

- A taxpayer doesn't need to wait until receiving a 1095-B or 1095-C in order for a return to be prepared and filed.

Follow these steps to enter Form 1095-B:

- Go to Screen 39, Affordable Care Act Subsidy/Penalty.

- Select Health Coverage (Form 1095-B) from the left navigation panel.

- This will take you to Screen 39.3.

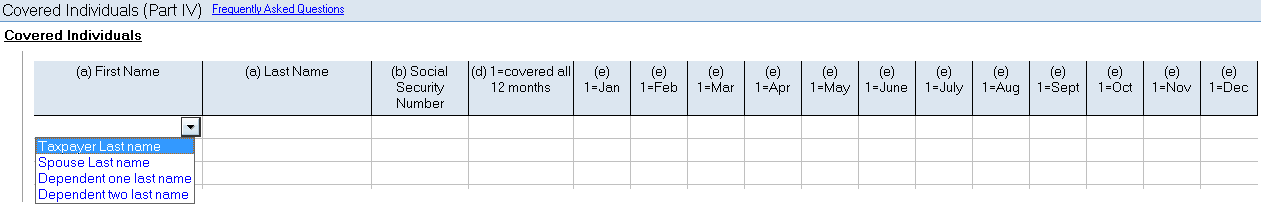

- Locate the Covered Individuals (Part IV) section.

- Select the First Name (a) of the individual from the dropdown menu.

- If you select the covered individuals name from the dropdown menu, Lacerte will populate the (a) First Name, (a) Last Name, and (b) SSN entered on Screen 1, Client Information or Screen 2, Dependents. If the covered individual isn't entered on Screen 1 or Screen 2, you'll need to manually enter their information here.

- Complete the applicable information:

- If the Individual was covered for all 12 months, enter a 1 in (d) 1= covered all 12 months.

- If the individual was only covered part of the year, enter a 1 for each (e) month field that the individual was covered for.

- Click on Add from the left navigation panel to add an additional Form 1095-B (if the taxpayer received multiple 1095-Bs).