To indicate a nonresident alien to generate a 1040NR follow these steps:

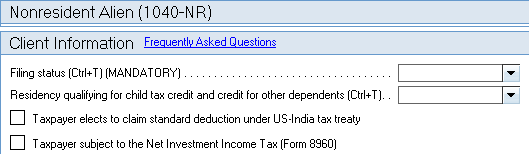

- Go to Individual module, Screen 58.1, Nonresident Alien (1040NR).

- In the Client Information section, select the Filing Status (Ctrl+T) (MANDATORY).

- This will generate the 1040NR in forms view.

- Select an option using the dropdown menu by the Filing status (Ctrl+T)[MANDATORY] section. This will generate form 1040NR in the forms view.

- Scroll down to the Schedule NEC - Tax on Income Not Effectively Connected with a US Trade or Business section.

- Enter income amounts in the appropriate 10%, 15%, and 30% columns for their tax rates.

- For other tax rates (column D), specify the tax rate you’re using in the Other percentage 1 (.xxxx) and Other percentage 2 (.xxxx) fields.

- Enter any other applicable fields in this section.

- Complete all other applicable sections for this form:

- Income,Credits, Taxes, and Adjustments

- Other Information

Where do I enter amounts for Schedule OI?

To enter amounts for Schedule OI in the program:

- Go to Screen 58.1, Nonresident Alien (1040-NR).

- Scroll down to the Other Information section.

- Enter any applicable fields.