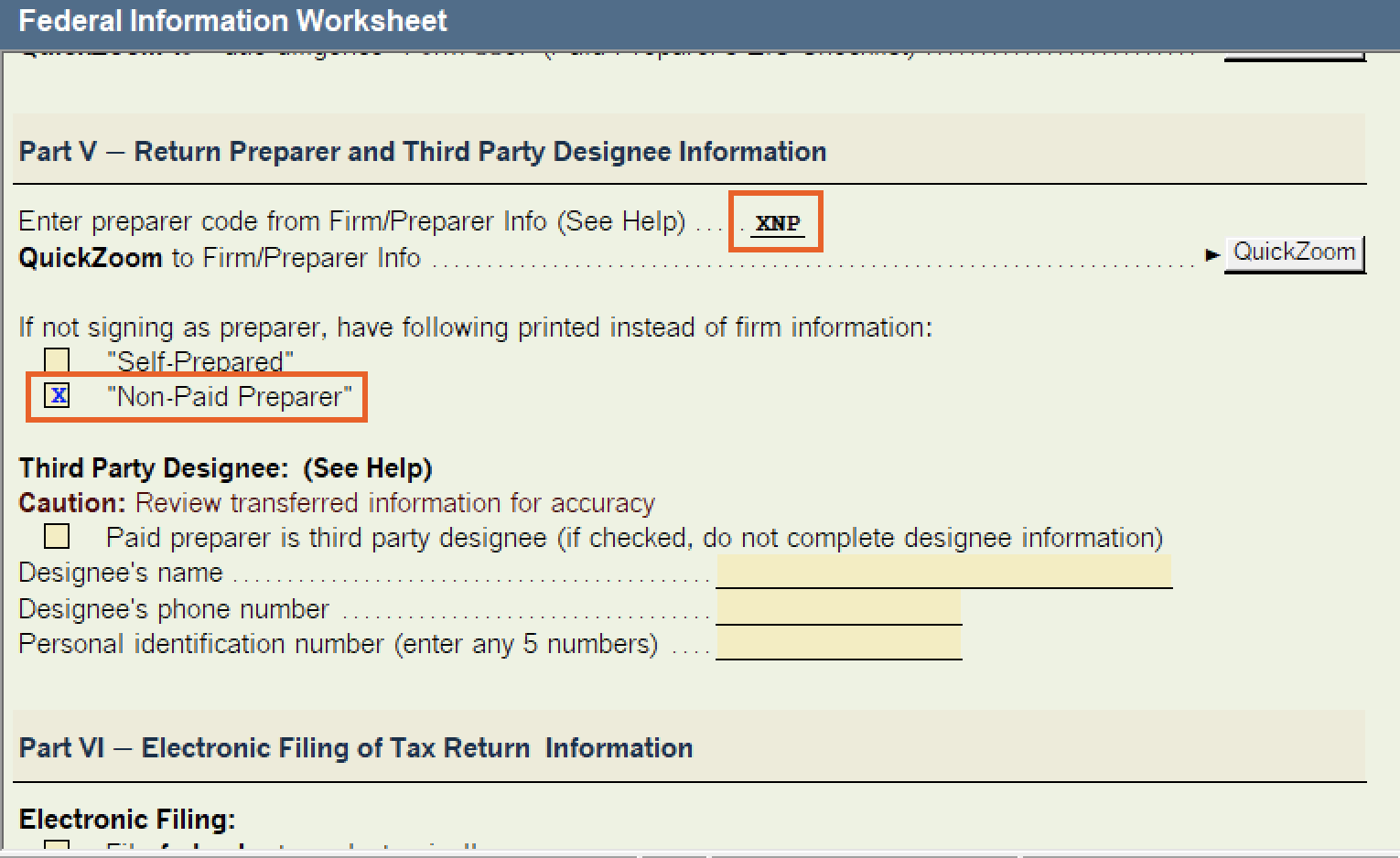

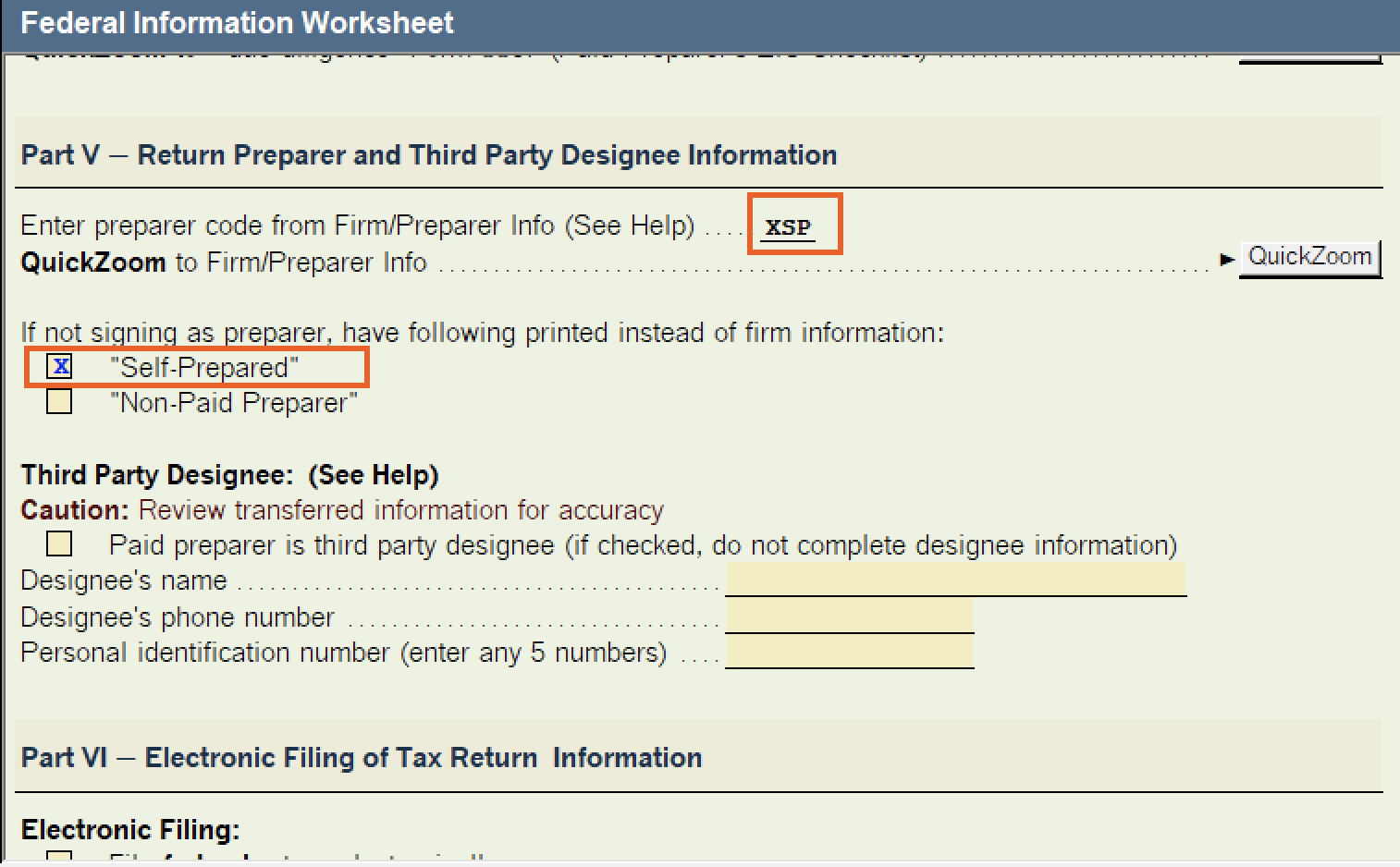

This article will show you how to mark individual and business returns as "Non-Paid Preparer" or "Self-Prepared" in ProSeries. Select the applicable tax type below for insructions.

Marking a return as "Non-Paid Preparer" or "Self-Prepared" in ProSeries

SOLVED•by Intuit•65•Updated November 16, 2023

Was this helpful?

You must sign in to vote, reply, or post

Sign in for the best experience

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Preparing state returns in ProSeriesby Intuit•46•Updated November 17, 2023

- Entering a Preparer's Tax Identification Number (PTIN) in ProSeriesby Intuit•335•Updated January 29, 2024

- COVID-19 relief: How to apply changes to returns in ProSeriesby Intuit•99•Updated November 21, 2023

- Adding or editing preparer information in ProSeriesby Intuit•90•Updated 1 month ago

- How to indicate that the preparer is a Third Party Designee in ProSeriesby Intuit•21•Updated October 30, 2023