General information about nonresident aliens

- Federal and FICA/Medicare taxes may apply to nonresident workers who aren't exempt by U.S. Treaty.

- Employees generally must pay Social Security taxes only to the country where they work.

- Federal withholding is a special calculation.

- Nonresident aliens must use Form W-4 or Form 8233.

- Nonresident aliens are treated as single regardless of their marital status.

- Nonresident aliens may claim only one allowance (exemption) with the exceptions noted in Publication 15.

- The following amounts are added to the nonresident alien employee's wages for calculating the federal tax withholding.

- These amounts are for federal tax calculation purposes only. They don't increase gross or net pay, and aren't added to the tax liability once the calculation is made.

- They don't appear on W2:

- These chart amounts don't increase the FICA, Medicare, or FUTA tax liability of the employer or the employee.

- Weekly pay period = $43.30

- Biweekly pay period = $86.50

- Semimonthly pay period = $93.80

- Monthly pay period = $187.50

- Quarterly pay period = $562.50

- Semiannual pay period = $1,125.00

- Annual pay period = $2,250.00

- Daily or miscellaneous pay period = $8.70

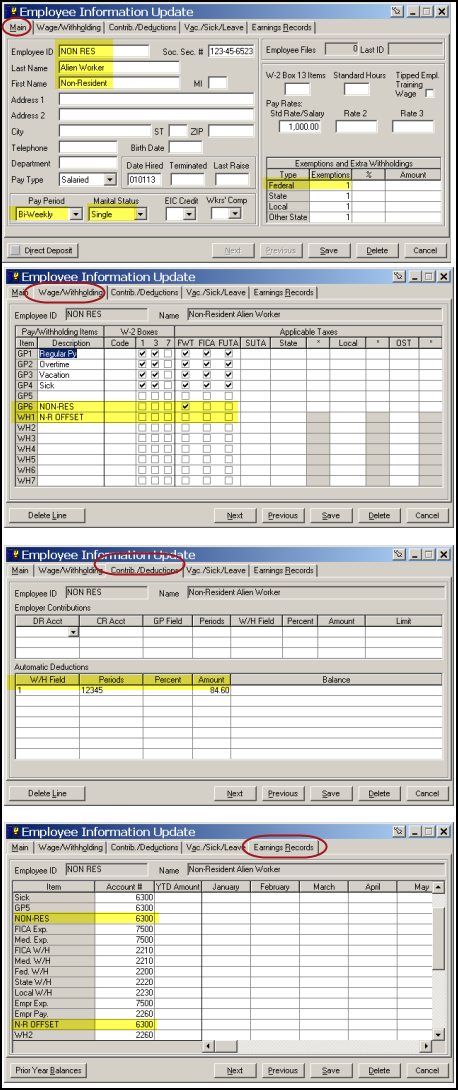

Follow these steps to set up the employee in EasyACCT:

- On the Employee Information Update main tab, select Single for the marital status and 1 exemption.

- On the Wage/Withholding tab, add a GP item as NonRes to use for the amount from the table above.

- On the NonRes GP item, don't select any W2 boxes. Select the FWT box only.

- Add a NonRes WH item to use for the offsetting amount and don't select any boxes at all.

- On the Contrib/Deductions tab, go to the Automatic Deduction grid, enter the WH item specified in Step 4. Periods 12345 and the amount from the table above depending on the payroll period.

- On the Earnings Records tab, enter the same GL account code for the NonRes GP and NonRes WH amounts, as this amount is being used for calculating only and will net to zero.

Processing batch payroll:

- In the Payroll Check Computation input, enter the pay period information and the number of the pay period for the Contrib/Deductions section.

- In the Payroll Transaction Entry, add the normal GP items for regular and any other applicable pay.

- Add the line for the NonRes GP item assigned in Step 2, and enter the pay period amount from the table (for example, $43.30 if weekly payroll and $86.50 for bi-weekly).

- Close and finish the payroll as normal.

- The NonRes amount will be added to the federal tax calculation, then deducted back out of the gross pay, and won't appear on the W2.

For additional information refer to:

- (Circular E) Employer's Tax Guide, IRS Pub. 15

- Withholding of Tax on Nonresident Aliens and Foreign Entities, IRS Pub. 515