- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Discover

- :

- Events

- :

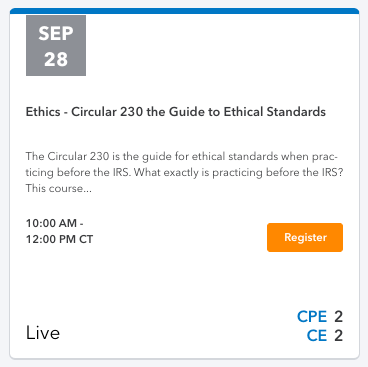

- Ethics - Circular 230 the Guide to Ethical Standards

Ethics - Circular 230 the Guide to Ethical Standards

Ethics - Circular 230 the Guide to Ethical Standards

- Subscribe

- Mark as read

- Mark as new

Register for this webinar by following this link here.

Our speaker for this event is Robin Gervais!

ABSTRACT:

The Circular 230 is the guide for ethical standards when practicing before the IRS. What exactly is practicing before the IRS? This course dives into the circular itself and provides an overview to its contents and answers that question and discusses many more. This course discusses how these ethical guidelines relate to your everyday practice. Attendees will be refreshed and ready for the upcoming tax season.

Learning objectives:

By completing this webinar, you will be able to:

- Define who is covered under Circular 230.

- Understand what it means to practice before the IRS.

- Discover who is a tax preparer.

- Identify “due diligence” and “unreasonable position”

- Discover the four types of sanctions that may be imposed when practitioners violate regulations and how to avoid them.

- Identify Due Diligence requirements.

Who should attend?

Anyone who prepares tax returns and advises clients

Course Level: Basic

Course Length: 120 Minutes

Prerequisites: NONE

Delivery Method: Group-Live Internet

Field of Study: Taxes - Technical

Recommended CPE: 2

Recommended CE: 2

IRS Course Number: Federal Tax Law Topics/Federal Tax Related Matters

Online: NESGF-E-00108-19-O

In Person: NESGF-E-00108-19-I