This article will help you instal the New Jersey midyear fiscal returns in the Corporate or S-Corporate of ProSeries Professional.

Before you start:

- For tax year 2022 New Jersey Mid-Year returns are no longer on a Pay-Per-Return basis.

- For tax year 2021 to tax year 2013 and later fiscal year New Jersey Corporate and S-Corporate products are only available on a Pay-Per-Return basis. When first opening the New Jersey fiscal Corporate or S-Corporate return in a client's file, you'll be prompted for the Pay-Per-Return authorization.

- The midyear return installs into the prior year of ProSeries.

- For example: If you need New Jersey midyear forms for tax year 2023, you'd open ProSeries 2022 to access the return.

- The New Jersey PTE forms for midyear filers are currently not supported in ProSeries.

How do I install New Jersey midyear returns?

The instructions below are applicable for tax year 2022 and newer. For prior years click here.

Follow these steps to install NJ midyear products:

- Open ProSeries.

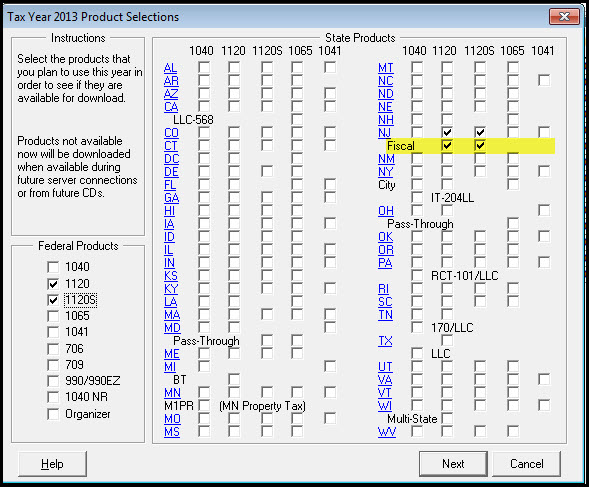

- From the Update menu, select Select and Download New Products...

- In the product selection window, locate the New Jersey (NJ) row

- Select the NJ 1120 and 1120S checkboxes.

- Click the Next button to begin the download and installation.

Generating New Jersey midyear returns:

- Open the prior year of ProSeries.

- Open the federal return.

- On the Information Worksheet scroll down to Part III Tax Year and Filing Information.

- Select Fiscal Year and enter the End Month.

- New Jersey midyear is applicable to fiscal years ending between July and November.

- From the File menu, select Go to State/City.

- Select New Jersey.

- When viewing the form midyear forms are indicated with MY in the forms list.