To e-file returns, you must submit official documentation of your credentials to e-file as a Provider in good standing with the IRS.

You can submit in one of two formats:

- If you received your EFIN within the last 12 months, you can submit the EFIN Acceptance Letter you received by mail from the IRS.

- If you received your EFIN more than 12 months ago, you must submit the Application Summary from the IRS e-Services website.

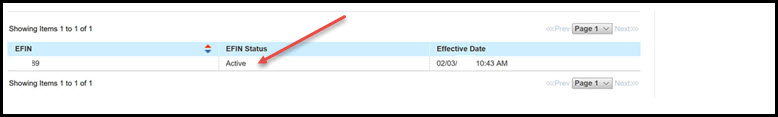

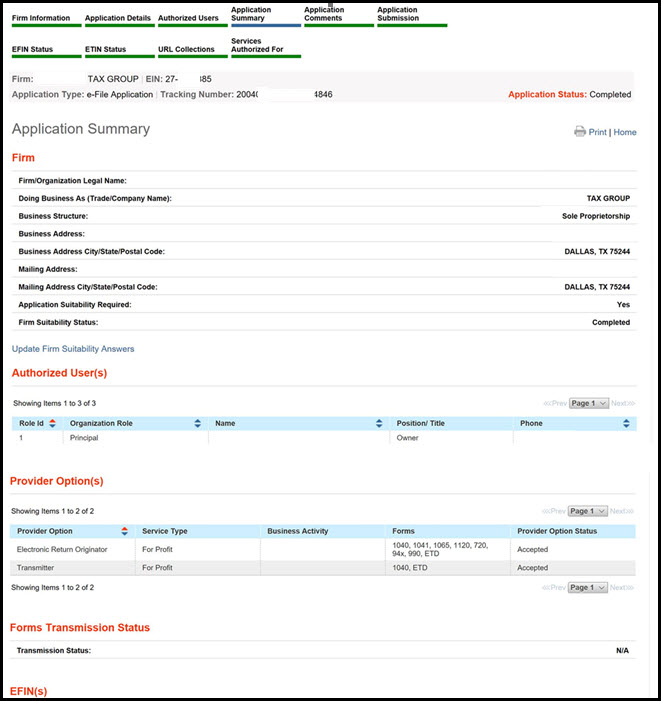

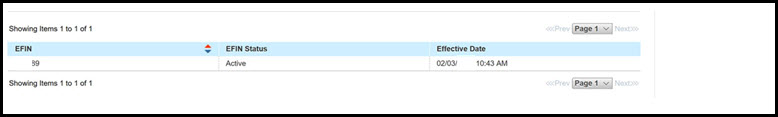

![]() EFIN status must be Active and ERO status must be Accepted.

EFIN status must be Active and ERO status must be Accepted.

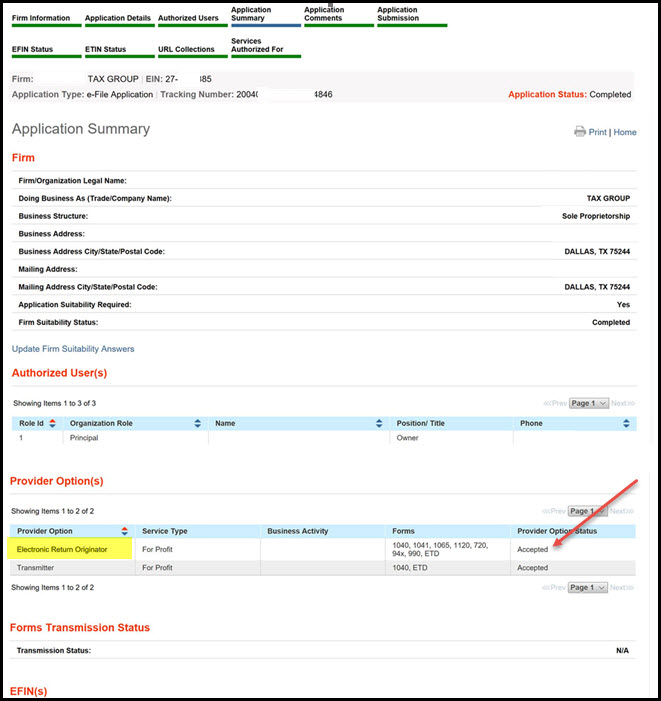

Down below is an example image of the Application Summary.

Click here for instructions on how to access and print the Application Summary on the IRS e-Services site

- Go to https://www.irs.gov/tax-professionals/e-file-provider-services.

- Click Access e-file Application and then Log in.

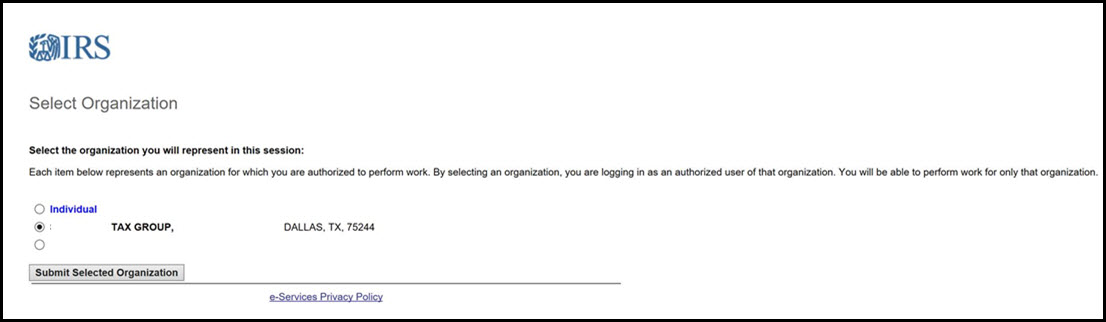

- Select your Organization:

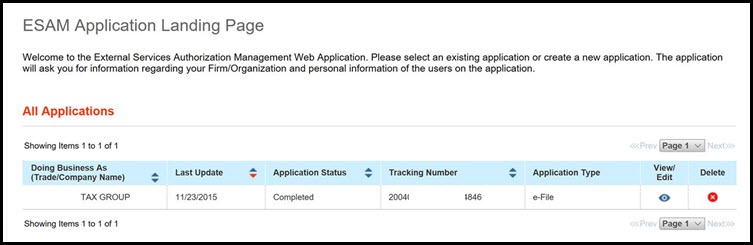

- Click Submit Selected Organization. You will then be directed to a page like this:

- Select View/Edit and you will be directed to your EFIN Application Summary:

- Select the Print button in the upper right of the form, printing to .pdf format using your local print driver.

- Save the file of your EFIN Application Summary to your computer.

What not to submit

We do not need to see the following or similar forms:

- Your PTIN Registration

- Your original Form 8633 Application

- Your EFIN Activity Report

- Your EIN Tax ID number

- Your e-Services Account Registration Information