Effective the first quarter of 2015, all filers are required to electronically file the NYS-45 SUTA report for New York state.

What to know before e-filing

Which account category should I choose?

Choose the Tax Professional category if you or your company:

- File New York State tax returns and make payments for your clients;

- Pay New York State tax bills and notices or request Installment Payment Agreements for your clients;

- Access New York State tax information for your clients; or

- Speak with New York State Department representatives on behalf of clients and receive confidential taxpayer information about their filings, bills and notices.

Choose the Business Account category if you're filing as:

- An owner, officer, or employee of a company that has New York State tax filing obligations for sales tax, corporation tax, withholding and employment taxes, or other business taxes;

- A corporation or S corporation;

- A sole proprietor, a business owned or operated by one person

- A partnership, which includes a syndicate, group, pool, joint venture, or other unincorporated organization that is carrying on a trade or business; or

- A limited liability partnership (LLP) or a limited liability company (LLC), is a partnership that provides professional services and has registered as a limited liability partnership, or is an unincorporated organization of one or more members, each having limited liability for the contractual and other liabilities of the company, formed for any lawful business purpose.

Online account requirement for e-filing

An online account with the state is required for electronic filing. Click the links below for more information:

- Click here for the online account link for the New York State Department of Taxation and Finance. Then, select Create Account or Login.

- Click here for a video demonstration of the NYS-45 web file application.

- Click here for the Tax Professional account creation checklist.

- Click here for the Business Account creation checklist.

How do I create the electronic file in EasyACCT?

Follow these steps to create the electronic file in EasyACCT:

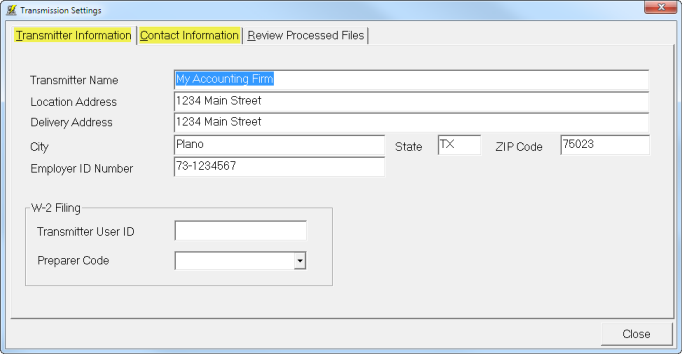

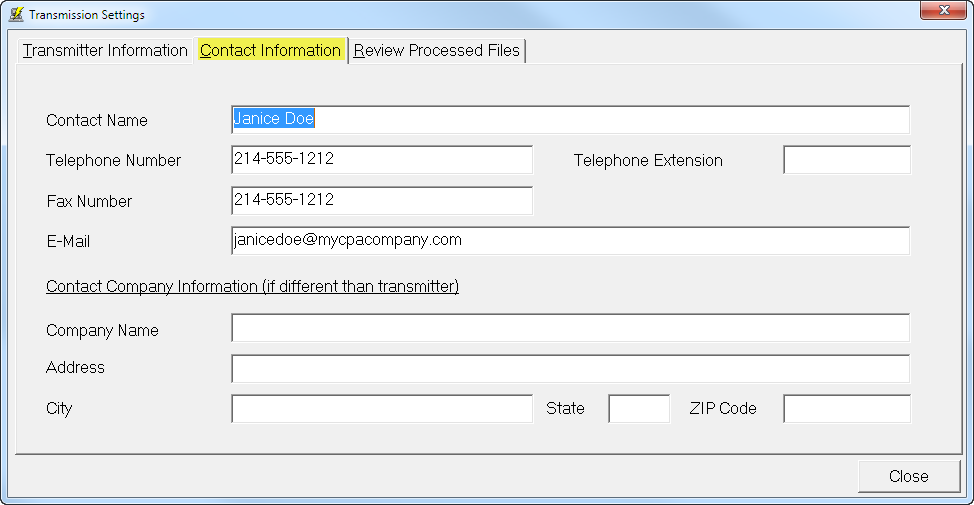

- Complete the Transmitter Information and Contact Information tabs of the Transmission Settings screen:

- From the Company Selection > System > Transmission Settings.

- Be sure to fill each line in the sections.

- Go to Print Reports > Batch Payroll Reports > Tax Reports > Special SUTA reports.

- Choose NY, select Print, and Begin Printing.

- The SUTA screen will appear.

- Review the input screen for accuracy and completeness.

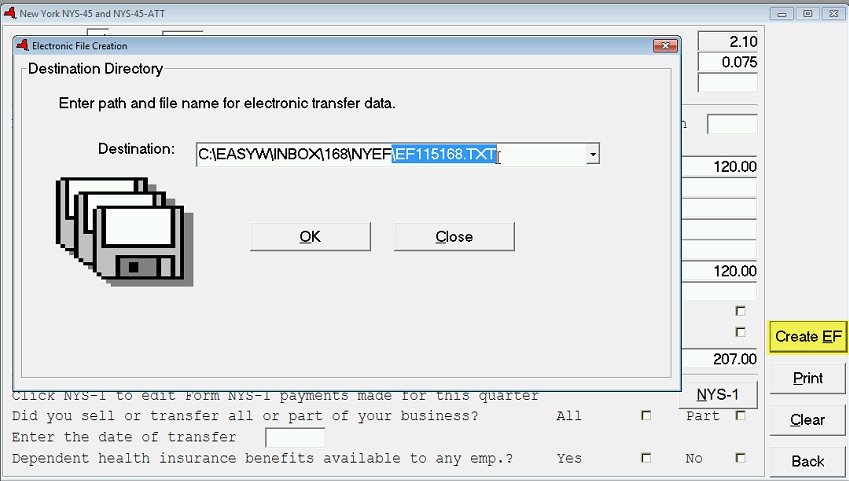

- To create the electronic file, select the Create EF button.

- A box will pop up with the name of the file and the path where it is located. Note this path.

- This path consists of your Current Data Path and creates a new NYEF subfolder the first time you e-file.

- You will get a message: "Path not found. Do you want to create it?" Answer Yes.

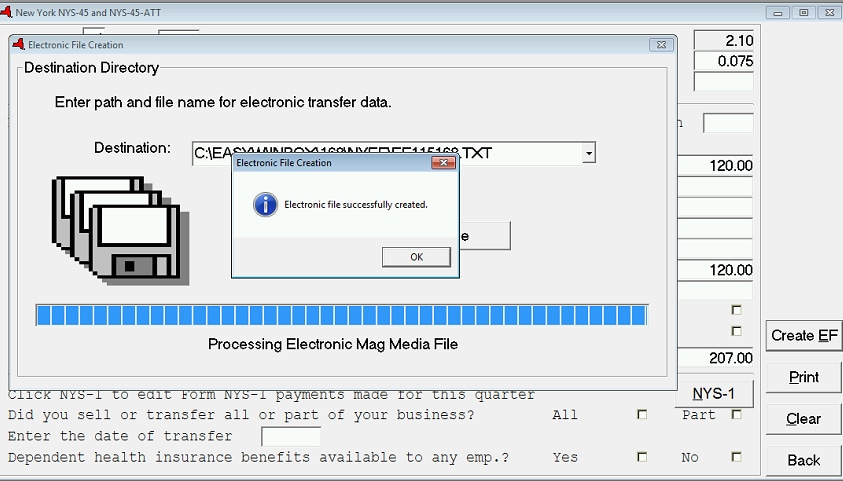

- You'll get a message that the file has been created. The file name is EFxyyzzz.TXT.

- xyy is the quarter and year and zzz is the company ID. For example, EF115168.TXT is 1st quarter 2015 for company ID 168.

- Login to the New York State Tax Department Online Services website.

- The file you'll upload to the state is in the "current data path" NYEF folder with the file name described in step 6.