As a convenience to you, Intuit ProConnect is offering you a Deferred Payment Option, which is the option to pay for your Software at a later date. The following terms and conditions will supplement those terms of the End User License Agreement of the software you are purchasing from ProConnect (the “Software”). If you do not agree to these Terms and Conditions, then you are not eligible to use this benefit.

You acknowledge that you may not qualify for this benefit if (1) your account with ProConnect or QuickBooks is “on hold,” (2) your payment method that was used to pay ProConnect did not have sufficient funds to pay for your product, or service over the past 24 months, or (3) you had Remote Entry Processing (REP) for any prior years and you had more than 3 late payments over 24 months. Intuit will determine your eligibility and notify you if you are not eligible.

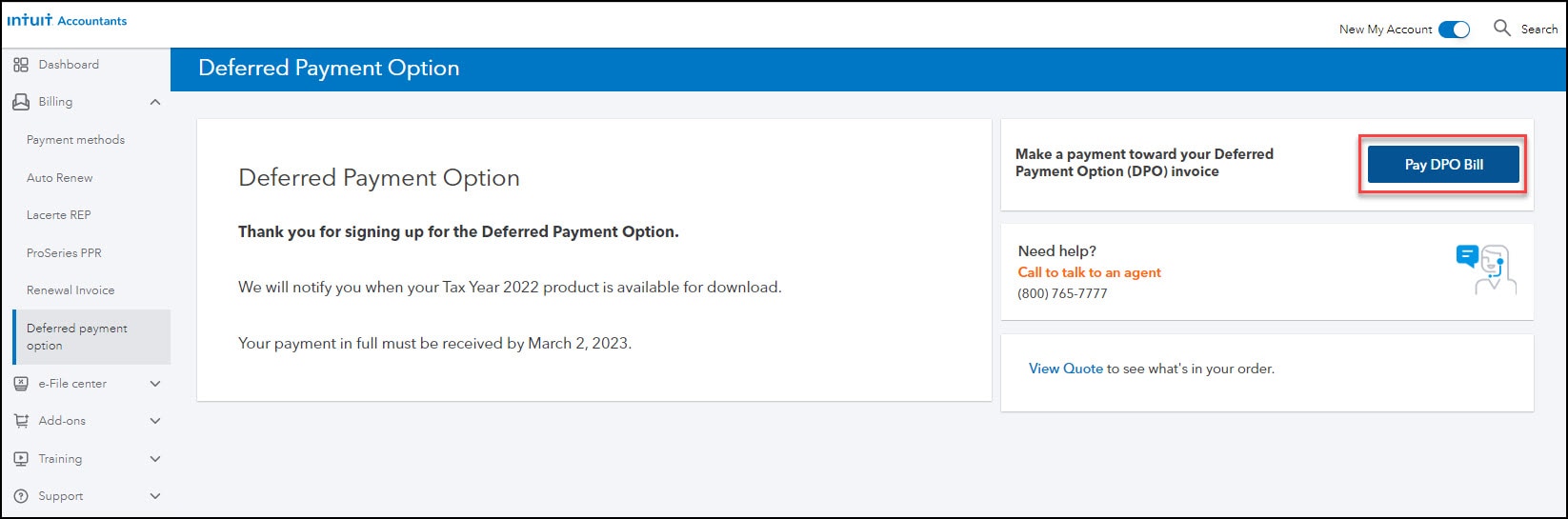

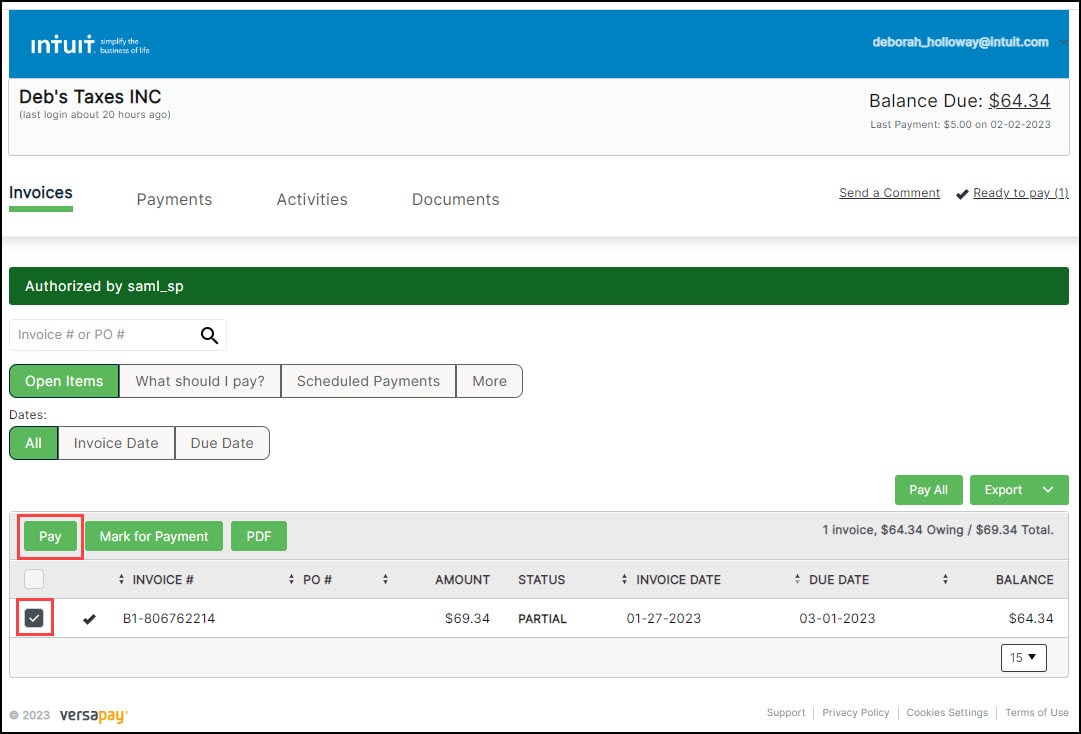

You will have access to the Software you have chosen via shipment or download on or near November 4th, depending on the tax year. You agree to pay for the cost of the Software on the due date.

If you fail to pay for any portion of the cost of the Software when it is due, Intuit may exercise one or more of the following remedies: (i) terminate the End User License Agreement upon notice to you; (ii) recover from you an amount equal to all accrued and unpaid fees; (iii) demand that you cease use of, uninstall, and return to Intuit all copies of the Software; (iv) prohibit access and terminate functionality to the Software; or (v) pursue any other remedy available under the applicable End User License Agreement or at law or in equity. You agree to reimburse Intuit for any expenses (such as attorney’s fees) that Intuit may incur in connection with its efforts to collect any late or delinquent amounts.

I understand that by executing these Terms and Conditions, I am requesting to obtain the Deferred Payment Option and that I agree to the foregoing.