![]() Please note that custom financial statements are not supported by the EasyACCT support team.

Please note that custom financial statements are not supported by the EasyACCT support team.

When you make changes to the financial statements, the subtotals and totals that print (i.e. Gross Profit, Operating Expenses, Net Income, etc.) are determined by what amount is stored in the first accumulator. So an understanding of how accumulators work is very important, key even in making customizations to your Income Statement and Balance Sheet. Then we'll take a look at some examples and how to fix them.

Understanding how accumulators work

Accumulators can be thought of as buckets, in that they are used to store numbers or totals of numbers. There are a total of 20 accumulators, numbered from 0 to 19, in which to store totals, which means that you can work with 20 different totals at one time (they can also be emptied and reused). These 20 accumulators are divided into two groups.

- The first group (0 to 9) is devoted to Special Accumulators used for Type R instructions. They are used to store the net income amount for the Balance Sheet and to create the comparison percentages on the Income Statement.

- The second group (10 to 19) is referred to as Computation Accumulators. They are used in the Computations formula ?First Accumulator * Second Accumulator = Third Accumulator? to compute and carry forward the totals in the financial statements.

*These are the ones that you will be working with the most and you will want to focus on when determining the calculations for totals and sub-totals.

Rules for computation accumulators:

You must keep in mind three rules when understanding how accumulators work in the computation section of the layout record. These rules explain how the account totals are being printed and brought forward throughout the financial report layout. These accumulator rules are taken from the equation: First Accumulator * Second Accumulator = Third Accumulator

- Rule #1 - The amount in the First Accumulator is the amount printed, not the Third Accumulator.

- Rule #2 - After the computation is complete, the First Accumulator is zeroed out so it can be reused again later in the layout. An accumulator always has a zero balance after being used in the First Accumulator field.

- Rule #3 - Always follow and know what is in each accumulator. Keep track of what balances have been added to a specific accumulator and which accumulators have been zeroed out because it was used in the First Accumulator field.

First Accumulator: Enter the accumulator which holds the balance you want printed.

Second Accumulator: Enter an accumulator which you want to use in the calculation performed with the first accumulator. This second accumulator retains its amount unless it is also used in the third position of the equation. In this situation, the second accumulator becomes the recipient of the result of the computation. For example, in the computation 10 + 11 = 11, accumulator 11 is added to 10 and the result is placed back in 11. At this point, 11 contains the result.

Third Accumulator: Enter the accumulator which is to receive the calculated amount derived from the operation between the first and second accumulators. This total is saved for use in later computations.

Hint: It is easier to keep track of accumulator balances if the second and third accumulators are the same number (i.e. 10 + 12 = 12)

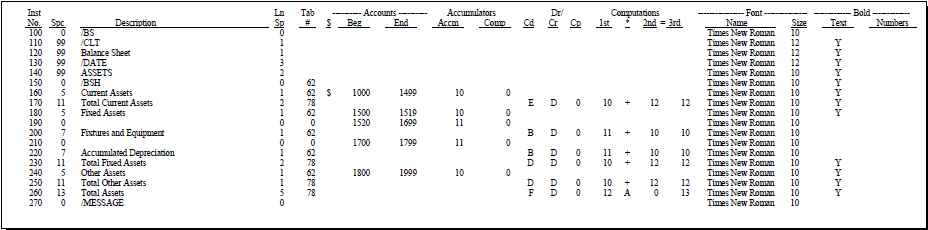

Let's take a look at a detailed example using a Balance Sheet:

Current Assets (Line 160): Accounts 1000-1499 are printed and their balance is stored in accumulator 10.

Total Current Assets (Line 170): This prints the sub-total for the Current Assets whose balance is stored in accumulator 10. That balance is then added to accumulator 12. Note that accumulator 10 is now empty and can be reused.

Fixed Assets (Line 180): Accounts 1500-1519 are printed and their balance stored in accumulator 10.

Line 190: This line isn't printing anything, but it's adding accounts 1520-1699 together in order to print on the next line. This groups the accounts together on one line instead of listing them separately. The total is stored in accumulator 11.

Fixtures & Equipment (Line 200): The balance in accumulator 11 is printed (which holds 1520-1699) and adds the amount to accumulator 10 (10 now holds 1500-1699). Note that accumulator 11 is now empty and can be reused.

Line 210: This line isn't printing anything, but it's adding accounts 1700-1799 together and storing the total in accumulator 11.

Accumulated Depreciation (Line 220): This is printing the balance stored in accumulator 11 (1700-1799), and adding that to the balance in accumulator 10.

Total Fixed Assets (Line 230): This is printing the balance stored in accumuator 10, all fixed assets and the accumulated depreciation. The balance is stored in accumulator 12 with the rest of the assets we've encountered thus far.

Other Assets (Line 240): Accounts 1800-1899 are printed and their balance is stored in accumulator 10.

Total Other Assets (Line 250): This prints the sub-total for the Other Asset Accounts (the balance stored in 10) and adds th etotal to accumulator 12.

Total Assets (Line 260): The balance in accumulator 12 is printed, which holds the account balances of all asset accounts. The balance is added (indicated by A) to the value $0 and stored in accumulator 13 for later use. Note that 12 + 13 = 13 would also have worked here.

Fixing Accumulator Problems

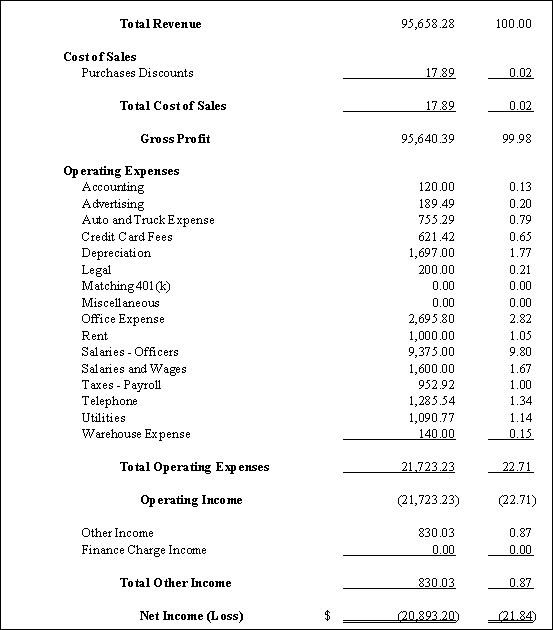

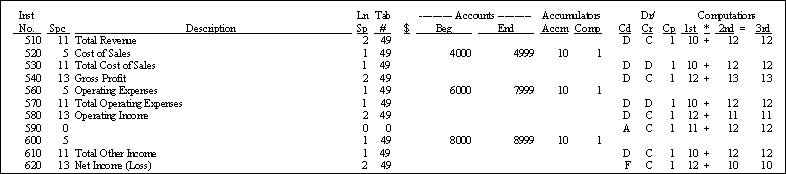

Take a look at an excerpt from an income statement where the balances in the Operating Income and Net Income are incorrect:

Clearly the Gross Profit is not included in either the Operating Income or Net Income (Loss) lines. We'll start by looking at where the Gross Profit is stored, and making sure that accumulator is included in Operating Income and Net Income.

Gross Profit (Line 540): 12 + 13 = 13. The balance for gross profit is stored in accumulator 13.

Operating Income (Line 580): 12 + 11 = 11. This line is printing the balance from accumulator 12, which at this point stores the Operating Expenses (from the line above it).

How do I fix it?

Change Line 570 (Total Operating Expenses) to 10 + 13 = 13.

Change line 580 (Operating Income) to 13 + 11 = 11

Every financial statement customization is unique and your instruction numbers/lines will vary, although the concepts are the same.